- United States

- /

- Insurance

- /

- NYSE:CNA

A Fresh Look at CNA Financial (CNA) Valuation Following Recent Share Price Moves

Reviewed by Simply Wall St

See our latest analysis for CNA Financial.

CNA Financial's share price has wobbled in recent months, reflecting a wider shift in insurance stocks. However, its 1-year total shareholder return of 1.41% tells a steadier story of resilience. Long-term investors have seen momentum build impressively, with a 36.5% return over three years and nearly 87% over five years. This context puts the latest short-term moves into perspective.

If recent swings have you rethinking your strategy, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership.

With shares hovering close to analyst targets but trading well below estimated intrinsic value, the real question is whether CNA Financial now offers hidden value or if future growth is already reflected in the current price.

Price-to-Earnings of 12.4x: Is it justified?

At a price-to-earnings (P/E) ratio of 12.4x and a recent close of $45.79, CNA Financial looks attractively valued when compared to both its peers and the wider insurance sector.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings, and is especially relevant in the insurance industry, where stable profit streams are common. A lower ratio can signal undervaluation, particularly if the company has solid earnings quality and reasonable growth prospects.

CNA’s current P/E sits below the US Insurance industry average of 13x and also below its peer group average of 13.4x. Compared to the estimated fair P/E ratio of 16.3x, the current level leaves notable upside if market sentiment improves or underlying fundamentals strengthen. This fair ratio reflects what the market might eventually pay if profitability persists.

Explore the SWS fair ratio for CNA Financial

Result: Price-to-Earnings of 12.4x (UNDERVALUED)

However, risks remain, including recent underperformance over 90 days. There is also the possibility that market sentiment might shift further if earnings growth slows.

Find out about the key risks to this CNA Financial narrative.

Another View: Discounted Cash Flow Model

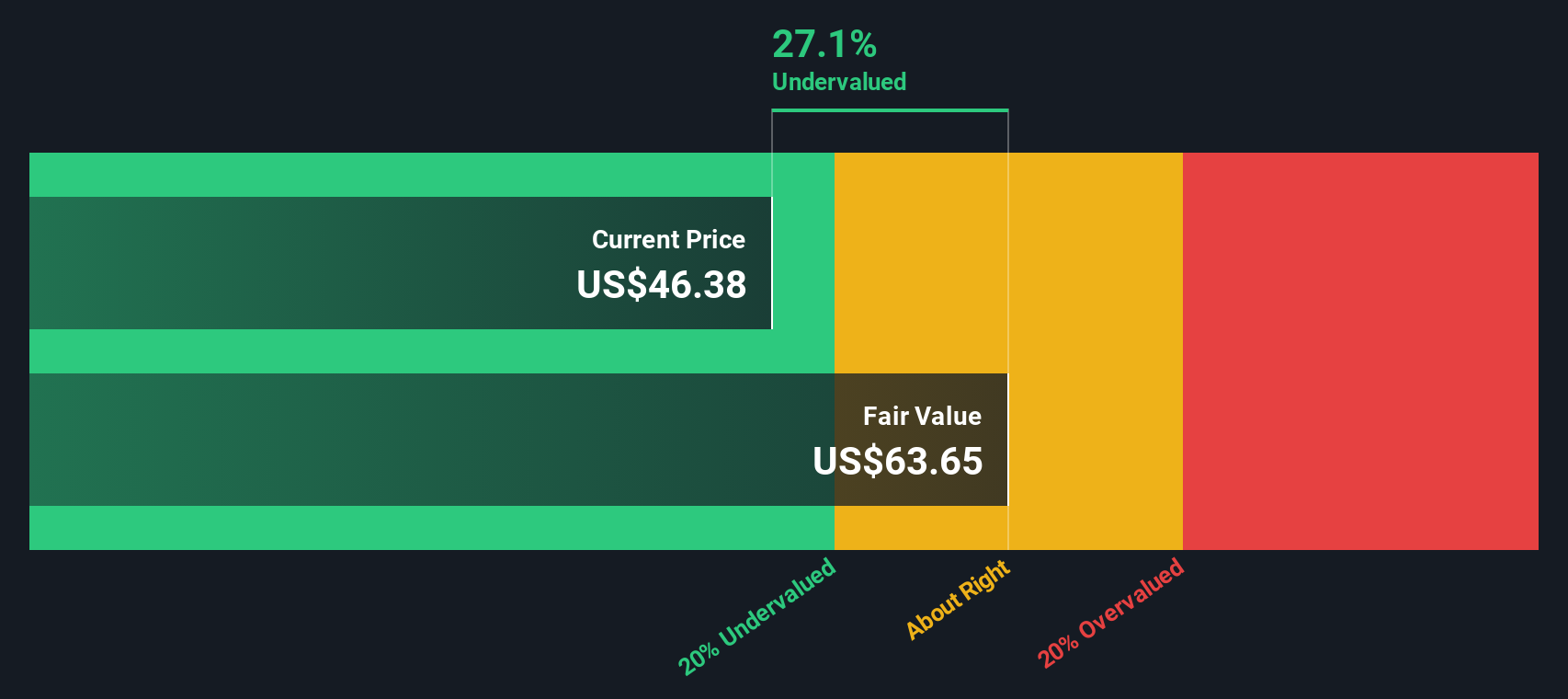

While the P/E ratio points to undervaluation, a different approach tells a similar story. Our SWS DCF model estimates CNA Financial's fair value at $63.65 per share, which is about 28% above the current price of $45.79. This suggests the market could be overlooking potential upside. However, does this mean the DCF view is more reliable, or are there hidden risks behind the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNA Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNA Financial Narrative

If you see the story differently or enjoy running your own numbers, the data is right at your fingertips. You can build a custom view in just a few minutes. Do it your way

A great starting point for your CNA Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your investment strategy and spot tomorrow's leaders. The right screener unlocks new opportunities, giving you an edge with data-driven insights that others might miss.

- Spot undervalued opportunities early by checking out these 899 undervalued stocks based on cash flows that could offer hidden growth and long-term upside.

- Supercharge your portfolio's potential with these 26 AI penny stocks that are changing industries and leveraging emerging AI technologies.

- Uncover reliable income streams by tracking these 18 dividend stocks with yields > 3% delivering consistently strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives