- United States

- /

- Insurance

- /

- NYSE:ALL

How Allstate's (ALL) AI Partnership With Advisor360° Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Allstate Financial Services recently announced a partnership with Advisor360° to implement a new AI-powered wealth management platform, designed to integrate insurance and investment offerings into a unified digital experience for customers and employees.

- This move highlights Allstate's increasing focus on digital transformation and operational efficiency, as the company seeks to streamline processes and enhance user experience in a competitive industry landscape.

- We'll explore how the addition of AI-driven portfolio management could strengthen Allstate's investment narrative and long-term growth outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Allstate Investment Narrative Recap

To own Allstate stock, you need to believe in the company's ability to innovate digitally, manage insurance risks, and sustain profitability amid industry competition and regulatory pressures. The recent announcement of substantial third quarter catastrophe losses, at US$558 million (US$441 million after-tax), underscores that severe weather remains the leading near-term risk for shareholders, and if anything, may weigh more on short-term earnings than ongoing digital transformation efforts like the new AI platform. While this loss figure highlights the persistent underwriting volatility inherent in property and casualty insurance, it does not materially alter the chief catalyst of broad product digitization or change the dominant risk profile for now.

Among recent company updates, Allstate’s implementation of an AI-powered wealth management platform with Advisor360° is most relevant in the current context. As the company continues to report volatility from catastrophe events, this digital initiative complements efforts to improve operational efficiency, diversify earnings, and maintain competitive differentiation, key factors for supporting Allstate’s long-term investment thesis in the face of climate and market headwinds.

But investors should be aware that while digital transformation is promising, the unpredictability of catastrophe losses can quickly challenge even well-laid plans...

Read the full narrative on Allstate (it's free!)

Allstate's narrative projects $76.3 billion in revenue and $4.3 billion in earnings by 2028. This requires a 4.9% yearly revenue growth and a $1.4 billion decrease in earnings from the current $5.7 billion.

Uncover how Allstate's forecasts yield a $232.85 fair value, a 20% upside to its current price.

Exploring Other Perspectives

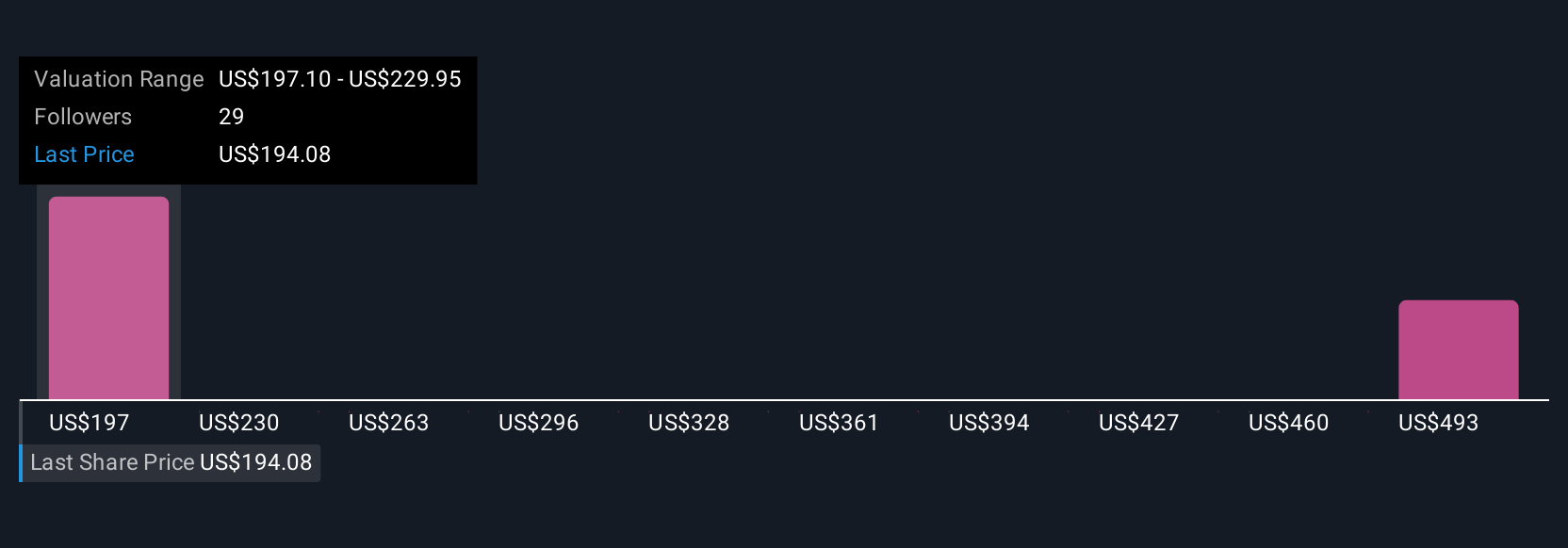

Simply Wall St Community members estimate Allstate's fair value from US$188 up to US$596, with five distinct opinions represented. While many see potential value, the risk of increased catastrophe losses remains front of mind and may affect how you interpret these wide-ranging perspectives.

Explore 5 other fair value estimates on Allstate - why the stock might be worth just $188.00!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives