- United States

- /

- Insurance

- /

- NYSE:AGO

Should Declining Earnings and Affirmed Dividend Prompt a Rethink for Assured Guaranty (AGO) Investors?

Reviewed by Sasha Jovanovic

- Assured Guaranty Ltd. recently reported its third-quarter results, with revenue declining to US$207 million and net income to US$105 million, compared to the same period last year.

- The company affirmed its quarterly dividend, signaling an ongoing commitment to shareholder returns even as its quarterly financial performance weakened.

- We will now examine how Assured Guaranty's decreased revenue and earnings may change its investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Assured Guaranty Investment Narrative Recap

To be comfortable as an Assured Guaranty shareholder, an investor needs to believe in the company’s ability to manage credit risk and generate consistent returns from its financial guarantee business, even through market cycles. The latest decline in quarterly revenue and earnings is notable, but does not appear to alter the key short-term catalyst: the effort to drive growth by expanding into new geographies and consolidating operations for greater efficiency. The greatest risk still lies in credit exposures and loss expenses arising from troubled credits and market disruptions.

Among recent company actions, the affirmation of Assured Guaranty’s quarterly dividend stands out for its relevance. By maintaining its US$0.34 per share payout despite weaker financial results, the company underscores a focus on shareholder returns, a signal of confidence that may offer reassurance as management works to stabilize and grow underlying earnings.

However, investors should pay close attention to credit risk issues, as the impact of troubled credits and unexpected loss expenses can...

Read the full narrative on Assured Guaranty (it's free!)

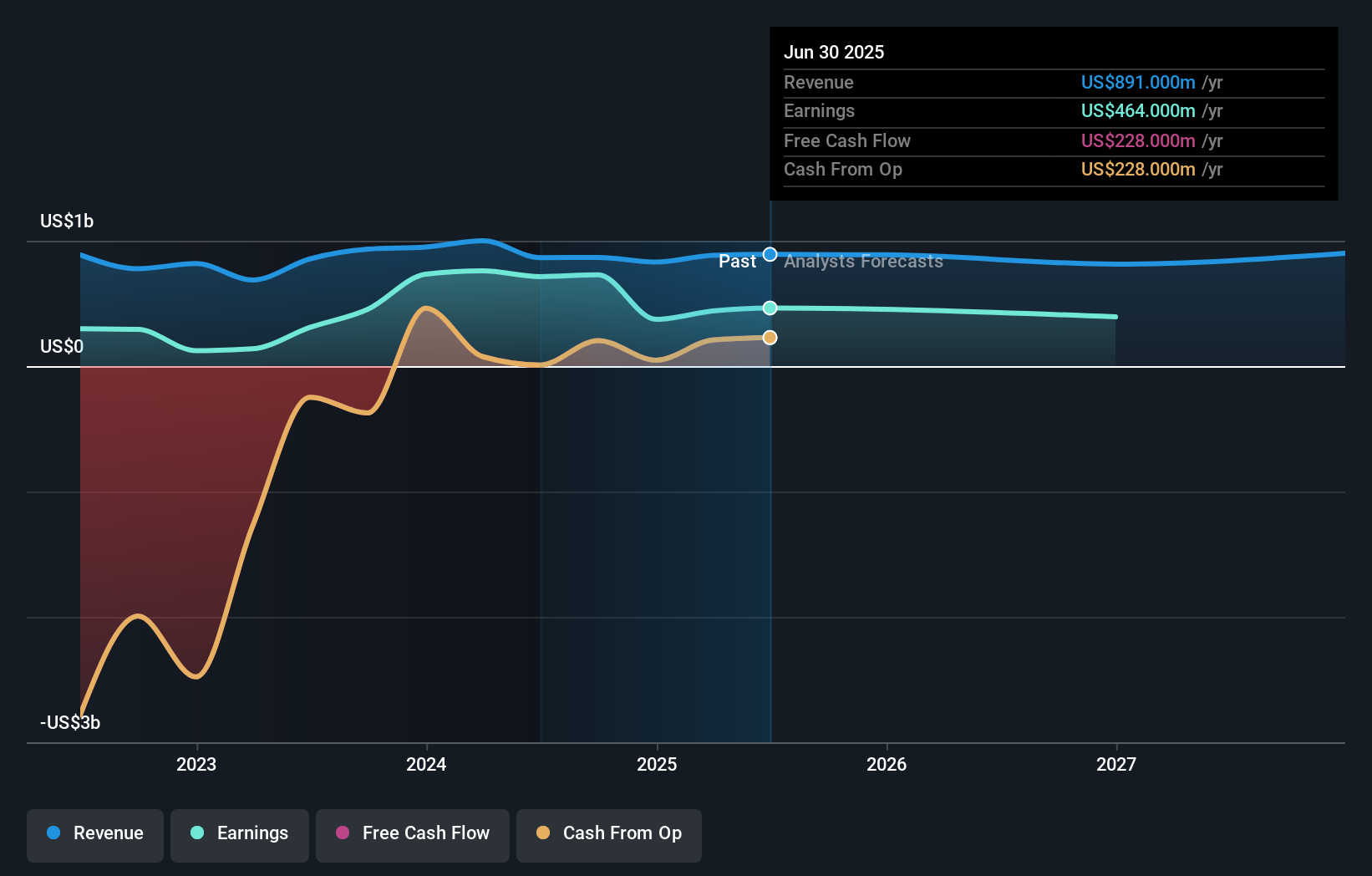

Assured Guaranty's narrative projects $830.5 million revenue and $262.6 million earnings by 2028. This requires a 2.1% annual revenue decline and a $177.4 million decrease in earnings from $440.0 million today.

Uncover how Assured Guaranty's forecasts yield a $106.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided a single fair value estimate of US$177.59, suggesting one-sided optimism. Given ongoing risks tied to credit exposure, you may want to see how other investors are thinking about Assured Guaranty as well.

Explore another fair value estimate on Assured Guaranty - why the stock might be worth just $177.59!

Build Your Own Assured Guaranty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assured Guaranty research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Assured Guaranty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assured Guaranty's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGO

Assured Guaranty

Provides credit protection products to public finance and structured finance markets in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives