- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (AFL): Assessing Valuation After Recent Growth and Analyst Consensus

Reviewed by Kshitija Bhandaru

See our latest analysis for Aflac.

Momentum for Aflac continues to build, with the stock’s roughly 8% share price return year-to-date capping a steady upward trend. While there haven’t been headline-making events recently, the three-year total shareholder return of nearly 100% highlights solid long-term wealth creation for investors. However, the one-year total return has lingered just below flat.

If you’re open to more discovery, now could be an opportune moment to check out fast growing stocks with high insider ownership.

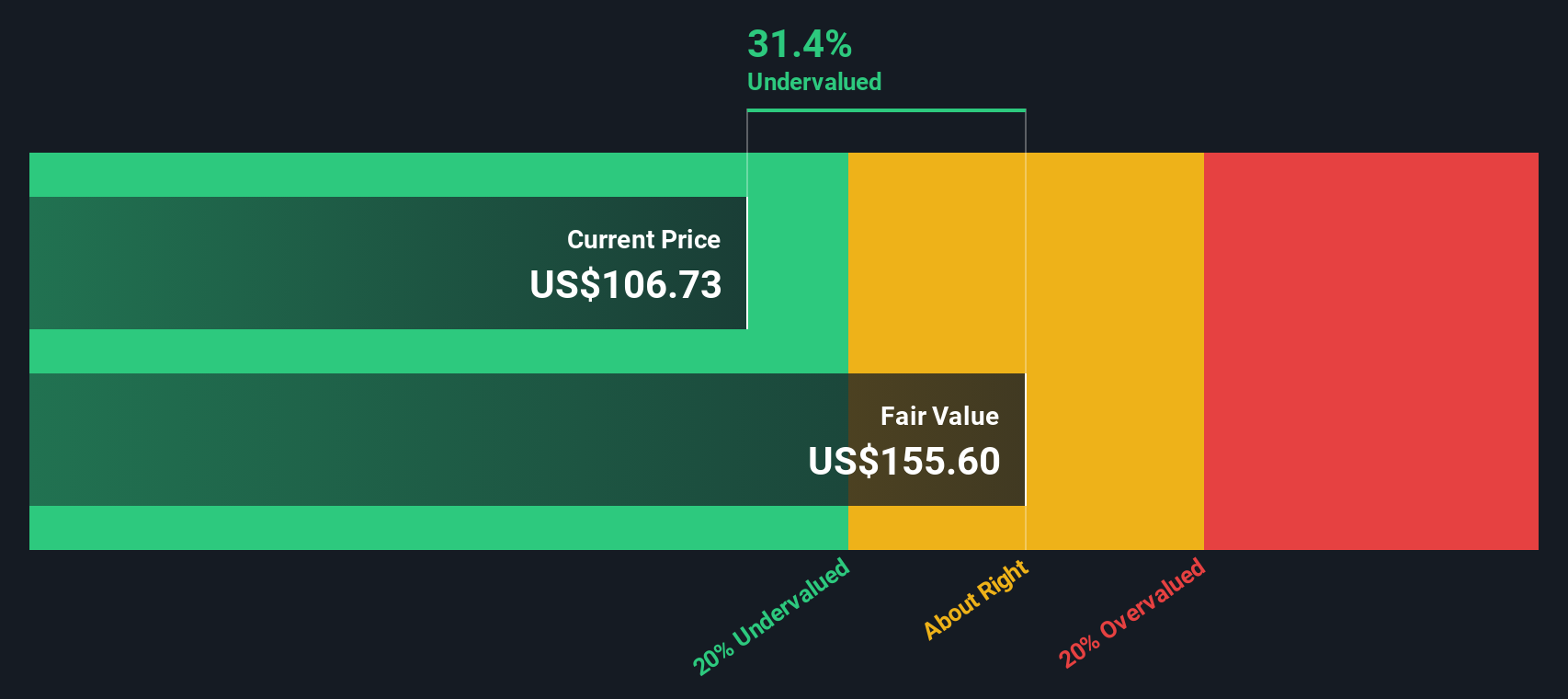

But with Aflac’s share price close to analyst targets despite robust recent growth, the real question is whether the stock remains undervalued or if the market has already priced in all the upside. Is there still a buying opportunity, or is future growth already accounted for by the market?

Most Popular Narrative: 2.3% Overvalued

Despite Aflac’s closing price sitting slightly above the average fair value projected by analyst narratives, there is strong conviction behind the current outlook. Right now, Aflac appears more expensive than what most analysts consider justified.

The successful launch of new, customizable cancer insurance (Miraito) in Japan, coupled with strong early sales across all distribution channels, including banks and Japan Post, positions Aflac to capture growing demand for supplemental health coverage among aging and younger consumers. This supports topline revenue and premium growth. Increased adoption of digital underwriting, customer-facing Gen AI, and digital human avatar initiatives in both Japan and the U.S. is expected to lower long-term operational costs and improve customer engagement. There is potential to materially expand net margins through enhanced efficiency and better scalability.

Curious about what powers this ambitious forecast? The narrative hints at growth so robust the company’s valuation rivals high-flying sectors. The real surprise comes from the future profit margins and market assumptions factored into that price. Dive in to discover the drivers behind the analysts’ consensus and how they are betting on transformation taking place over time.

Result: Fair Value of $108.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in Japan’s premiums and muted U.S. sales growth could challenge Aflac’s ability to meet these bullish expectations.

Find out about the key risks to this Aflac narrative.

Another View: The SWS DCF Model Weighs In

Taking a different approach, the SWS DCF model values Aflac at $229.64 per share. This is significantly higher than current market pricing, suggesting the stock could be meaningfully undervalued if cash flows play out as projected. Is the market overlooking hidden value, or simply being more cautious with its assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aflac for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aflac Narrative

Whether you have a different perspective or enjoy digging into the details on your own, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Aflac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There are incredible opportunities waiting if you’re proactive and ready to broaden your stock portfolio. Make your next move count by exploring these standout ideas:

- Uncover reliable income streams when you review these 19 dividend stocks with yields > 3% offering yields above 3% for shareholders seeking consistent returns.

- Power up your portfolio’s future focus by targeting artificial intelligence trends with these 24 AI penny stocks poised to change entire industries.

- Take advantage of attractive price points by checking out these 904 undervalued stocks based on cash flows that could be trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives