- United States

- /

- Insurance

- /

- NYSE:CNA

What CNA Financial (CNA)'s Businesswide Modernization Means For Shareholders

Reviewed by Sasha Jovanovic

- In recent months, CNA Financial has embarked on an enterprisewide modernization, overhauling its financial, operational, and technological infrastructure to strengthen agility and long-term sustainability.

- This transformation includes major improvements to internal systems and processes, reducing indirect costs while aiming to boost accuracy and transparency across financial operations.

- Now, we'll explore how CNA Financial's comprehensive business modernization may influence the company's long-term earnings outlook and operational efficiency.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

CNA Financial Investment Narrative Recap

To be a shareholder in CNA Financial, you need confidence that operational improvements, disciplined expense management, and technology investments can offset industry risks such as underwriting volatility. The company's recent modernization efforts are aimed at streamlining operations, but they do not materially alter the most important short-term catalyst, premium growth, or immediately address the biggest risk of elevated catastrophe losses affecting earnings.

Among recent announcements, CNA's third quarter 2025 earnings stood out, with revenue and net income increasing year-on-year. These results align closely with the modernization initiative’s goal of operational efficiency and suggest that business fundamentals remain a key driver of any near-term share price movements.

However, investors should also be aware that, despite these improvements, the risk posed by elevated catastrophe losses could unexpectedly erode margins and profitability if...

Read the full narrative on CNA Financial (it's free!)

CNA Financial’s outlook anticipates $17.1 billion in revenue and $1.7 billion in earnings by 2028. This scenario requires a 6.2% annual revenue growth rate and a $741 million increase in earnings from the current $959 million.

Uncover how CNA Financial's forecasts yield a $48.37 fair value, a 5% upside to its current price.

Exploring Other Perspectives

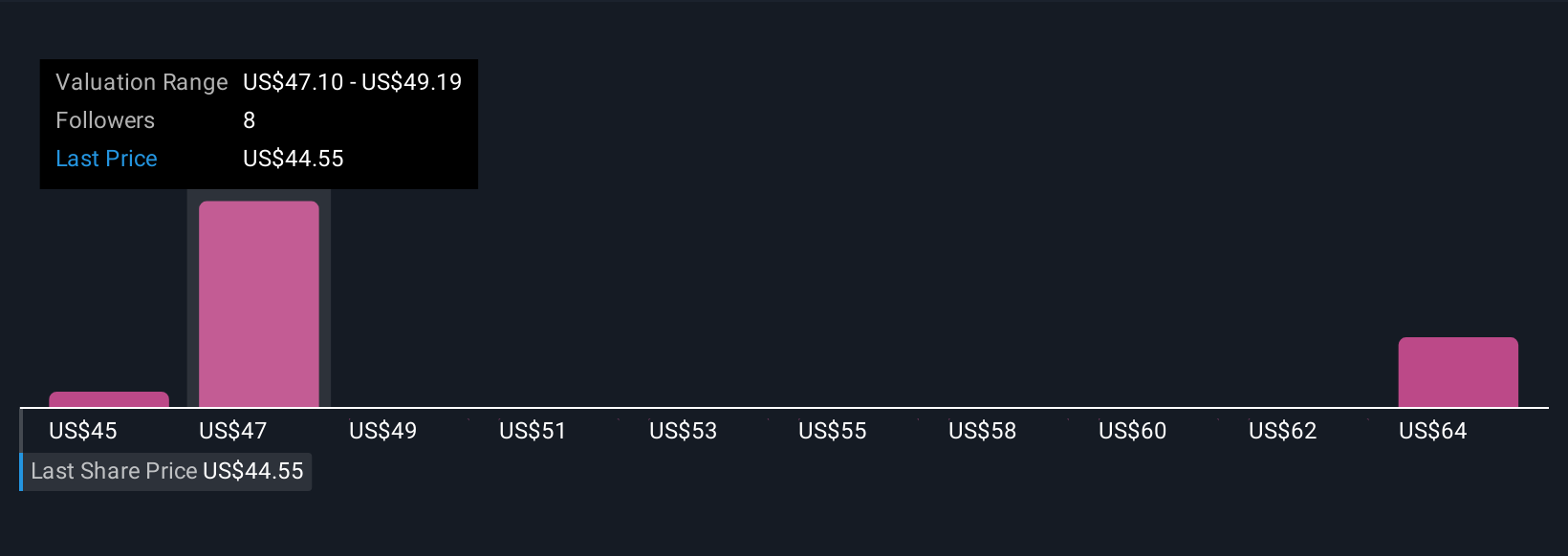

Fair value estimates from three members of the Simply Wall St Community for CNA Financial range from US$45 to nearly US$63.65 per share. As you compare these varied opinions, remember that underwriting volatility remains a concern and can influence whether future results meet these forecasts.

Explore 3 other fair value estimates on CNA Financial - why the stock might be worth as much as 38% more than the current price!

Build Your Own CNA Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNA Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CNA Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNA Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives