- United States

- /

- Insurance

- /

- NYSE:ALL

How Allstate’s (ALL) Reaffirmed $1.00 Dividend Will Impact ALL Investors

Reviewed by Simply Wall St

- The Allstate Corporation recently announced that its board of directors approved a quarterly dividend of US$1.00 per share, payable in cash on October 1, 2025, to shareholders of record as of August 29, 2025.

- This decision to maintain its regular dividend highlights Allstate’s ongoing commitment to shareholder returns and signals confidence in the company's financial health.

- We'll explore how Allstate’s reaffirmed dividend payment influences investor perspectives on its stability and future earnings trajectory.

Allstate Investment Narrative Recap

Investors in Allstate are typically drawn by the belief in the resilience and growth of its Property-Liability insurance business, driven by expanding product offerings and disciplined cost management. The recent dividend affirmation reinforces confidence in the company’s financial standing, but its impact on the most significant near-term catalyst, increased customer retention and growth through improved offerings, is limited. Catastrophe losses and heightened competition remain the primary risks that can affect Allstate’s ability to deliver stable returns.

Among the recent company updates, the April 30, 2025 share repurchase activity stands out, as it ties into Allstate's ongoing program to deliver shareholder value alongside dividends. While the dividend consistency underlines stability, the buyback program provides another lever to enhance returns, complementing efforts to scale the core business and manage earnings volatility in the face of catastrophe-driven risks.

In contrast to these measured signals, investors should be alert to the effects of unexpected catastrophe losses, as these...

Read the full narrative on Allstate (it's free!)

Allstate's outlook anticipates $77.4 billion in revenue and $5.1 billion in earnings by 2028. This projection is based on a 5.8% annual revenue growth rate and an earnings increase of $1.2 billion from the current earnings of $3.9 billion.

Uncover how Allstate's forecasts yield a $226.13 fair value, a 16% upside to its current price.

Exploring Other Perspectives

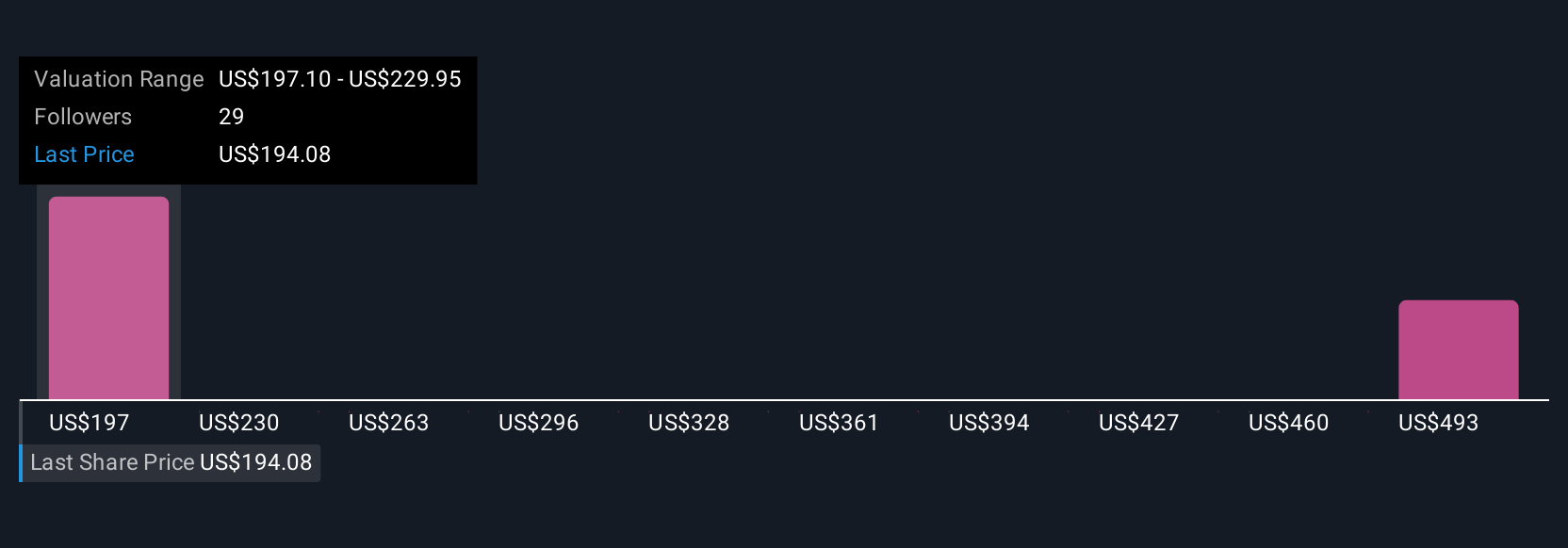

Fair value views from four Simply Wall St Community members range from US$197.10 to US$521.88 per share. While some see significant upside, others focus on the business’s exposure to severe catastrophe losses and what that could mean for future returns.

Explore 4 other fair value estimates on Allstate - why the stock might be worth just $197.10!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives