- United States

- /

- Insurance

- /

- NYSE:CNA

CNA Financial (CNA) Net Profit Margin Drops to 6%, Challenging Bullish Narratives

Reviewed by Simply Wall St

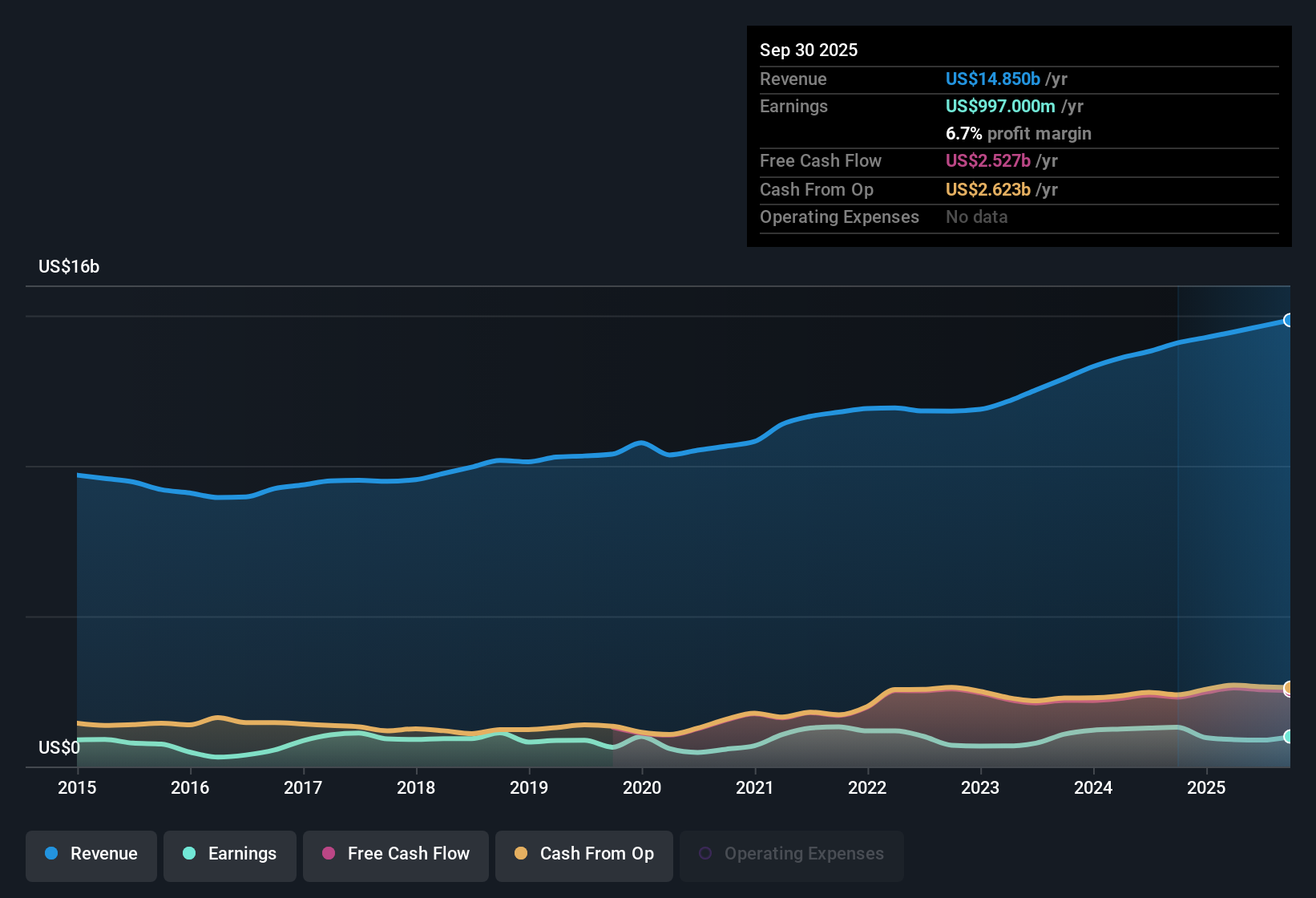

CNA Financial (CNA) reported a net profit margin of 6%, a drop from 9.3% a year earlier, signaling a notable decline in profitability year over year. The company’s annual earnings have grown at a rate of 5.2% over the last five years, but the most recent period saw negative earnings growth. With shares trading at $44.05, below the estimated fair value of $65.97, the focus now shifts to forward-looking estimates as analysts expect robust growth of 22.16% per year over the next three years, outpacing the broader US market forecast of 16.1%. Despite recent headwinds, the combination of long-term earnings quality and optimistic projections sets the stage for a nuanced evaluation of CNA's value proposition.

See our full analysis for CNA Financial.The next section puts these earnings results in context, matching the latest numbers against the narratives investors are actually using to make decisions in the market.

See what the community is saying about CNA Financial

Premium Rates Drive Margin Outlook

- The latest analyst projections expect profit margins to rise from 6.7% now to 9.8% in three years, while revenue is forecast to grow by 6.2% annually over that period.

- Consistent with the analysts' consensus view, these improvements are attributed to strong premium growth and high policyholder retention. Expense discipline and rate increases in social inflation-affected lines are expected to reinforce the path to wider margins.

- Sustained investment in technology and a focus on operational efficiency have led to improved expense ratios, further supporting the margin expansion thesis.

- Higher investment income is also anticipated to strengthen total earnings, building confidence in reaching the target margin improvement.

Consensus expects new policy growth and efficiency wins could push CNA closer to those profit margin targets, but it still hinges on how well they manage costs and continue recent pricing gains. 📊 Read the full CNA Financial Consensus Narrative.

Underwriting Volatility Remains a Concern

- Recent filings highlight elevated catastrophe losses and unfavorable developments in segments like commercial auto and professional liability, which have increased underwriting volatility beyond prior periods.

- Bears point to these losses and the rising underlying loss ratio as risks to the company's profit targets, arguing that persistently higher claims or further adverse development could derail margin gains.

- Foreign currency losses in the International segment and expectations for lower short-term investment gains are also flagged as obstacles to future earnings growth.

- This skepticism centers on whether the company can offset these headwinds fast enough before they meaningfully erode core profitability.

Valuation Sits Below Fair Value Despite Peer Premium

- CNA trades at 13.6 times earnings, a hair above the industry average of 13.4x, but its $44.05 share price is well below the DCF fair value of $65.42, presenting a sizable valuation gap.

- Analysts' consensus view holds that, despite CNA's recent earnings pressures, current pricing implies the market is baking in both the forecasted earnings rebound and the risk of slower growth than peers.

- Consensus price targets cluster narrowly around $45.00, suggesting that, at present, Wall Street interprets CNA as fairly priced in relation to its sector's challenges and future returns.

- Investors who believe in the upside case must be convinced CNA can deliver on forecasted growth and margin expansion, closing the discount to intrinsic value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CNA Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective and shape your personal outlook by crafting a narrative in just a few minutes. Do it your way.

A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

CNA’s recent profit margin compression and negative earnings growth highlight the challenge of maintaining consistent financial performance in the face of market volatility and underwriting setbacks.

If steady, reliable progress matters most to you, use stable growth stocks screener (2094 results) to focus on companies that consistently deliver solid revenue and earnings growth, regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives