- United States

- /

- Insurance

- /

- NYSE:BRO

Brown & Brown (NYSE:BRO) Appoints Industry Veteran Stephen Hearn As New COO

Reviewed by Simply Wall St

Stephen P. Hearn's appointment as Executive Vice President and Chief Operating Officer marks a leadership shift at Brown & Brown (NYSE:BRO), which may have influenced the company's 5% price increase over the past month. The company's recent performance, characterized by substantial revenue growth in the fourth quarter of 2024 despite a drop in net income, reflects its strong financial health amidst strategic changes. This expansion aligns with Brown & Brown's long-standing commitment to scale its operations under Hearn's guidance. The company's share buyback program continues, adding value for investors. During this period, the broader market experienced volatility, with major indexes registering declines. However, Brown & Brown's performance diverged from these trends, highlighting the distinct impact of its internal developments. While the overall market faced challenges, the insurance sector, where Brown & Brown operates, displayed resilience, which contributed to the positive stock movement amid a turbulent market backdrop.

Click to explore a detailed breakdown of our findings on Brown & Brown.

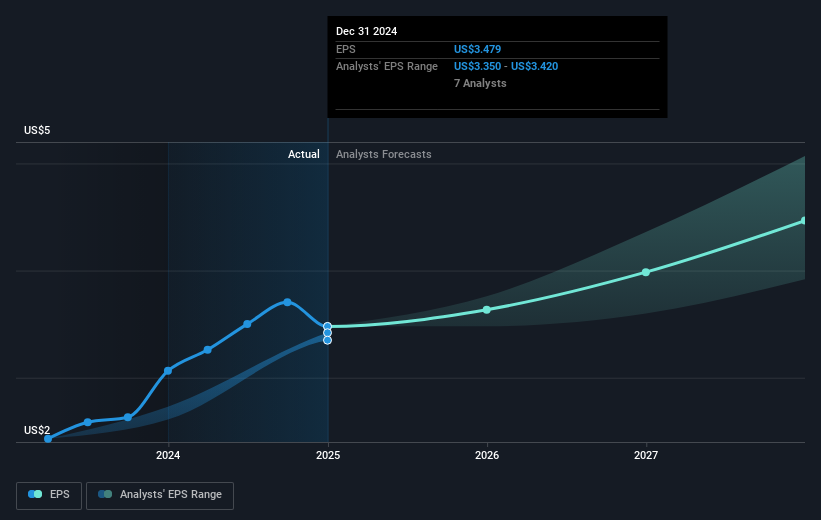

In the last five years, Brown & Brown's shares have delivered a total return of 154.56%, highlighting significant value creation for investors. While the broader market exhibited volatility, Brown & Brown's performance standout can be partially attributed to internal developments and strategic initiatives. Notably, the company's sustained earnings growth, averaging 18.4% annually, and its commitment to shareholder value through consistent dividend enhancements, like the 15% increase in October 2024, likely played a role in this positive trajectory.

Executive leadership changes, including the strategic appointments of Stephen P. Hearn and other key figures in early 2024, supported this growth narrative by aligning the company with innovative expansions. Moreover, the corporate strategy of targeting culturally and strategically compatible acquisitions, as discussed in September 2023, underscores the company's focus on long-term operational scaling. These factors collectively have helped enhance Brown & Brown's market standing, as reflected in its performance surpassing the US Insurance industry and broader market over the past year.

- See whether Brown & Brown's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Brown & Brown's market positioning with our detailed risk analysis report.

- Got skin in the game with Brown & Brown? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives