- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

How Investors May Respond To Selective Insurance Group (SIGI) Outlook of Premium Growth and Stronger Investment Income

Reviewed by Sasha Jovanovic

- In recent news, Selective Insurance Group indicated it expects to benefit from strong renewal trends, premium increases, and favorable market conditions that should drive premium growth, especially in its Excess & Surplus Lines segment. The company also anticipates higher after-tax net investment income in 2025, attributing this outlook to improved book yields amid a higher interest rate environment.

- An interesting aspect is the emphasis on both robust renewal pricing and improving investment returns, which together highlight multiple drivers for enhanced future earnings potential beyond just underwriting operations.

- With this positive outlook for investment income, we’ll examine how Selective Insurance Group’s investment narrative may be further supported by these developments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Selective Insurance Group Investment Narrative Recap

To believe in Selective Insurance Group as a shareholder, you need confidence in its ability to achieve premium growth in challenging markets while successfully managing rising loss costs and reserve risks. The recent news of stronger renewal trends and higher investment income may support short-term earnings, but does not fully offset the volatility from escalating claims severity, a persistent risk that continues to impact predictability in margins and reserves.

Among Selective's recent company announcements, its updated 2025 guidance for after-tax net investment income (raising expectations to US$415 million) is closely linked to this news. With rising book yields boosting projected investment returns, this catalyst provides some support to near-term performance, even as casualty claim trends continue to require attention.

In contrast, investors should not overlook the continuing issue of claim severity and social inflation, which could pressure future results if...

Read the full narrative on Selective Insurance Group (it's free!)

Selective Insurance Group's outlook anticipates $6.1 billion in revenue and $605.5 million in earnings by 2028. This projection assumes a 6.3% annual revenue growth rate and an increase in earnings of $231 million from the current $374.5 million.

Uncover how Selective Insurance Group's forecasts yield a $83.33 fair value, in line with its current price.

Exploring Other Perspectives

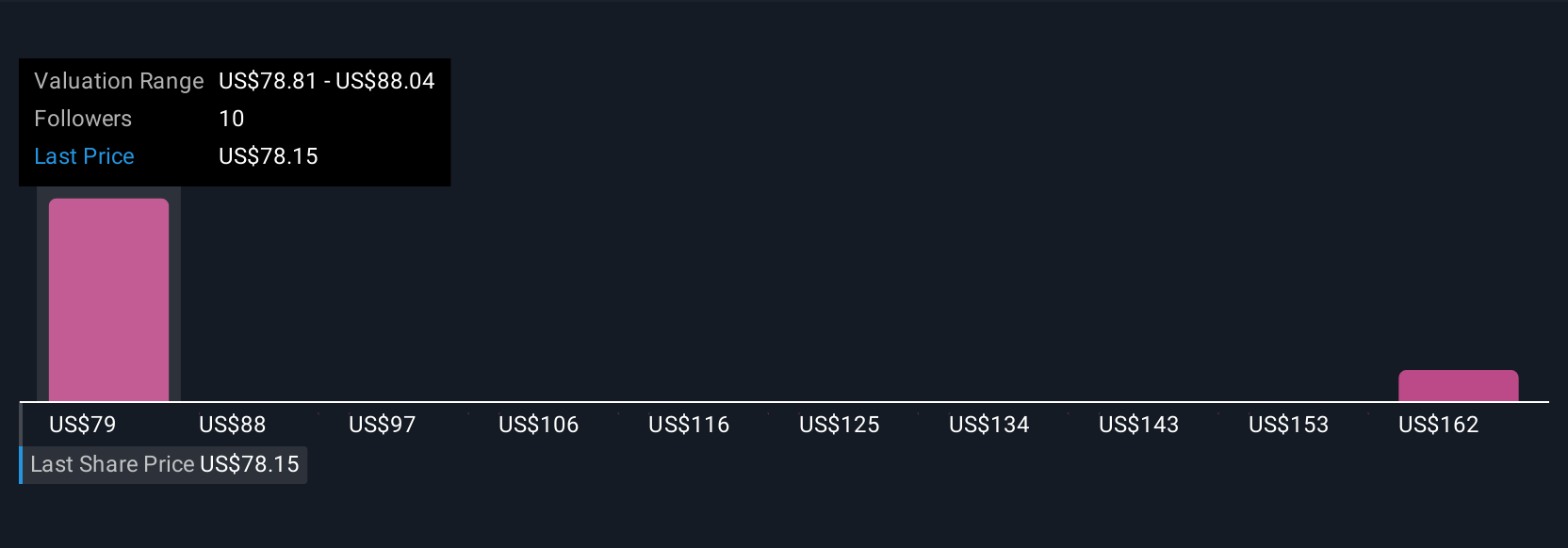

Simply Wall St Community members provided 3 fair value estimates for Selective Insurance Group, ranging widely from US$78.81 up to US$170.50 per share. With views this diverse, don't miss how concerns about claim severity and reserve forecasting could be influencing opinions on the company’s future direction.

Explore 3 other fair value estimates on Selective Insurance Group - why the stock might be worth just $78.81!

Build Your Own Selective Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Selective Insurance Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Selective Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Selective Insurance Group's overall financial health at a glance.

No Opportunity In Selective Insurance Group?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives