- United States

- /

- Insurance

- /

- NasdaqGS:SLDE

Is Slide Insurance Holdings Set for a Rebound After Recent 14.8% Price Surge?

Reviewed by Bailey Pemberton

If you have been eyeing Slide Insurance Holdings or already hold some shares, you are probably wondering whether now is a smart time to buy, sell, or simply sit tight. The stock has certainly been on the move, with prices rising 5.2% over the past week and up 14.8% in the last month. That momentum stands in stark contrast to its year-to-date performance, where shares are still down 22.3%. This kind of turnaround often hints at shifting investor sentiment, possibly tied to developments in the insurance sector that have highlighted growth potential for agile players like Slide Insurance Holdings.

No valuation conversation would be complete without some numbers. Here is a quick snapshot: Slide Insurance Holdings earns a value score of 4 out of 6, which means it passes four separate undervalued checks across major valuation methods. That is a promising sign for bargain hunters, but also leaves room to dig deeper into what is actually driving value here.

To really get a full picture, we will weigh the key valuation approaches and see where Slide Insurance Holdings comes out ahead. For investors who want more than just formulas, there is an even smarter way to look at valuation that we will touch on at the end.

Approach 1: Slide Insurance Holdings Excess Returns Analysis

The Excess Returns model evaluates what a company earns beyond the minimum required return for its shareholders, focusing on profitability and growth in relation to invested capital. For Slide Insurance Holdings, this means analyzing whether it generates returns above its cost of equity, an important indicator of long-term value creation.

Currently, Slide Insurance Holdings has a book value of $6.93 per share and is expected to achieve a stable earnings per share (EPS) of $3.54 in the future, based on weighted estimates from four analysts. With an average return on equity of 35.02%, the company is far outpacing its cost of equity, which stands at just $0.68 per share. This results in an excess return of $2.85 per share, evidence that the company is deploying shareholder capital very efficiently. Additionally, the stable book value is projected to grow to $10.10 per share, according to consensus from three analysts.

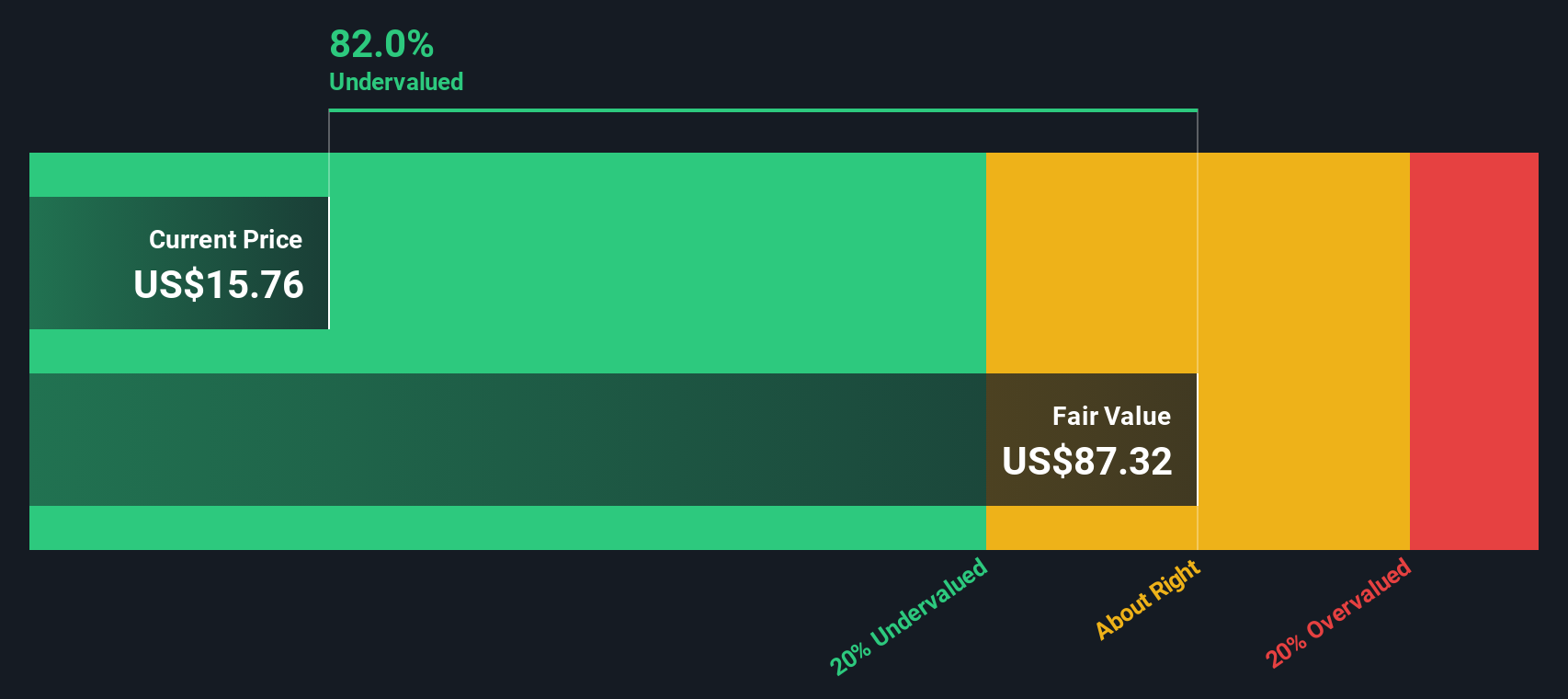

Given these strong figures, the Excess Returns valuation estimates an intrinsic value that is 82.0% above the current share price. This suggests Slide Insurance Holdings is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests Slide Insurance Holdings is undervalued by 82.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Slide Insurance Holdings Price vs Earnings

For a profitable company like Slide Insurance Holdings, the Price-to-Earnings (PE) ratio is one of the most commonly used valuation metrics. It provides a straightforward way to compare how much investors are willing to pay for each dollar of the company’s earnings. This makes the PE ratio particularly relevant here, since it connects the market price to the company's current profitability.

However, it is important to remember that what counts as a “fair” PE ratio can vary widely. Companies with higher expected growth and lower risk tend to justify a higher multiple, since investors are willing to pay more for future earnings. On the other hand, if growth potential is modest or the business carries more risk, a lower multiple is usually warranted.

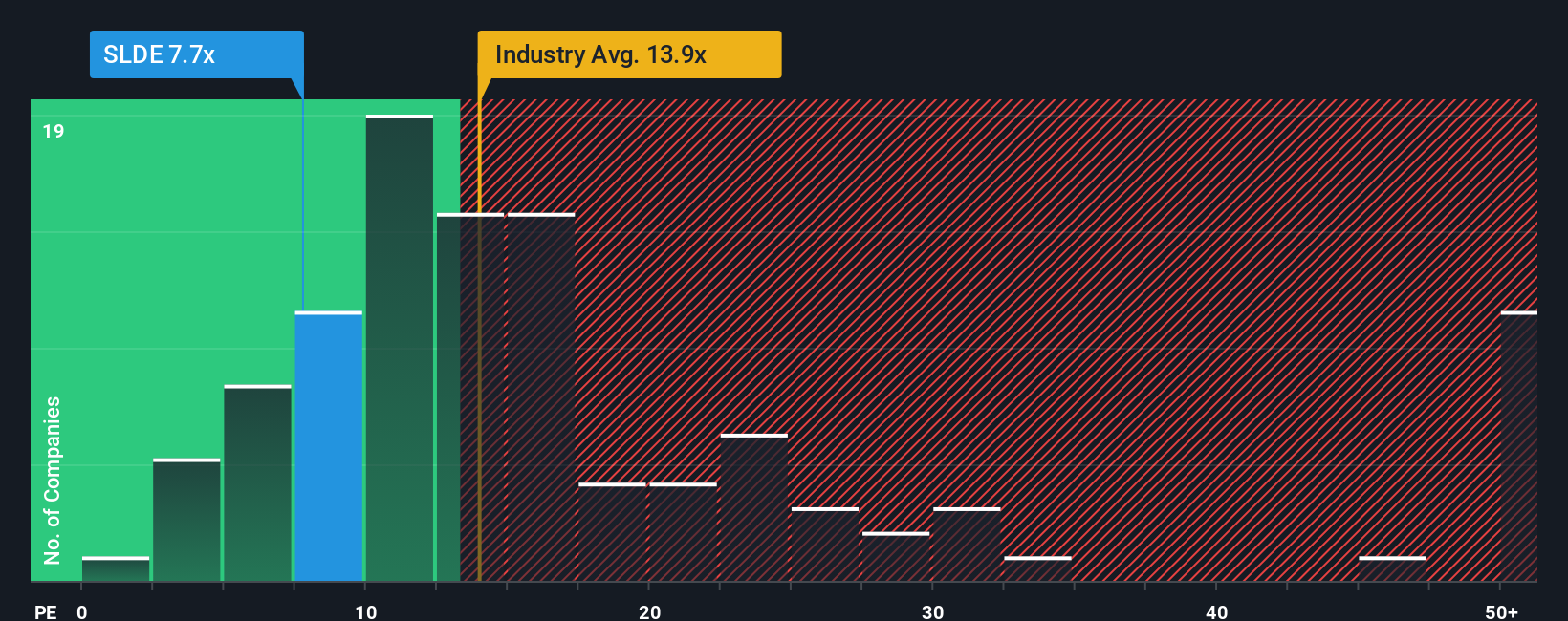

Slide Insurance Holdings currently trades at a PE of 7.74x. This is significantly below both the broader insurance industry average of 14.23x and well under the average of its direct peers at 53.38x. While such a low multiple might suggest potential undervaluation, simple PE comparisons can be misleading because they overlook crucial factors like differences in growth, risk, and profitability.

This is where the Simply Wall St Fair Ratio comes in. Unlike basic industry or peer benchmarks, the Fair Ratio is tailored for Slide Insurance Holdings. It considers unique company-specific elements such as growth forecasts, profit margins, risk profile, market capitalization, and the broader industry context. By using these factors, the Fair Ratio provides a more accurate target multiple than the blunt averages of peers or the overall insurance sector.

Comparing Slide Insurance Holdings’ actual 7.74x PE to its Fair Ratio gives a clear final verdict. If the stock’s current multiple closely matches the Fair Ratio, it means the price is justified based on the company’s true potential and risks. In this case, the difference is well within a reasonable range, meaning valuation looks balanced based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Slide Insurance Holdings Narrative

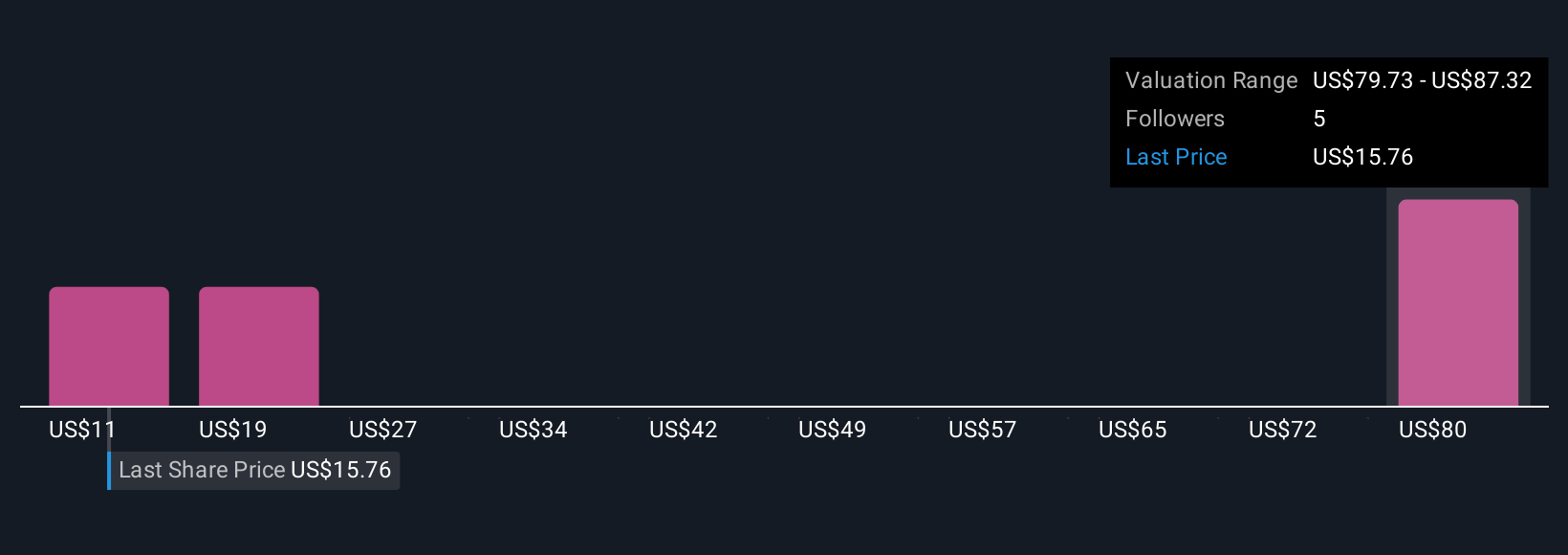

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your chance to tell the story behind the numbers, bringing together your assumptions for Slide Insurance Holdings’ future revenue, profits, and margins into a single perspective on fair value.

Narratives connect a company’s story with financial forecasts and boil this down into a fair value, so you can see how your outlook compares to the market price. They are simple, accessible, and ready for you to use on Simply Wall St’s Community page, where millions of investors share their views.

By setting your Narrative, you get dynamic updates whenever news or earnings change the outlook. This makes it easier to act when Fair Value and Price drift apart. For example, one investor’s optimistic Narrative for Slide Insurance Holdings sets a higher fair value based on strong growth potential, while a more cautious investor’s Narrative keeps expectations lower. Narratives turn your personal view on Slide Insurance Holdings into smarter investment decisions, all in just a few clicks.

Do you think there's more to the story for Slide Insurance Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDE

Slide Insurance Holdings

Engages in underwriting single family and condominium policies in the property and casualty industry in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives