- United States

- /

- Insurance

- /

- NYSE:AON

We Ran A Stock Scan For Earnings Growth And Aon (NYSE:AON) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Aon (NYSE:AON). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Aon with the means to add long-term value to shareholders.

See our latest analysis for Aon

How Fast Is Aon Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Impressively, Aon has grown EPS by 25% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

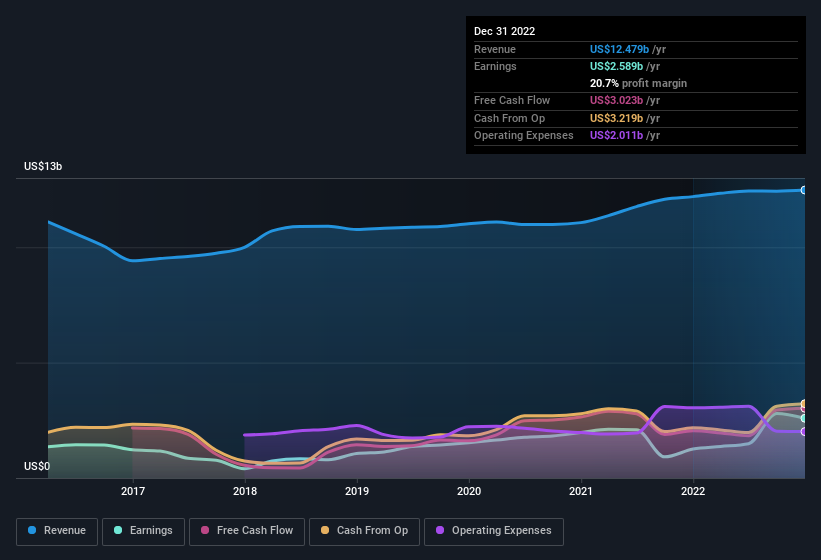

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Aon shareholders is that EBIT margins have grown from 17% to 28% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Aon's future profits.

Are Aon Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold US$256k worth of shares. But that's far less than the US$1.3m insiders spent purchasing stock. We find this encouraging because it suggests they are optimistic about Aon'sfuture. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman of the Board Lester Knight for US$1.1m worth of shares, at about US$287 per share.

On top of the insider buying, it's good to see that Aon insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$685m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Aon Deserve A Spot On Your Watchlist?

You can't deny that Aon has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. We should say that we've discovered 2 warning signs for Aon (1 is significant!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Aon, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Fair value with mediocre balance sheet.