- United States

- /

- Insurance

- /

- NYSE:BNT

Here's Why Brookfield Wealth Solutions (NYSE:BNT) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Brookfield Wealth Solutions (NYSE:BNT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Brookfield Wealth Solutions with the means to add long-term value to shareholders.

Check out our latest analysis for Brookfield Wealth Solutions

How Fast Is Brookfield Wealth Solutions Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Brookfield Wealth Solutions' EPS has grown 31% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

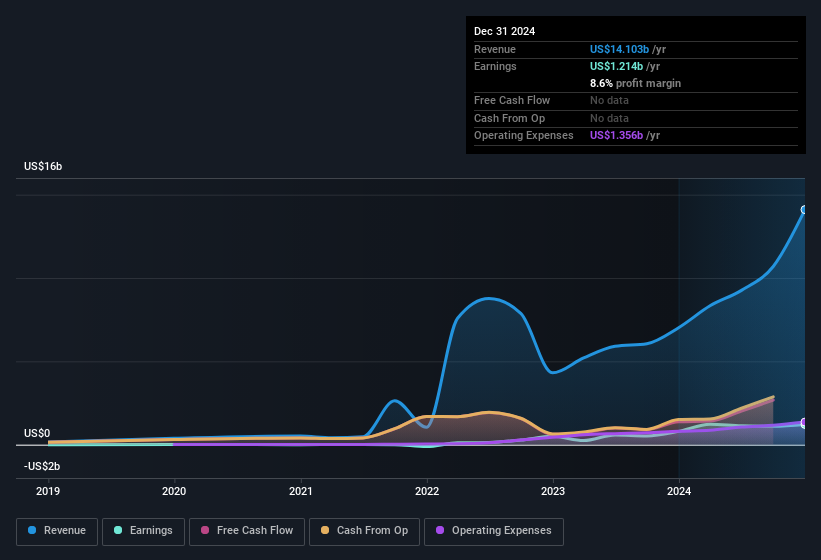

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Brookfield Wealth Solutions' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. On the one hand, Brookfield Wealth Solutions' EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Brookfield Wealth Solutions' balance sheet strength, before getting too excited.

Are Brookfield Wealth Solutions Insiders Aligned With All Shareholders?

Since Brookfield Wealth Solutions has a market capitalisation of US$8.7b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$844m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is Brookfield Wealth Solutions Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Brookfield Wealth Solutions' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Brookfield Wealth Solutions' continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. We don't want to rain on the parade too much, but we did also find 1 warning sign for Brookfield Wealth Solutions that you need to be mindful of.

Although Brookfield Wealth Solutions certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success