- United States

- /

- Insurance

- /

- NYSE:AXS

How Will AXIS Capital’s (AXS) AI Underwriting Advancements Influence Its Long-Term Profitability?

Reviewed by Sasha Jovanovic

- AXIS Capital Holdings recently received a positive analyst upgrade following rising earnings estimates and a favorable business outlook, attributed to its continued investments in technology and new multi-line specialty insurance initiatives such as AXIS Capacity Solutions.

- An interesting insight is the company's focus on AI-driven underwriting and operational efficiency enhancements, which are viewed as key contributors to improved risk selection and profitability.

- We’ll now explore how AXIS’s technology-driven underwriting momentum could shape its investment narrative amid recent analyst optimism.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

AXIS Capital Holdings Investment Narrative Recap

To be a shareholder in AXIS Capital Holdings right now, you need to believe that the company’s significant investments in technology and specialty insurance solutions will sustain earnings growth, even as competitive pressures and pricing challenges persist. The recent analyst upgrade underlines short-term confidence tied to continued momentum in underwriting profitability, though the greatest current risk remains the unpredictability of claims in casualty and liability lines due to social inflation, this risk is unchanged by the latest news.

AXIS’s launch of Capacity Solutions is especially relevant, expanding its multi-line specialty portfolio and aligning directly with the catalyst of growing demand for specialty products supported by technology-driven underwriting and greater efficiency. By focusing on higher-margin segments while enhancing operational capabilities, AXIS may offer stronger and more consistent underwriting results, conditions that underpin recent analyst optimism and could attract investors looking for resilient growth strategies.

But in contrast, investors should pay close attention to growing unpredictability in claims and potential for reserve adjustments stemming from...

Read the full narrative on AXIS Capital Holdings (it's free!)

AXIS Capital Holdings' narrative projects $7.0 billion revenue and $1.1 billion earnings by 2028. This requires 3.9% yearly revenue growth and a $238.5 million earnings increase from $861.5 million today.

Uncover how AXIS Capital Holdings' forecasts yield a $113.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

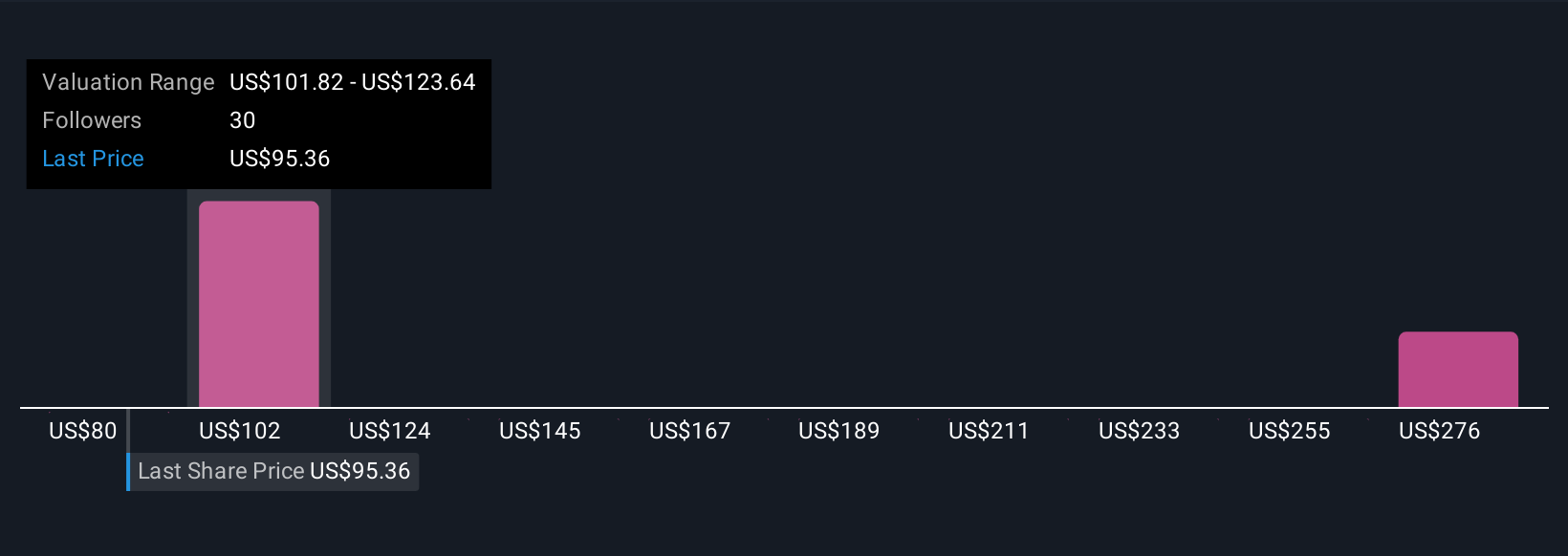

Five Simply Wall St Community fair value estimates span from US$80 to US$292.51, showcasing dramatically differing views on AXIS’s future. While some see deep value, others highlight that evolving specialty insurance demands and technology investment could influence outcomes in ways that might surprise even the most experienced market participants.

Explore 5 other fair value estimates on AXIS Capital Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own AXIS Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXIS Capital Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AXIS Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXIS Capital Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXS

AXIS Capital Holdings

Through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives