- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Here's Why We Think Willis Towers Watson (NASDAQ:WTW) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Willis Towers Watson (NASDAQ:WTW). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Willis Towers Watson

Willis Towers Watson's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Impressively, Willis Towers Watson has grown EPS by 35% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

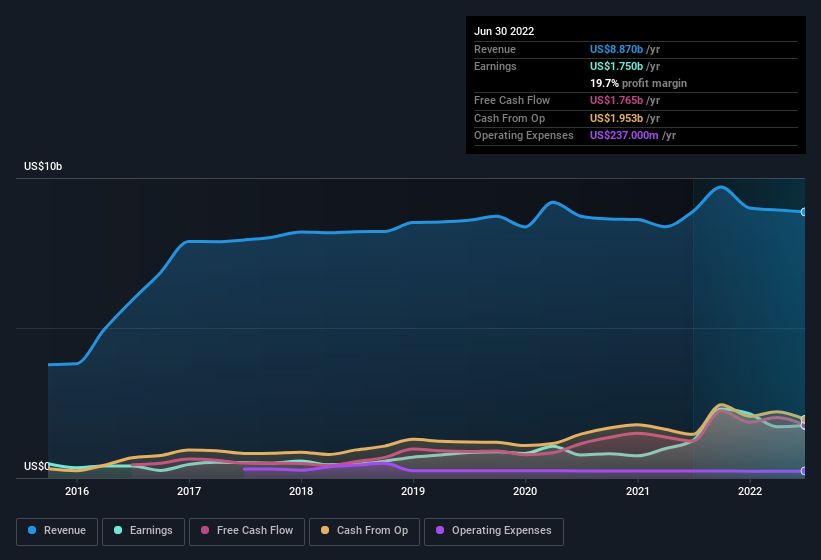

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Willis Towers Watson look pretty good, on balance; although revenue is flattish, EBIT margins improved from 18% to 20% in the last year. That's something to smile about.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Willis Towers Watson's future EPS 100% free.

Are Willis Towers Watson Insiders Aligned With All Shareholders?

Owing to the size of Willis Towers Watson, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$184m. This comes in at 0.8% of shares in the company, which is a fair amount of a business of this size. This should still be a great incentive for management to maximise shareholder value.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Willis Towers Watson, with market caps over US$8.0b, is about US$13m.

The Willis Towers Watson CEO received total compensation of just US$4.8m in the year to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Willis Towers Watson Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Willis Towers Watson's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Willis Towers Watson has underlying strengths that make it worth a look at. You should always think about risks though. Case in point, we've spotted 2 warning signs for Willis Towers Watson you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Willis Towers Watson, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives