- United States

- /

- Insurance

- /

- NYSE:AXS

Has the AXIS Capital Rally Gone Too Far or Is There More Room to Run?

Reviewed by Bailey Pemberton

- If you have ever wondered whether AXIS Capital Holdings is still a smart buy after its big run, you are in the right place. We are going to unpack what the current price really implies about future value.

- The stock has climbed 1.4% over the last week, 8.5% over the past month, and is now up 14.3% year to date, building on a 91.6% gain over 3 years and 123.8% over 5 years.

- Recent headlines around the insurance space have focused on shifting catastrophe risks, tighter underwriting standards, and investors rotating toward insurers that balance growth with disciplined capital management. AXIS has been part of that conversation as markets reassess which underwriters are positioned for a higher risk, higher premium environment. This context helps explain why the stock has been steadily re-rated.

- On our numbers, AXIS posts a solid 5 out of 6 valuation score. This suggests it screens as undervalued on most of the key checks we run. Next we will walk through those methods, before finishing with a broader way to think about AXIS’s worth beyond any single model.

Approach 1: AXIS Capital Holdings Excess Returns Analysis

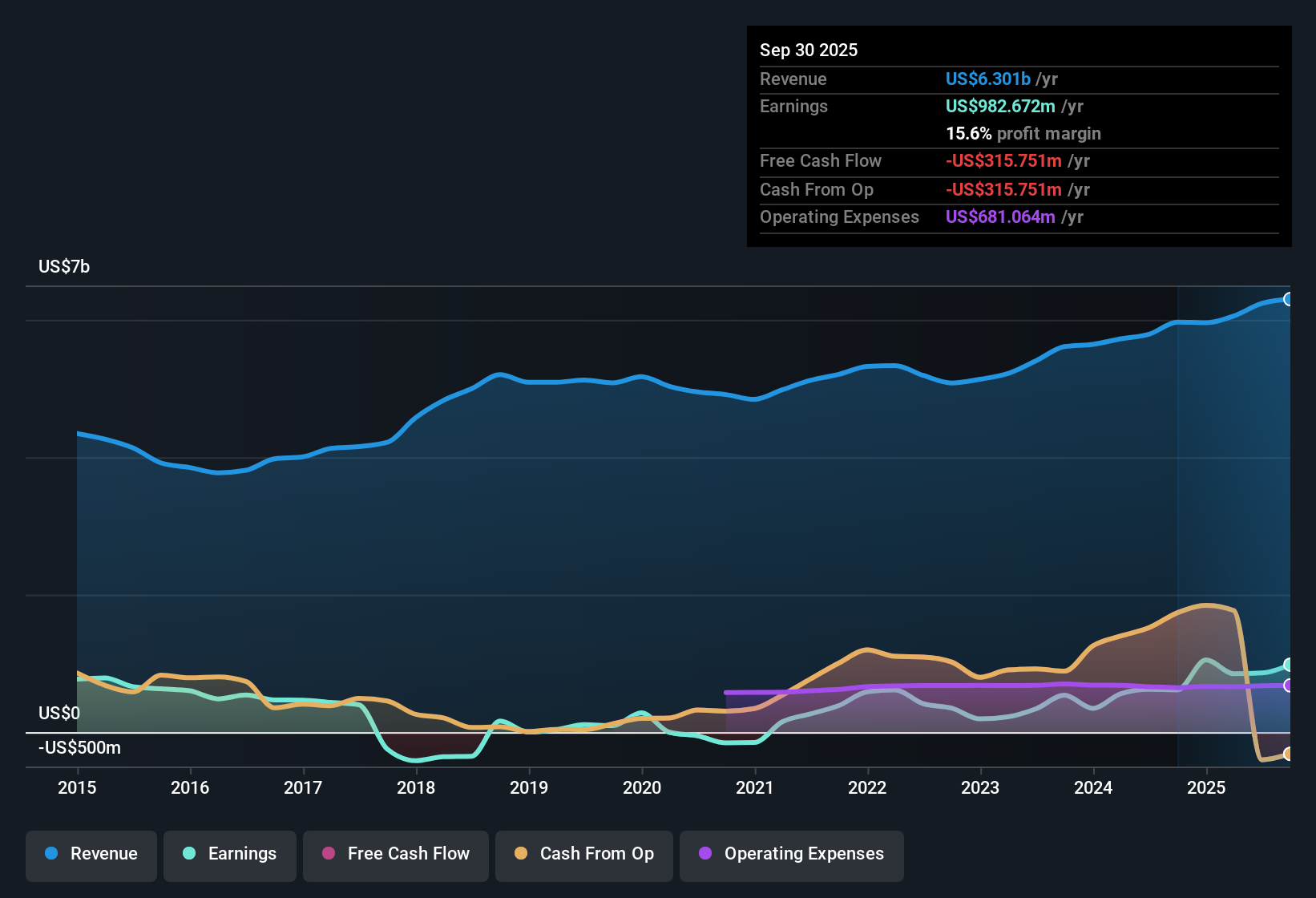

The Excess Returns model looks at how much value AXIS Capital Holdings can create above the basic return shareholders demand, based on how efficiently it reinvests its equity. Starting from a Book Value of $75.51 per share and an Average Return on Equity of 16.86%, analysts estimate a Stable EPS of $14.61 per share, supported by future return on equity expectations from 7 analysts. With a Cost of Equity of $6.03 per share, the model implies an Excess Return of $8.58 per share, meaning AXIS is expected to earn materially more than the minimum required return on its capital.

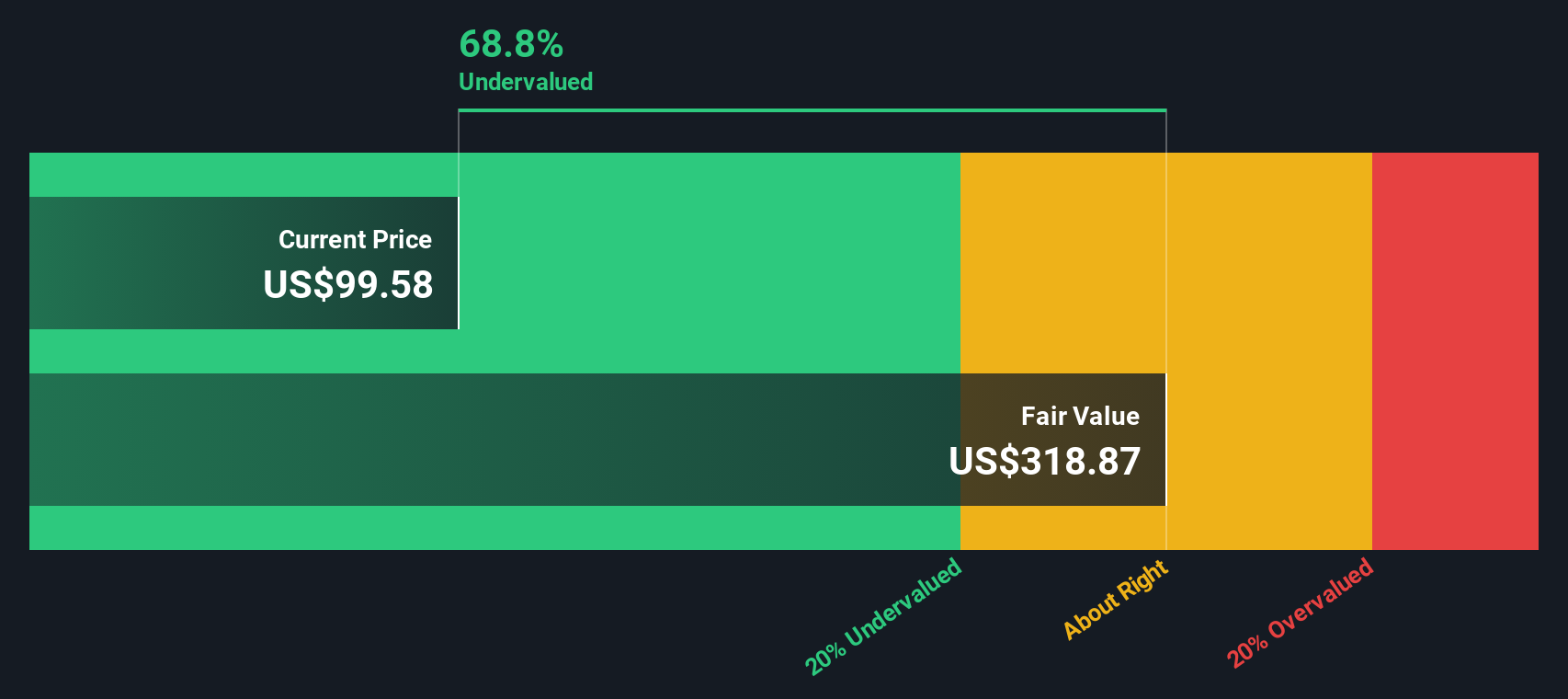

Those excess profits are then projected forward on a Stable Book Value of $86.63 per share, based on estimates from 6 analysts, and discounted back to today. This yields an intrinsic value of about $318.87 per share in dollar terms. Compared with the current share price, the Excess Returns model suggests AXIS is roughly 68.1% undervalued, pointing to substantial upside if these assumptions hold.

Result: UNDERVALUED

Our Excess Returns analysis suggests AXIS Capital Holdings is undervalued by 68.1%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: AXIS Capital Holdings Price vs Earnings

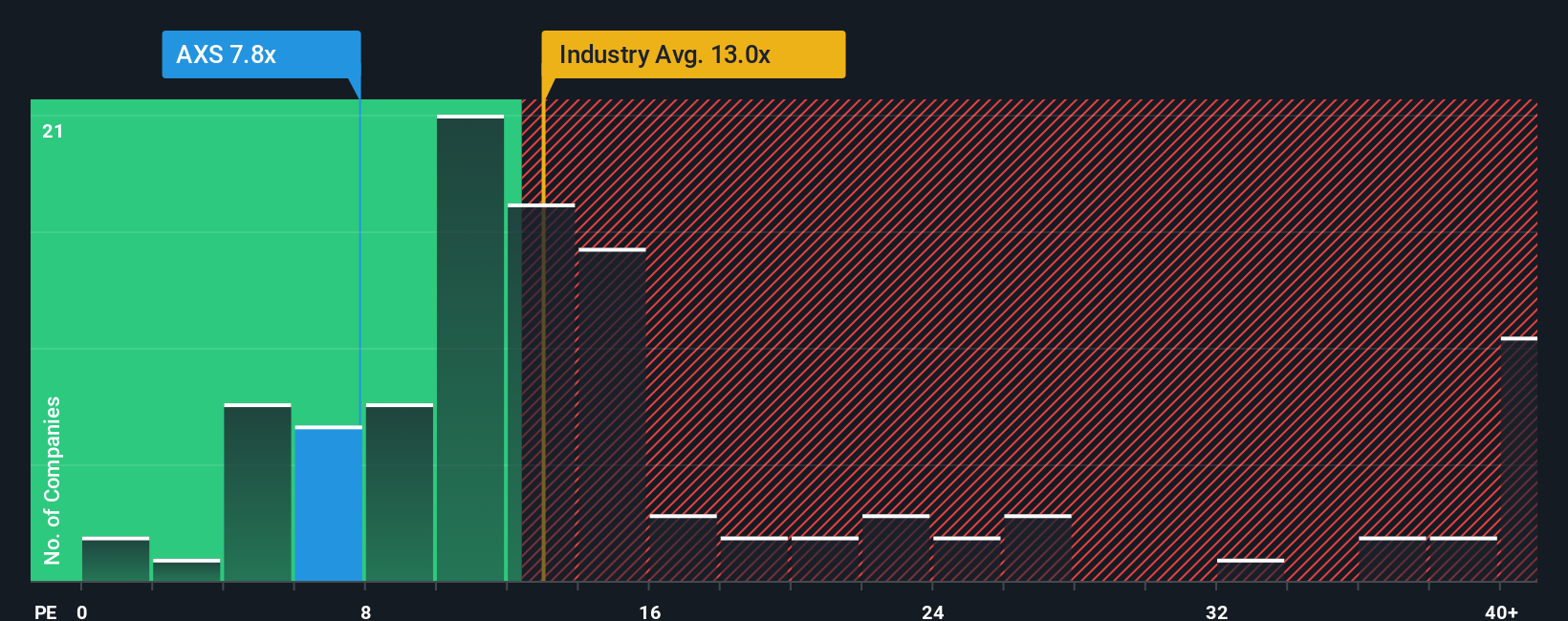

For a consistently profitable insurer like AXIS, the price to earnings ratio is a useful yardstick because it links what investors pay today directly to the earnings the business is already generating. In general, faster growth and lower perceived risk justify a higher PE, while slower growth, more volatile results, or elevated risk point to a lower, more conservative multiple.

AXIS currently trades on a PE of about 8.0x, which is well below both the Insurance industry average of roughly 13.1x and the broader peer group average of around 13.4x. Simply Wall St, however, goes a step further by estimating a Fair Ratio of about 13.4x. This proprietary metric reflects AXIS’s specific earnings growth profile, profit margins, industry dynamics, market cap, and risk characteristics. This makes it a more tailored benchmark than simple peer or sector comparisons.

When you line up the current 8.0x PE against a Fair Ratio of 13.4x, AXIS appears meaningfully cheap. This suggests that the market is still discounting its earnings power more than those fundamentals appear to warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AXIS Capital Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about AXIS to the numbers behind its fair value, revenue, earnings, and margin forecasts.

A Narrative on Simply Wall St connects three things: what you believe about a company’s business, how that belief translates into future financials, and what fair value those numbers imply today.

Available on the Community page used by millions of investors, Narratives make it easy to compare your view of Fair Value for AXIS with its current price, and they automatically update as new earnings, news, or guidance change the outlook.

For example, one AXIS Narrative might assume buybacks and higher specialty margins justify a Fair Value near the top of analyst targets at about $130 per share. A more cautious Narrative focused on competitive and cyber risk might anchor closer to $100, giving you a clear, dynamic range to compare with the current price and form your own view.

Do you think there's more to the story for AXIS Capital Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXS

AXIS Capital Holdings

Through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026