- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Did Trupanion's (TRUP) Outperformance and CEO Stock Activity Signal Shifts in Management Strategy?

Reviewed by Sasha Jovanovic

- On September 25, 2025, Trupanion CEO Margaret Tooth sold 2,961 shares of company stock as part of a pre-arranged Rule 10b5-1 trading plan, while also exercising options to acquire 6,000 shares at a lower strike price, increasing her direct ownership to 144,229 shares.

- This news followed Trupanion’s second-quarter 2025 earnings, which significantly outperformed expectations on both earnings per share and revenue, prompting multiple analysts to raise their outlook while others maintained caution regarding the company’s overall strategic direction.

- We'll explore how Trupanion's strong second-quarter financial performance shapes its investment narrative and outlook for sustained growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Trupanion Investment Narrative Recap

To be a Trupanion shareholder, you need to believe that pet insurance adoption will continue to rise, driving profitable subscriber growth and higher retention as the industry expands. The recent CEO share sale and option exercise appear routine and do not materially affect the short-term catalyst of accelerating subscriber growth, which remains the company's most closely watched goal; the main risk remains a potential slowdown in gross new pet additions relative to higher acquisition costs.

Among recent announcements, Trupanion's strong second-quarter 2025 earnings, marked by a return to profitability and raised full-year guidance for both total and subscription revenue, provide fresh evidence supporting the company’s focus on scaling its subscriber base and investing for future growth. This outperformance highlights why investor attention remains fixed on whether Trupanion can translate financial momentum into sustained, high-quality subscriber growth while navigating challenges to revenue diversification.

By contrast, investors should also be aware that slowing gross new pet adds could pose a challenge if pricing power weakens or competition intensifies...

Read the full narrative on Trupanion (it's free!)

Trupanion's narrative projects $1.7 billion in revenue and $17.4 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $6.4 million earnings increase from $11.0 million today.

Uncover how Trupanion's forecasts yield a $56.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

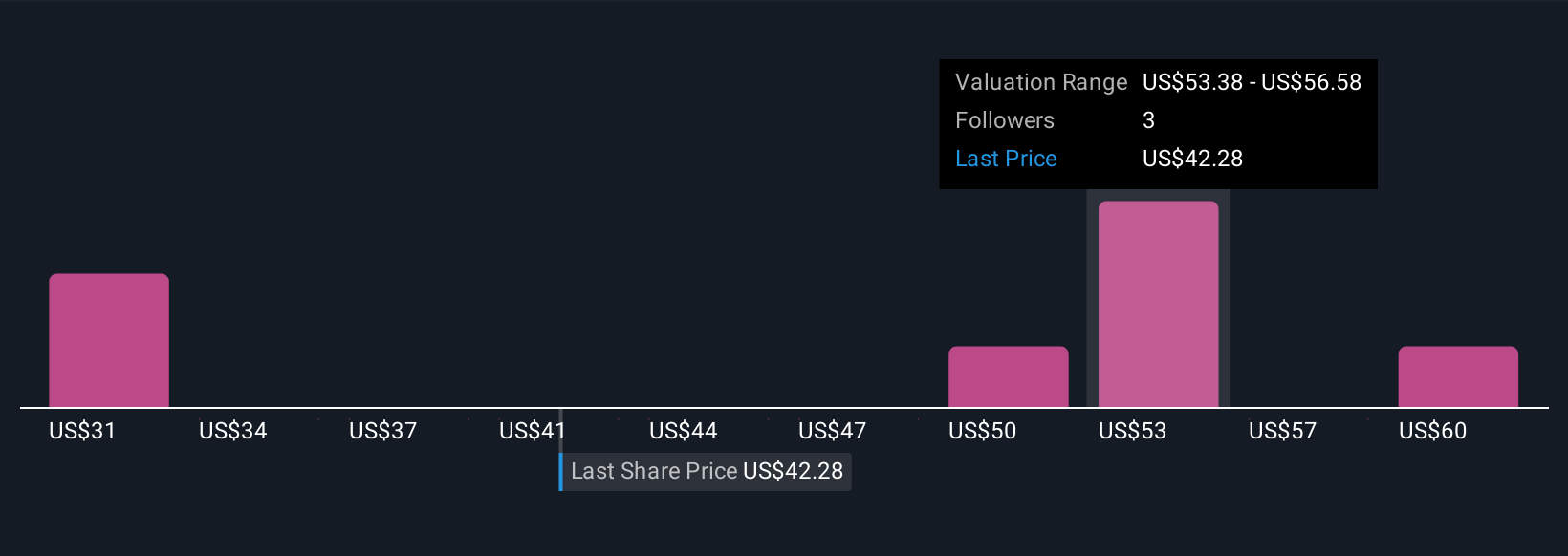

Five Simply Wall St Community members estimate Trupanion’s fair value spanning US$31 to US$62.97. While opinions diverge significantly, the outlook for new subscriber growth is a crucial factor influencing future company performance and worth exploring further.

Explore 5 other fair value estimates on Trupanion - why the stock might be worth 29% less than the current price!

Build Your Own Trupanion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Trupanion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trupanion's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives