- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (NasdaqGS:WTW) Announces 5 Percent Dividend Increase to US$0.92 per Share

Reviewed by Simply Wall St

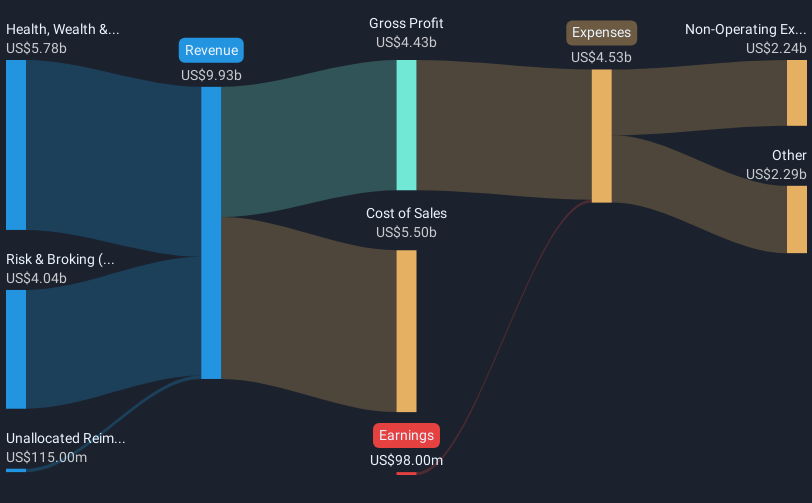

Willis Towers Watson (NasdaqGS:WTW) announced a 5% dividend increase, reflecting confidence amid a resilient market performance. Despite a challenging quarter for major indexes, the company’s stock price rose by 3.65%, possibly due to strong fourth-quarter earnings, with sales and net income substantially increasing year-over-year. This outperformed broader market trends that saw the S&P 500 and Nasdaq fall amid declines in technology stocks and economic concerns. Additional support may have come from the completion of a $395 million share buyback and M&A opportunities highlighted by the CFO. New leadership appointments and a product launch boosting their analytics capabilities likely bolstered investor sentiment. Concurrently, the market as a whole saw a 3% drop over the last week, emphasizing the significance of the company's positive developments. Despite general market volatility and tech sector declines, WTW's performance highlights investor confidence supported by robust financial results and strategic initiatives.

Navigate through the intricacies of Willis Towers Watson with our comprehensive report here.

Willis Towers Watson has delivered a total shareholder return of 76.22% over the last five years, with several key developments contributing to this enhanced performance. Despite the company being unprofitable over this period, it has made strategic financial moves such as completing an extensive share buyback totaling US$8.83 billion, significantly returning value to shareholders. The company's efforts to explore strategic mergers and acquisitions, as announced by CFO Andrew Krasner, have likely positively influenced investor sentiment. Moreover, enhancements to its Radar analytics engine highlight its commitment to improving its technological capabilities.

Over the past year, WTW has exceeded both the US market's 18.3% return and the US insurance industry's 16.6% return, reflecting robust relative performance. Executive appointments and collaborations, such as the partnership with the University of Colorado Boulder, have bolstered its market position by refining insurance analytics. These concerted efforts underscore Willis Towers Watson's resilience and potential for improving shareholder value amid a competitive industry landscape.

- Unlock the insights behind Willis Towers Watson's valuation and discover its true investment potential

- Analyze the downside risks for Willis Towers Watson and understand their potential impact—click to learn more.

- Already own Willis Towers Watson? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives