- United States

- /

- Insurance

- /

- NYSE:CNO

Can CNO Financial Group’s (CNO) Share Buybacks Offset Declining Profits?

Reviewed by Simply Wall St

- CNO Financial Group reported its second quarter and first half 2025 results, showing higher revenue but lower net income compared to the prior year, and revealed it repurchased 2.6% of its shares for US$99.03 million during the quarter.

- This combination of mixed financial performance and ongoing share buybacks draws attention to how the company is balancing returning capital to shareholders with evolving profitability trends.

- We'll explore how the recent share repurchase activity impacts CNO Financial Group's investment narrative and future earnings outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

CNO Financial Group Investment Narrative Recap

To invest in CNO Financial Group today, you need to believe in the ongoing growth of the middle-income retirement market, confidence in the company’s ability to expand digital channels, and resilient recurring revenue from stable insurance and annuity products. The recent earnings release, showing higher revenue but notably lower net income, does not materially shift these near-term catalysts, but highlights that net investment margin pressures remain a core risk to monitor closely.

Of the recent announcements, the US$99.03 million share buyback stands out, signaling continued capital returns to shareholders despite earnings volatility. This repurchase helps cushion per-share metrics and supports confidence, yet long-term growth will still rely on sustained margin improvement and CNO’s execution in digital distribution, both vital to offsetting structural competitive and interest rate pressures.

By contrast, what investors should really watch for is if the pace of digital transformation at CNO lags behind peers and ...

Read the full narrative on CNO Financial Group (it's free!)

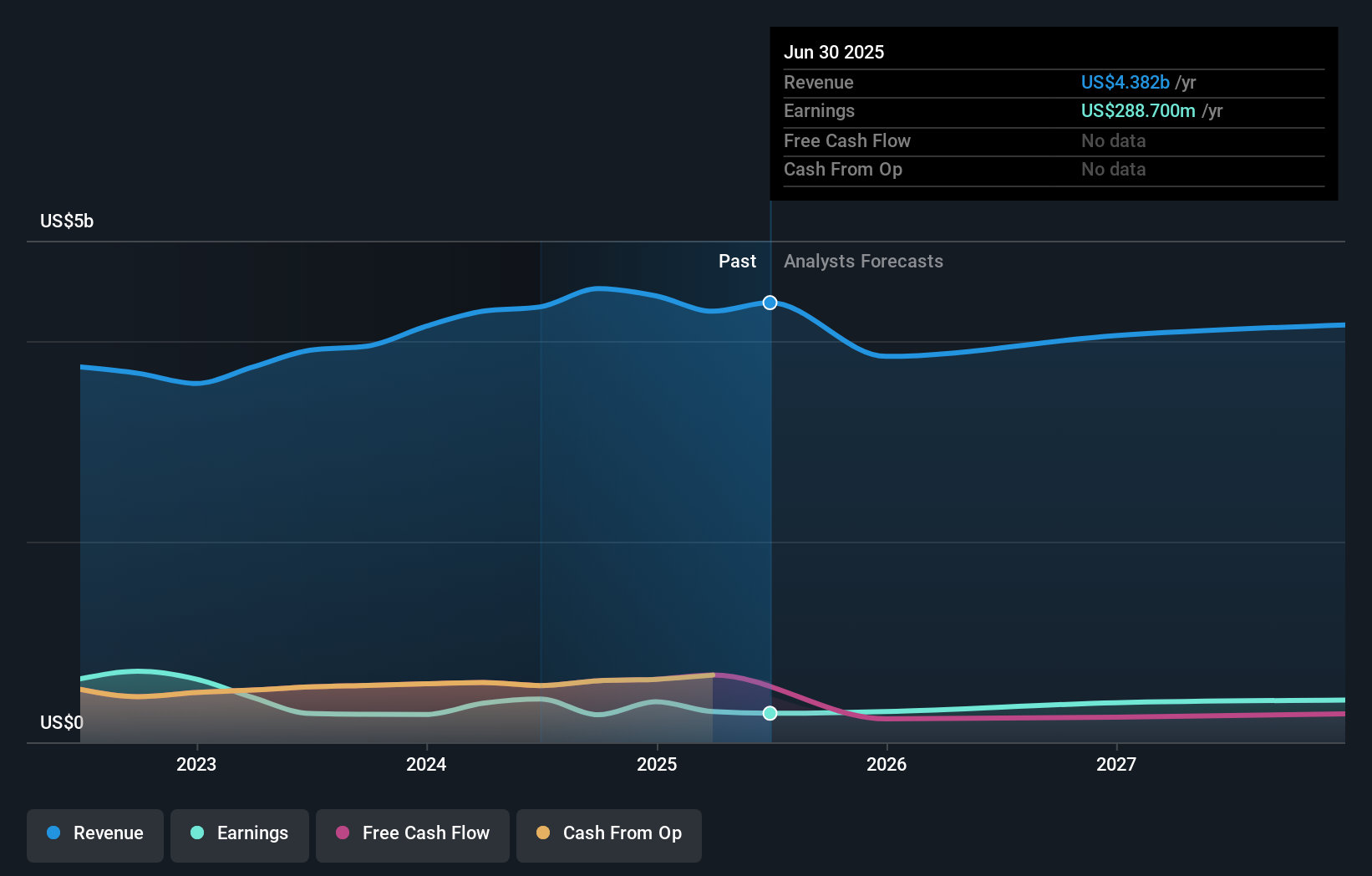

CNO Financial Group's outlook assumes $4.3 billion in revenue and $431.3 million in earnings by 2028. This projection is based on a 0.8% annual decline in revenue and a $142.6 million increase in earnings from the current $288.7 million.

Uncover how CNO Financial Group's forecasts yield a $42.40 fair value, a 15% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has contributed 1 fair value estimate for CNO at US$42.40, all falling within a single narrow range. While opinions in the community may sometimes differ widely, competition from new entrants in digital insurance solutions remains an overarching factor that could alter CNO’s future results.

Explore another fair value estimate on CNO Financial Group - why the stock might be worth as much as 15% more than the current price!

Build Your Own CNO Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNO Financial Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CNO Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNO Financial Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives