- United States

- /

- Insurance

- /

- NYSE:CNO

Assessing CNO Financial Group’s Valuation After Jefferies’ Upgrade to Buy

Reviewed by Simply Wall St

Jefferies’ upgrade of CNO Financial Group (CNO) to a Buy rating, along with a higher expected upside, has put fresh attention on the insurer’s stock and prompted investors to reassess its recent performance.

See our latest analysis for CNO Financial Group.

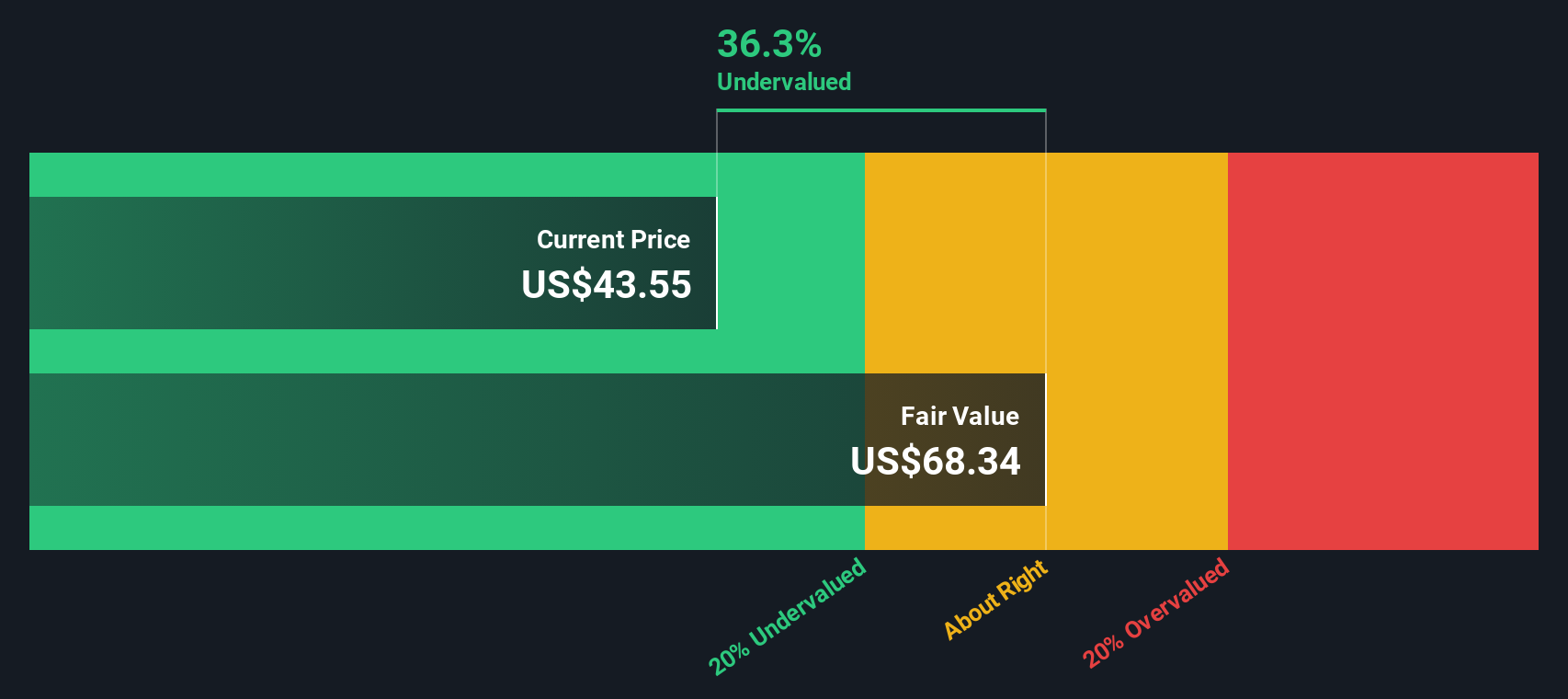

That upgrade lands on top of an already solid run, with the share price at $43.55 and a year to date share price return of 17.26%, while the 3 year total shareholder return of 102.62% signals momentum is clearly building.

If Jefferies’ call has you rethinking your watchlist, this could also be a smart moment to broaden your search and discover fast growing stocks with high insider ownership.

With CNO trading just below analyst targets but at a sizable intrinsic discount, along with robust earnings growth and strong multi year returns, the key question is whether this represents a fresh buying opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 50% Undervalued

With CNO last closing at $43.55 against a narrative fair value near $43.75, the story hinges more on earnings power than on headline upside.

Strong momentum in digital and web based direct to consumer channels evidenced by 39% year over year growth and over 30% of D2C leads now from digital sources is reducing customer acquisition costs and is expected to drive further margin expansion and scalability.

Want to know how flat top line expectations can still support a richer earnings outlook and lower future multiple than the industry? The narrative leans heavily on margin upgrades, disciplined buybacks, and a profitability mix shift that rewrites what mature insurers can earn on each dollar of revenue. Curious how these levers combine into that fair value?

Result: Fair Value of $43.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat outlook could be challenged if long term care claims normalize upward or if digital rivals outpace CNO’s transformation, which could pressure margins and growth.

Find out about the key risks to this CNO Financial Group narrative.

Another Angle on Value

While the narrative view suggests CNO is about fairly priced, our DCF model paints a different picture, with fair value near $68.34 versus a $43.55 share price. This implies the stock may be materially undervalued. Is the market underestimating long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CNO Financial Group Narrative

If this perspective does not quite match your own or you would rather rely on your own research, you can quickly build a personalized view in minutes: Do it your way.

A great starting point for your CNO Financial Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few fresh ideas that could help you find your next position, using targeted screens built to uncover standout opportunities quickly.

- Explore potential early stage growth by reviewing these 3633 penny stocks with strong financials that already support their promise with improving fundamentals.

- Review structural tech shifts by scanning these 24 AI penny stocks positioned in key areas of machine learning and automation demand.

- Refine your income strategy by focusing on these 12 dividend stocks with yields > 3% that combine regular payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion