- United States

- /

- Insurance

- /

- NasdaqGM:YB

Yuanbao (NasdaqGM:YB) Profit Surge Reinforces Value Narrative with Trailing P/E at 4.3x

Reviewed by Simply Wall St

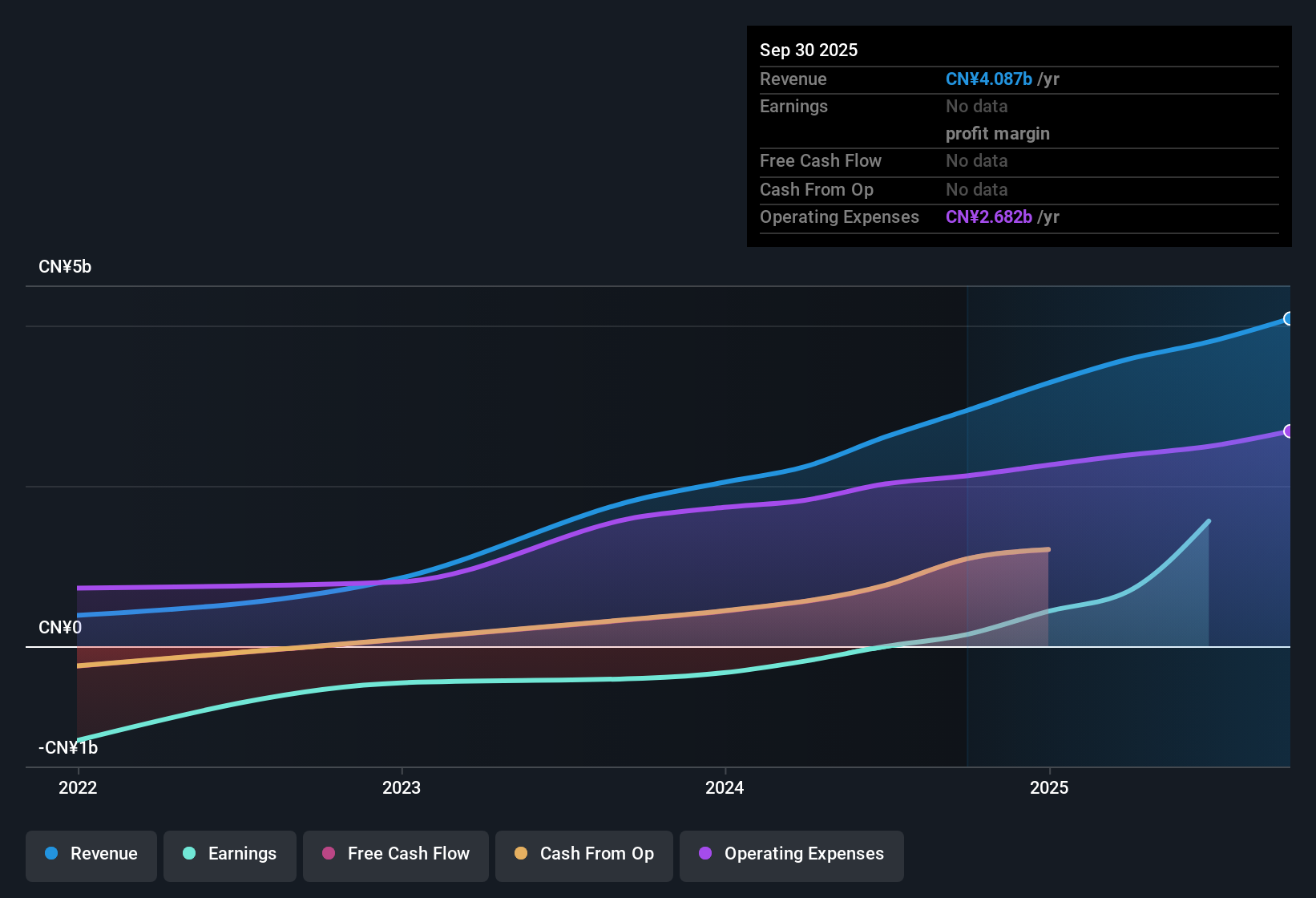

Yuanbao (YB) just posted Q2 2025 results with revenue of CNY 1.1 billion and net income of CNY 983.9 million, translating to basic EPS of CNY 27.33 as the company continues to build on its recent move into solid profitability. The company has seen revenue move from CNY 854.5 million and net income of CNY 106.4 million in Q2 2024 to CNY 1.1 billion and CNY 983.9 million in Q2 2025, while trailing twelve month EPS has climbed from a loss of CNY 0.20 per share a year ago to CNY 69.96, highlighting that margins are doing much of the work behind the headline numbers.

See our full analysis for Yuanbao.With the latest figures on the table, the next step is to see how this sharp profitability shift lines up with the dominant narratives around Yuanbao and where the numbers may be starting to tell a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings swing from loss to CNY 1.6 billion profit

- Over the last twelve months, net income moved from a small loss of CNY 2.8 million in the prior TTM period to CNY 1,561.8 million, while TTM EPS rose from a loss of CNY 0.20 to CNY 69.96.

- Supporters of a bullish view point to this rapid earnings turnaround, and the data shows why it looks compelling:

- Quarterly net income climbed from CNY 68.2 million in Q1 2024 to CNY 983.9 million by Q2 2025, alongside revenue rising from CNY 674.5 million to CNY 1,069.9 million over the same span.

- That shift lines up with the reported five year earnings growth rate of 117.7 percent per year, giving bulls a concrete profitability track to reference rather than just a single strong quarter.

Valuation gap versus 4.3x trailing P E

- On the trailing numbers, YB trades at a P E of 4.3 times, well below both the peer average of 22.8 times and the US insurance industry average of 13.3 times, while the share price of 20.65 dollars sits far under the DCF fair value estimate of 95.51 dollars.

- What stands out for bullish investors is how this low multiple is paired with solid profitability metrics:

- TTM revenue is CNY 3.8 billion and TTM net income is CNY 1.6 billion, so the stock is being valued off an already profitable base rather than off distant projections.

- Q2 2025 EPS of CNY 27.33 sits within a clear progression from CNY 4.97 in Q1 2024 and CNY 11.01 in Q4 2024, suggesting the 4.3 times trailing P E is not being driven by one isolated spike.

After a move from losses to high quality profitability and a trailing P E far below peers, many investors will want to see how a full narrative connects these numbers to long term potential before deciding whether the gap to DCF fair value can close. 📊 Read the full Yuanbao Consensus Narrative.

Net income scaling faster than revenue

- From Q1 2024 to Q2 2025, revenue increased from CNY 674.5 million to CNY 1,069.9 million, while net income in the same quarters went from CNY 68.2 million to CNY 983.9 million, meaning profit growth outpaced the top line.

- Optimistic narratives about improving business quality find backing here, but the figures also invite a closer look at how durable this pattern is:

- Across the last six reported quarters, revenue stepped up more gradually, from the mid CNY 600 million range into just over CNY 1.0 billion, yet net income moved from tens of millions to nearly CNY 1.0 billion.

- With TTM EPS jumping from negative 14.78 CNY in early 2024 to positive 69.96 CNY by Q2 2025, any bullish case built on margin expansion now has concrete numbers, but future reports will need to show whether these levels can be maintained.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yuanbao's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Yuanbao’s rapid profit surge leans heavily on aggressive margin expansion, raising questions about how resilient earnings will be if growth or conditions normalize.

If you would rather focus on businesses proving they can grow consistently through cycles, use our stable growth stocks screener (2071 results) today to quickly surface steadier, lower risk alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:YB

Yuanbao

Through its subsidiaries, provides online insurance distribution and services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026