- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

How Investors May Respond To Selective Insurance Group (SIGI) Margin Gains and Digital Transformation Momentum

Reviewed by Sasha Jovanovic

- Selective Insurance Group recently reported steady revenue growth and a strong increase in net income, attributed to investments in operational efficiency and expansion in its Excess & Surplus segment.

- The company’s focus on data analytics, digital claims management, and broadening distribution is enhancing margins and driving premium growth amid favorable insurance market conditions.

- Now, we'll examine how Selective's margin improvements and digital transformation momentum may influence its investment narrative going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Selective Insurance Group Investment Narrative Recap

To be a shareholder in Selective Insurance Group, you need to believe in the company's ability to convert operational efficiencies and digital transformation into consistent margin improvement, even as broader insurance industry risks persist. The recent news reinforces the near-term earnings catalyst, premium growth in the Excess & Surplus segment amid supportive market pricing, but does not fundamentally change the fact that ongoing claim severity trends and social inflation remain the biggest threats to performance volatility in the short-term.

The company's announcement that it expects higher after-tax net investment income in 2025, driven by improved book yields in a higher interest rate environment, directly aligns with its margin expansion narrative. Enhanced investment returns could bolster overall profitability, providing Selective with added flexibility as it continues to grow its E&S segment and invest in digital claims and analytics to drive further operating leverage.

In contrast, investors should stay alert to the ongoing risk that elevated claim severities, particularly in casualty and commercial auto, could quickly disrupt...

Read the full narrative on Selective Insurance Group (it's free!)

Selective Insurance Group's outlook anticipates $6.1 billion in revenue and $605.5 million in earnings by 2028. This relies on a 6.3% annual revenue growth rate and a $231 million increase in earnings from the current $374.5 million.

Uncover how Selective Insurance Group's forecasts yield a $83.33 fair value, in line with its current price.

Exploring Other Perspectives

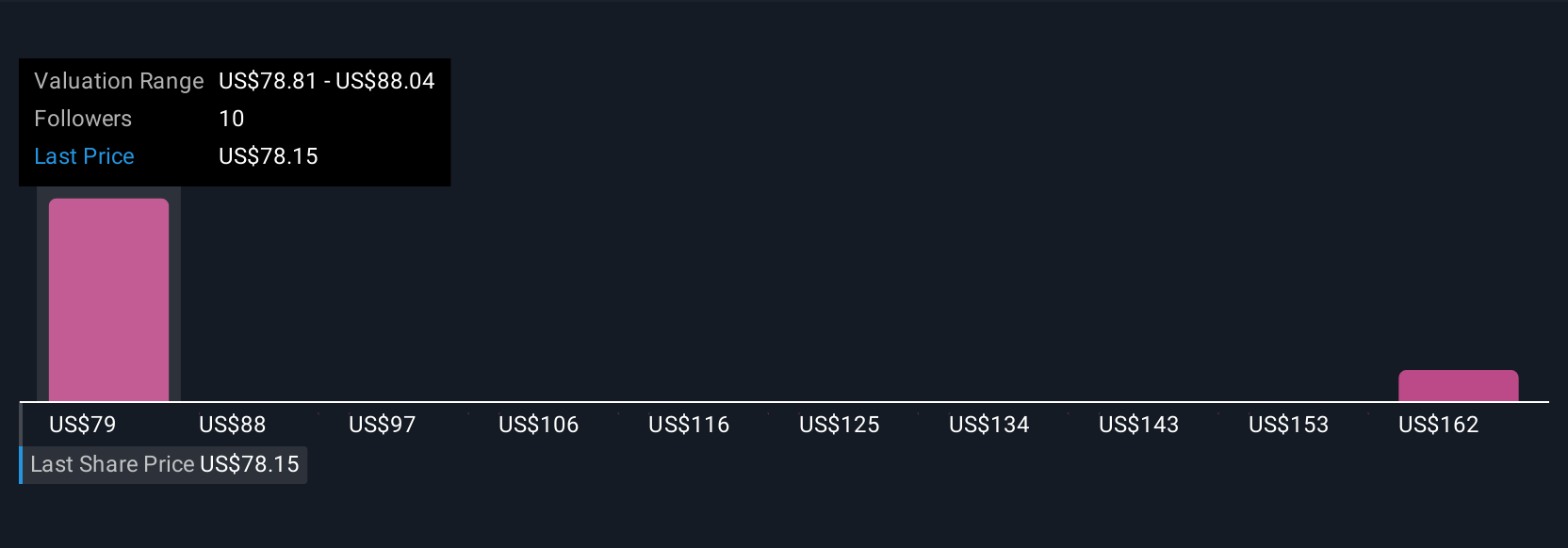

Fair value estimates from the Simply Wall St Community span from US$78.81 to US$170.50, based on three unique analyses. While some highlight substantial upside, others see less room for growth, underscoring how the company’s exposure to casualty claim trends can shift expectations for future returns.

Explore 3 other fair value estimates on Selective Insurance Group - why the stock might be worth over 2x more than the current price!

Build Your Own Selective Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Selective Insurance Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Selective Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Selective Insurance Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives