- United States

- /

- Insurance

- /

- NYSE:AJG

Is Analyst Optimism on Upcoming Q3 EPS Shaping the Core Story for Arthur J. Gallagher (AJG)?

Reviewed by Sasha Jovanovic

- In early October 2025, Arthur J. Gallagher attracted attention as analysts updated their ratings and projections ahead of the company's upcoming fiscal Q3 results, which are expected soon.

- This focus comes as analysts project adjusted EPS growth for the quarter and maintain a cautiously optimistic outlook, highlighting both recurring business strength and external uncertainties facing the firm.

- With analyst projections of EPS growth in focus, we'll explore what this means for Arthur J. Gallagher's investment outlook and core risks.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Arthur J. Gallagher Investment Narrative Recap

Being a shareholder in Arthur J. Gallagher rests on confidence in the firm’s ability to deliver steady growth through a blend of recurring revenue, industry expertise, and disciplined acquisitions. The latest wave of analyst updates, including Piper Sandler lowering its target while maintaining a positive rating and KBW’s upward revision coupled with a hold stance, largely reflect ongoing monitoring of Gallagher’s earnings trajectory ahead of Q3 results. These reviews appear unlikely to have a material impact on the near-term catalyst, quarterly EPS growth, or to shift the primary risk around sustained property rate declines.

Of the recent announcements, the company’s continued dividend growth (last increased to US$0.65 per share in January and consistently paid through Q3) stands out as particularly relevant, reinforcing Gallagher’s focus on rewarding shareholders amid market scrutiny on its earnings reliability. While quarterly results and analyst changes garner attention, tangible actions like steady dividends anchor investor expectations around the company’s ability to generate and distribute cash in the face of market and sector-specific pressures.

However, investors should be mindful that if property insurance rates keep falling at the sharp pace seen earlier this year, the long-term impact on Gallagher’s commission income and earnings could...

Read the full narrative on Arthur J. Gallagher (it's free!)

Arthur J. Gallagher's outlook anticipates $19.5 billion in revenue and $3.5 billion in earnings by 2028. This scenario implies 19.0% annual revenue growth and a $1.9 billion increase in earnings from the current $1.6 billion.

Uncover how Arthur J. Gallagher's forecasts yield a $339.20 fair value, a 9% upside to its current price.

Exploring Other Perspectives

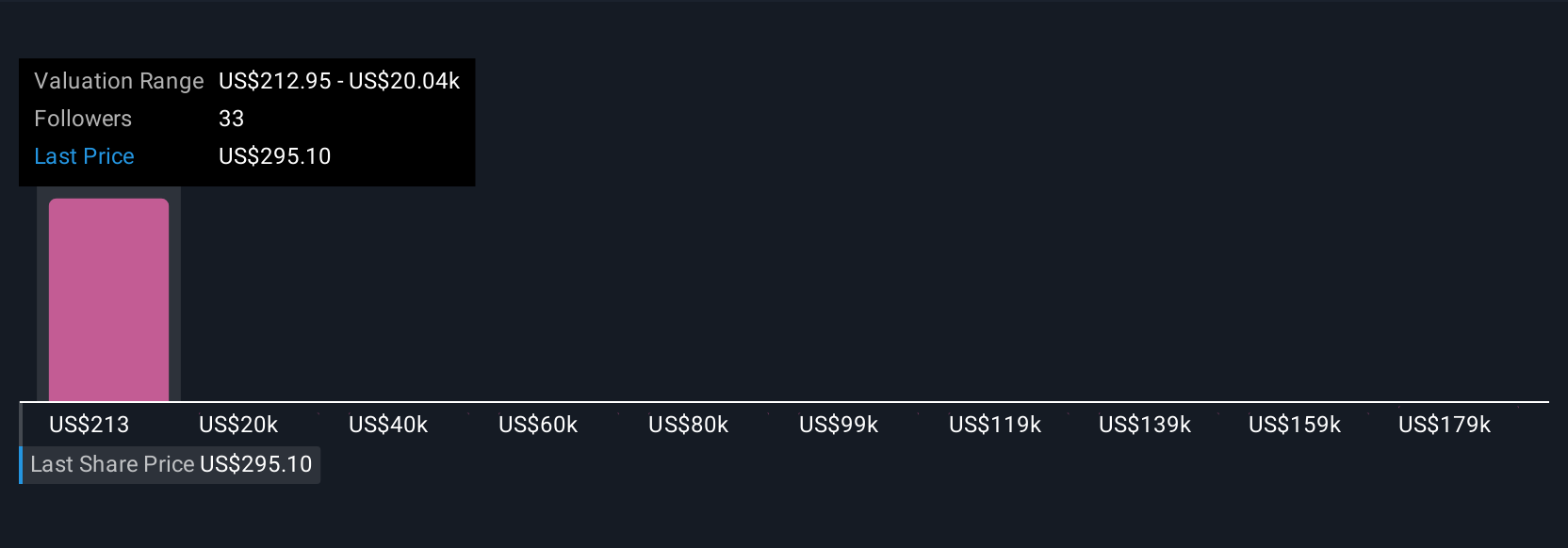

Seven fair value estimates from the Simply Wall St Community span from US$212.95 to over US$198,000, highlighting very different outlooks. Against this backdrop, questions about how Gallagher navigates persistent property insurance rate declines may shape future performance more than headline consensus suggests.

Explore 7 other fair value estimates on Arthur J. Gallagher - why the stock might be a potential multi-bagger!

Build Your Own Arthur J. Gallagher Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arthur J. Gallagher research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Arthur J. Gallagher research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arthur J. Gallagher's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives