- United States

- /

- Insurance

- /

- NYSE:AJG

Is Arthur J. Gallagher Now Offering Value After a 20% Share Price Slide?

Reviewed by Bailey Pemberton

- Wondering if Arthur J. Gallagher at around $244 a share is starting to look like value, or if you would just be catching a falling knife? You are not alone. This is exactly the kind of setup where a closer look at valuation really matters.

- The stock is down about 2.4% over the last week, 2.1% over the last month, and 11.5% year to date. That extends to a 20.5% drop over the last year, even though the 3 year and 5 year returns are still a solid 27.8% and 119.7% respectively.

- Those weaker recent returns sit against a backdrop of the insurance brokerage sector resetting expectations around pricing, capital requirements, and interest rate paths, with policyholders and carriers both pushing harder on margins. At the same time, Gallagher has stayed active on the acquisition front and continued to emphasize its scale advantages and recurring revenue profile, which helps explain why long term performance still looks far better than the last 12 months suggest.

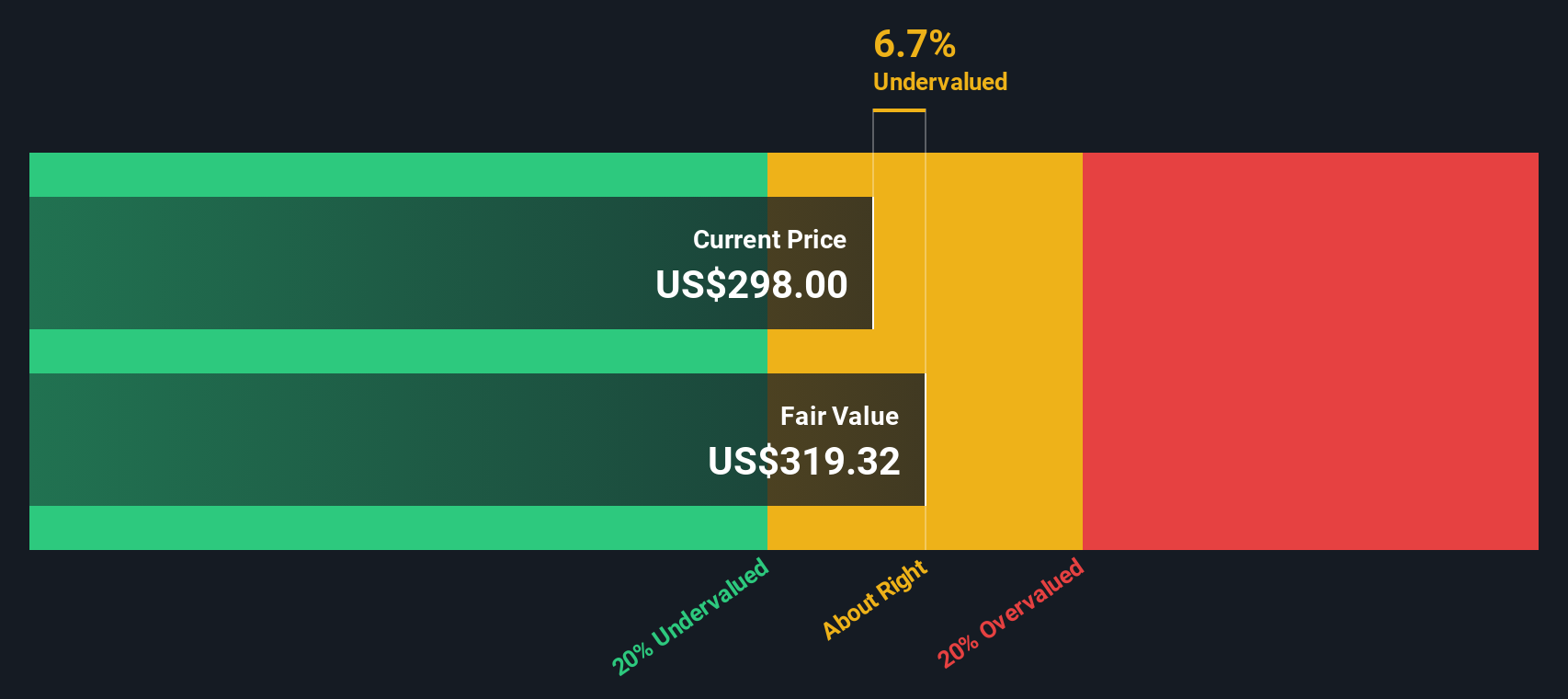

- On our checks, Arthur J. Gallagher scores a 3/6 valuation score, meaning it screens as undervalued on half of the key metrics we track. In the next sections we will unpack what that looks like under different valuation approaches, before finishing with an even more practical way to think about what “fair value” really means for this stock.

Find out why Arthur J. Gallagher's -20.5% return over the last year is lagging behind its peers.

Approach 1: Arthur J. Gallagher Excess Returns Analysis

The Excess Returns model looks at how effectively Arthur J. Gallagher turns shareholder equity into profits above its cost of capital, then capitalizes those surplus returns into an intrinsic value per share.

On this view, the business starts from an estimated book value base of $90.37 per share and is expected to generate stable earnings of about $15.42 per share, based on forward looking return on equity estimates from four analysts. With an average return on equity of 14.13% and a cost of equity equivalent to $7.59 per share, the model estimates excess return of $7.83 per share, suggesting Gallagher is consistently earning more than investors theoretically require for the risk they are taking.

As book value compounds toward a stable level of roughly $109.11 per share, the model converts these excess returns into an intrinsic value estimate of about $321 per share. Against a current share price around $244, this implies the stock is roughly 23.9% undervalued on an excess returns basis.

Result: UNDERVALUED

Our Excess Returns analysis suggests Arthur J. Gallagher is undervalued by 23.9%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Arthur J. Gallagher Price vs Earnings

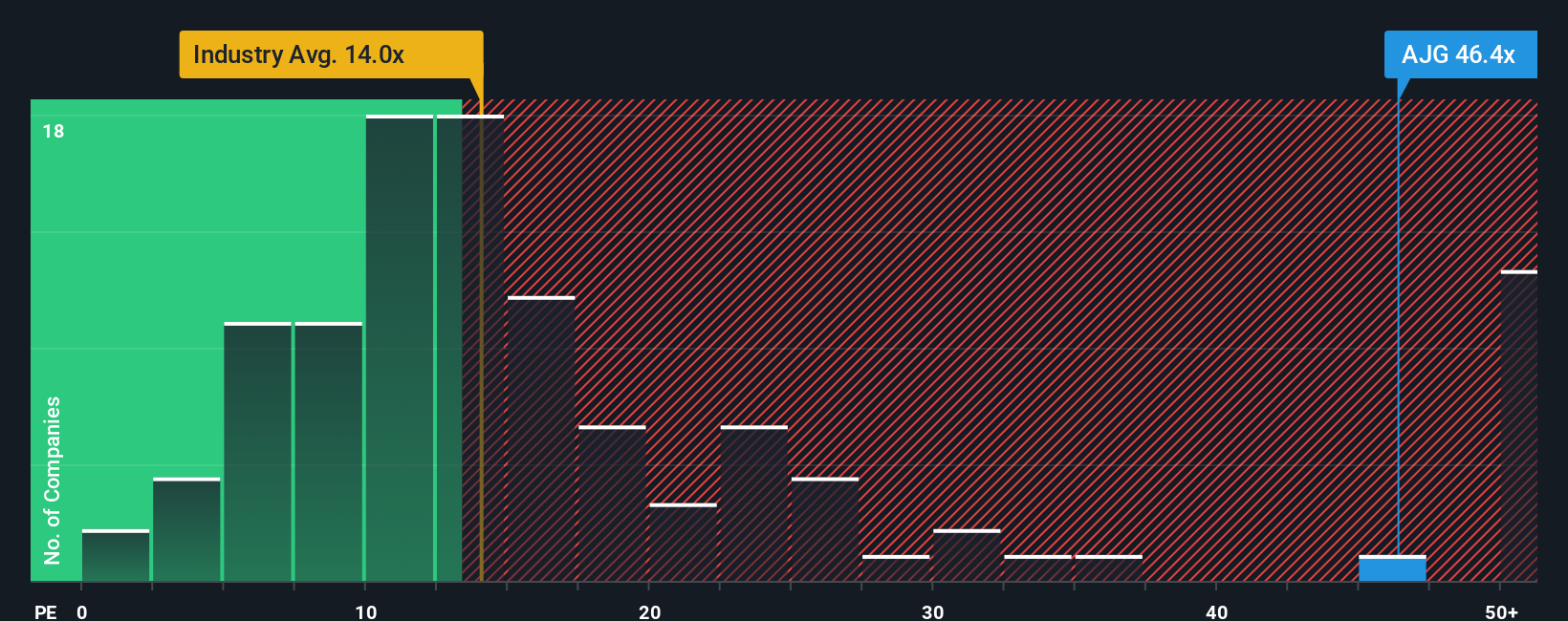

For a profitable, mature business like Arthur J. Gallagher, the price to earnings (PE) ratio is a practical way to gauge what investors are paying for each dollar of current profits. In general, faster expected earnings growth and lower perceived risk can justify a higher PE, while slower growth or greater uncertainty usually call for a lower, more conservative multiple.

Gallagher currently trades on a PE of about 39.17x, which is well above the broader Insurance industry average of roughly 13.25x and also ahead of the 22.74x average for its closest peers. Simply comparing these figures might suggest the stock is expensive, but this ignores company specific drivers like growth, margins, and risk.

That is where Simply Wall St’s Fair Ratio comes in. Our Fair PE of 18.15x reflects what we would expect investors to pay given Gallagher’s earnings growth outlook, profitability, risk profile, industry positioning, and market cap. Because this Fair Ratio is tailored to the company rather than a rough sector average, it offers a more nuanced benchmark. Set against the current 39.17x, Gallagher appears overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

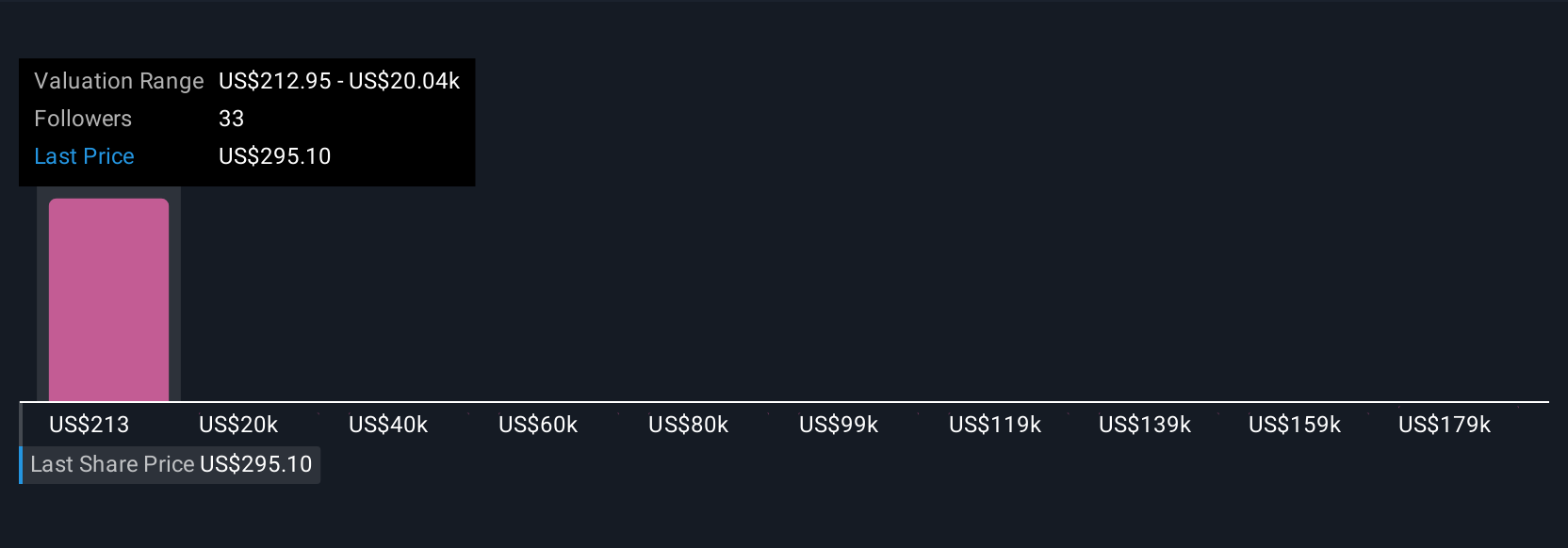

Upgrade Your Decision Making: Choose your Arthur J. Gallagher Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Arthur J. Gallagher’s future to the numbers behind its fair value. A Narrative is your story for the company, expressed as assumptions about how fast revenue and earnings might grow, what margins could look like, and what multiple the market might eventually pay, which then links directly to a fair value estimate you can compare to today’s share price. On Simply Wall St’s Community page, used by millions of investors, Narratives are easy to set up, update automatically as new news or earnings arrive, and can help inform your decision making by showing whether your fair value is above or below the current market price. For example, one Arthur J. Gallagher Narrative might assume strong organic growth, rising margins, and a future fair value closer to the higher analyst targets. A more cautious Narrative could lean toward slower growth, pressure on margins, and a fair value nearer the lowest targets, yet both are transparently built from different but explicit assumptions.

Do you think there's more to the story for Arthur J. Gallagher? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026