- United States

- /

- Insurance

- /

- NYSE:AFG

Assessing American Financial Group’s Value After Strong 8% Share Price Surge in June 2025

Reviewed by Bailey Pemberton

Thinking about your next move with American Financial Group? You are not alone. With this stock's recent performance, it is no wonder investors are weighing their options. Over the last month, shares have climbed 8.2%, notching a 2.4% gain just in the past week. Taking a longer view, the story looks even more impressive, with a 14.9% increase over the past year and a remarkable 240% return over the last five years. The latest market momentum hints at evolving views on growth potential and risk in the insurance and financial sector. This may reflect optimism amid a shifting economic landscape and investor appetite for reliable compounders.

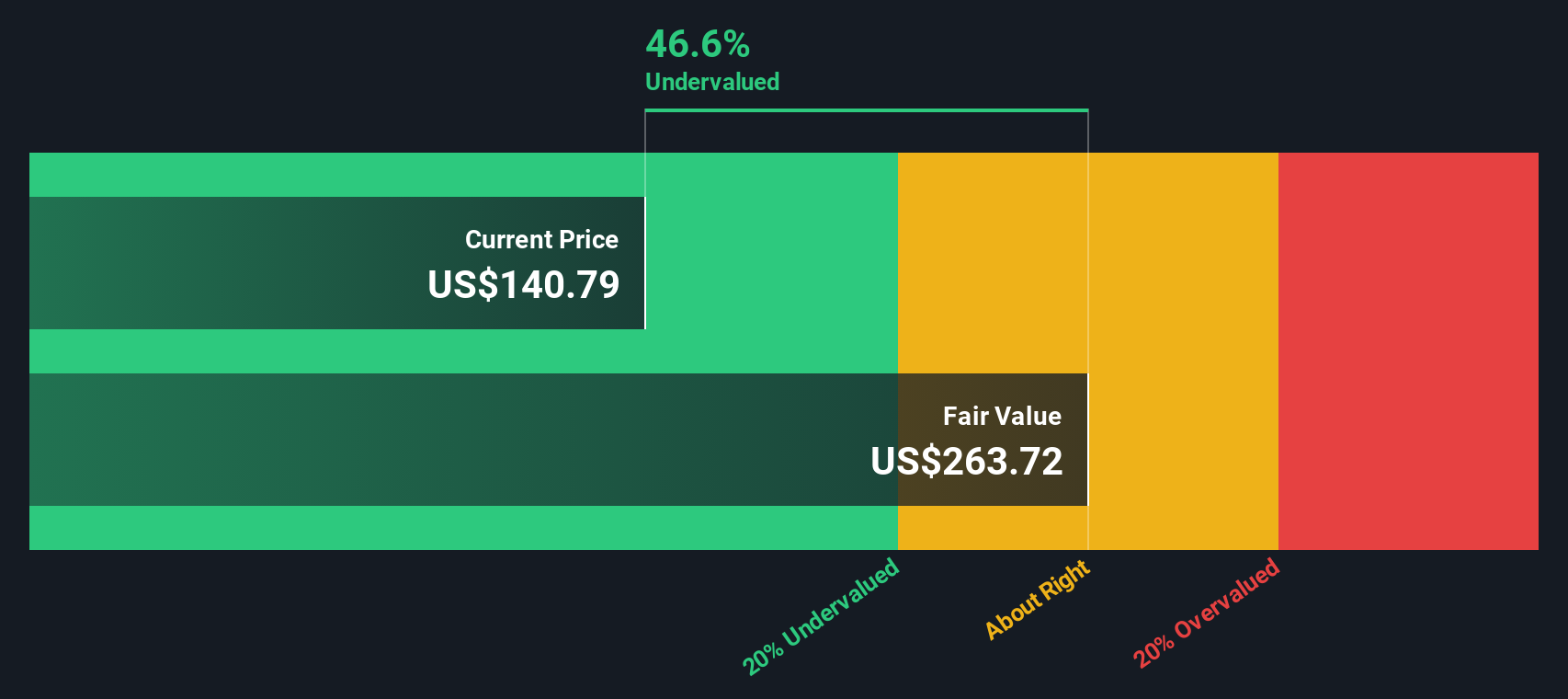

When it comes to valuation, American Financial Group earns a value score of 2 out of 6. This means it is considered undervalued by two of the six standard checks analysts use. This score gives us a starting point. As you will see, there is a lot packed into each valuation method. Up next, we will dig into these different approaches and, just as importantly, look for a smarter way to judge if the stock is truly a bargain or not.

American Financial Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American Financial Group Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate profits above the minimum return required by shareholders, known as the cost of equity. In this approach, analysts estimate how much value American Financial Group creates over and above what investors would expect for the risk they are taking. The focus is on both return on equity as well as the firm's capacity to grow its book value and earnings over time.

Currently, American Financial Group has a book value of $54.16 per share and stable earnings per share of $11.76, based on forecasts from five analysts. The company's cost of equity is $4.19 per share. This means that for every dollar of equity invested, this is the minimum annual return shareholders demand. With an average return on equity of 19.02%, AFG is producing an excess return of $7.57 per share, signifying strong value creation. Looking further ahead, the company is expected to grow its stable book value to $61.86 per share.

Based on these calculations, the Excess Returns model suggests an intrinsic value of $266.74 per share for American Financial Group. With this figure being 44.2% higher than current trading levels, the stock appears significantly undervalued using this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests American Financial Group is undervalued by 44.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

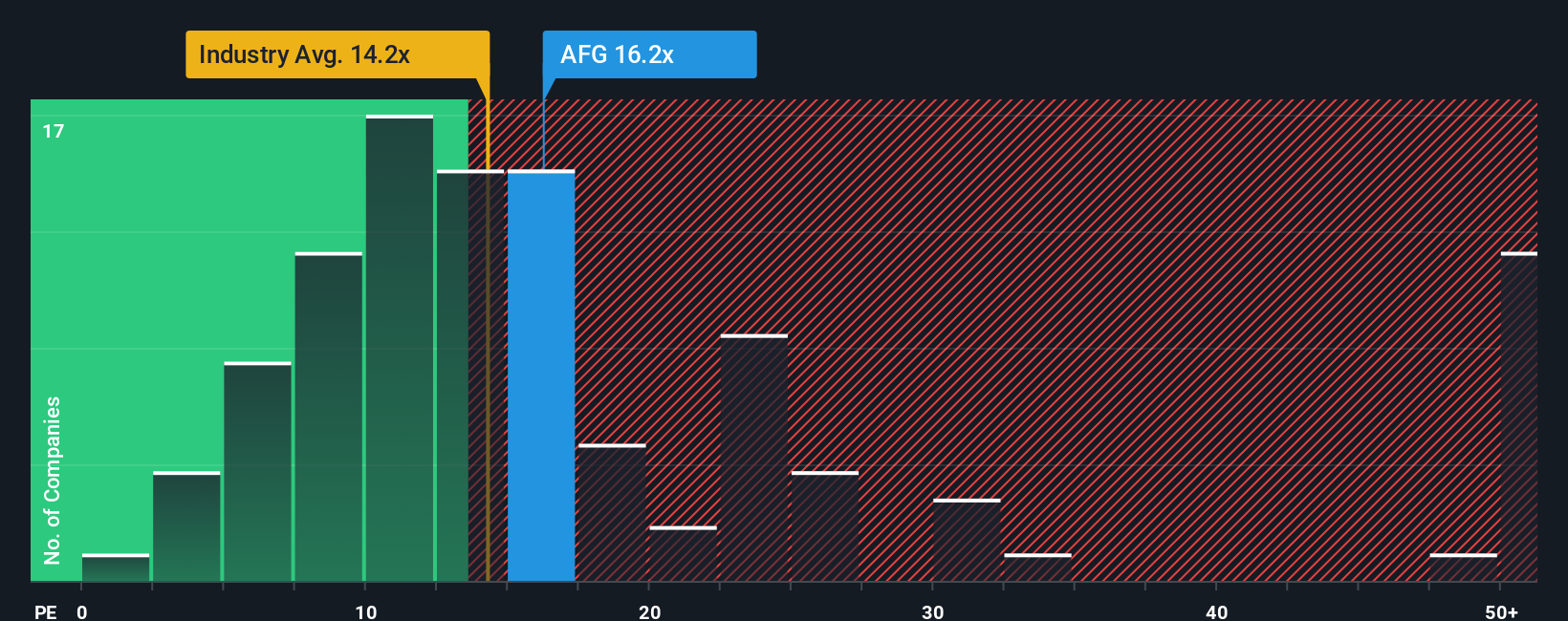

Approach 2: American Financial Group Price vs Earnings

The price-to-earnings (PE) ratio is a popular valuation tool for profitable companies because it directly compares what investors are willing to pay for each dollar of earnings. For a business like American Financial Group, with consistent profitability, the PE ratio provides a straightforward checkpoint on whether the stock trades at a reasonable price relative to its underlying earnings power.

Recent growth trends and perceived risks in the insurance sector play a significant role in determining what is considered a “fair” PE ratio. Robust growth or lower risk usually brings a higher PE, while slower growth or greater risk suggests a lower one. Currently, American Financial Group trades at 16.23x earnings. This is higher than both the industry average of 13.99x and the peer average of 14.18x, indicating the market may be assigning a premium to its shares.

Simply Wall St’s proprietary Fair Ratio goes beyond simple averages by factoring in American Financial Group’s earnings growth, profit margins, size, risk profile, and industry context to set a fair value benchmark, which is 15.56x for this stock. Unlike peer or industry comparisons, the Fair Ratio provides a more complete and nuanced view that is tailored specifically to American Financial Group’s unique profile.

Comparing the Fair Ratio with the current PE ratio shows American Financial Group’s valuation is slightly above this tailored fair benchmark, suggesting the stock is trading just a touch above where it would ideally be valued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Financial Group Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is the story you use to explain your perspective on a company, bringing together your personal assumptions about fair value, future revenue, earnings, and margins, and linking them directly to what you think the company is worth.

Narratives transform numbers into meaning, connecting the real-world outlook on American Financial Group to financial forecasts and fair values. With Narratives available in the Simply Wall St Community, millions of investors can easily share and compare their views, making these powerful tools accessible to everyone, not just experts.

With a Narrative, you can see how your financial expectations translate into fair value, then compare that figure to the current share price for a clear, actionable decision on whether to buy or sell. Narratives update dynamically whenever new news, earnings, or data arrives, ensuring your analysis always reflects the latest information.

For example, one investor looking at American Financial Group may build an optimistic Narrative, factoring in growth from digital transformation and a consensus price target of $155. Another, concerned about revenue declines and margin pressures, may see $124 as fair value. Each perspective tells a different story behind the numbers, helping you anchor your own outlook and investment choices.

Do you think there's more to the story for American Financial Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFG

American Financial Group

An insurance holding company, provides specialty property and casualty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives