- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (NasdaqGS:WTW) Appoints Industry Veteran Helen Campbell As Head Of Property Wordings

Reviewed by Simply Wall St

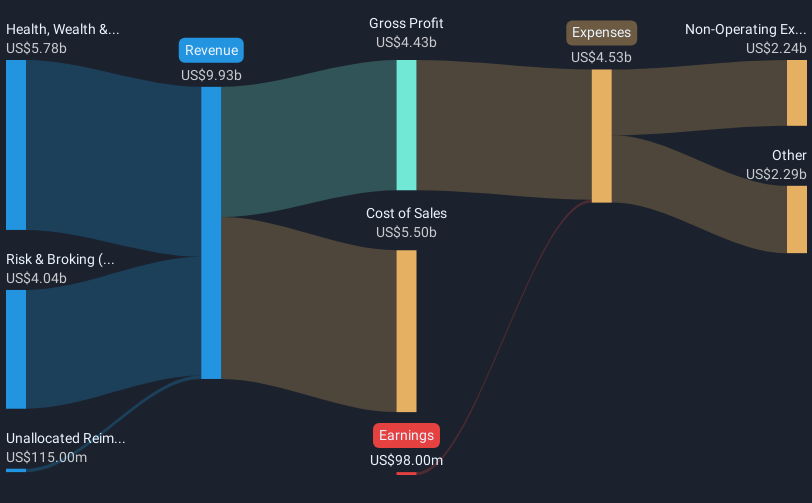

Helen Campbell's recent appointment as the Head of Property Wordings in North America highlights a strategic focus on policy clarity at Willis, a WTW business. Over the last quarter, shares of Willis Towers Watson (NasdaqGS:WTW) moved 3.65%. This period included several executive changes, such as Pat Donnelly's appointment as Head of Risk and Broking for North America, and significant financial maneuvers, like completing an $8.83 billion share buyback program. The company's earnings report, which revealed a year-over-year increase in quarterly sales and net income despite a full-year net loss, also played a crucial role. Concurrently, broader market trends saw record highs in the S&P 500, although there was a market dip due to investors adjusting to various economic signals. These elements collectively influenced WTW's performance against a backdrop of fluctuating market conditions.

Take a closer look at Willis Towers Watson's potential here.

Over the past five years, Willis Towers Watson (WTW) has achieved a total shareholder return of 70.65%. During this period, several key developments have shaped its long-term performance. The company's extensive share buyback program, culminating in a total repurchase of US$8.83 billion, has been a significant factor, as it bolstered shareholder value. Additionally, the regular quarterly cash dividend of US$0.88 per share provided steady income to investors, contributing to the total return. Furthermore, WTW's collaboration with Kayna and Vibrant strengthened its cybersecurity insurance offerings, positioning it favorably within the market.

Despite these efforts, WTW faced challenges, including being unprofitable with increasing losses over the five-year span. The company’s total return over one year lagged behind the overall US market, which returned 23.7%, but was in line with the US Insurance industry's 19% return. Nonetheless, WTW’s ongoing initiatives, such as exploring M&A options and enhancing its analytics capabilities, suggest a continued focus on long-term growth.

- See how Willis Towers Watson measures up with our analysis of its intrinsic value versus market price.

- Explore the potential challenges for Willis Towers Watson in our thorough risk analysis report.

- Invested in Willis Towers Watson? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives