- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

Assessing Selective Insurance Group (SIGI) Valuation: Is the Quiet Rebound Signaling New Opportunity?

Reviewed by Simply Wall St

Selective Insurance Group (SIGI) shares have moved quietly in recent weeks, with investors keeping an eye on underlying performance trends. Activity has been relatively muted. As a result, valuation and long-term fundamentals are more relevant topics for discussion right now.

See our latest analysis for Selective Insurance Group.

Selective Insurance Group’s share price saw a near 8% rise over the last month but remains down 9% for the year to date. This reflects some hesitation after earlier declines. The company’s total shareholder return over the past year is similarly muted, signaling that recent momentum may be stabilizing and the market is reassessing long-term value versus short-term sentiment.

If you’re curious about what else is quietly gaining traction, consider broadening your search and discovering fast growing stocks with high insider ownership

With fundamentals appearing steady and the recent share price rebound in mind, the key question for investors is whether Selective Insurance Group is trading at an attractive valuation or if any upside is already reflected in the price.

Most Popular Narrative: Fairly Valued

With Selective Insurance Group’s last close at $83.60 and the most-followed narrative putting fair value at $83.33, the gap is negligible. This sets a tight stage for debates on market pricing and what is truly driving the company’s value.

*The company's deliberate strategy to diversify its business mix and geographic footprint, including growth in the mass affluent personal lines and underserved regional markets, is likely to generate a more resilient and balanced revenue stream, while moderating catastrophe and underwriting volatility.*

What is the real story behind these numbers? The fair value calculation rests on ambitious growth, shifting margins, and a profit profile that may surprise you. The narrative’s full breakdown reveals the bold assumptions baked into this consensus. Find out what could move the needle next.

Result: Fair Value of $83.33 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure from rising casualty claim costs and uncertainty around reserve adequacy could quickly shift sentiment and challenge the current fair value outlook.

Find out about the key risks to this Selective Insurance Group narrative.

Another View: Are Shares Actually Undervalued?

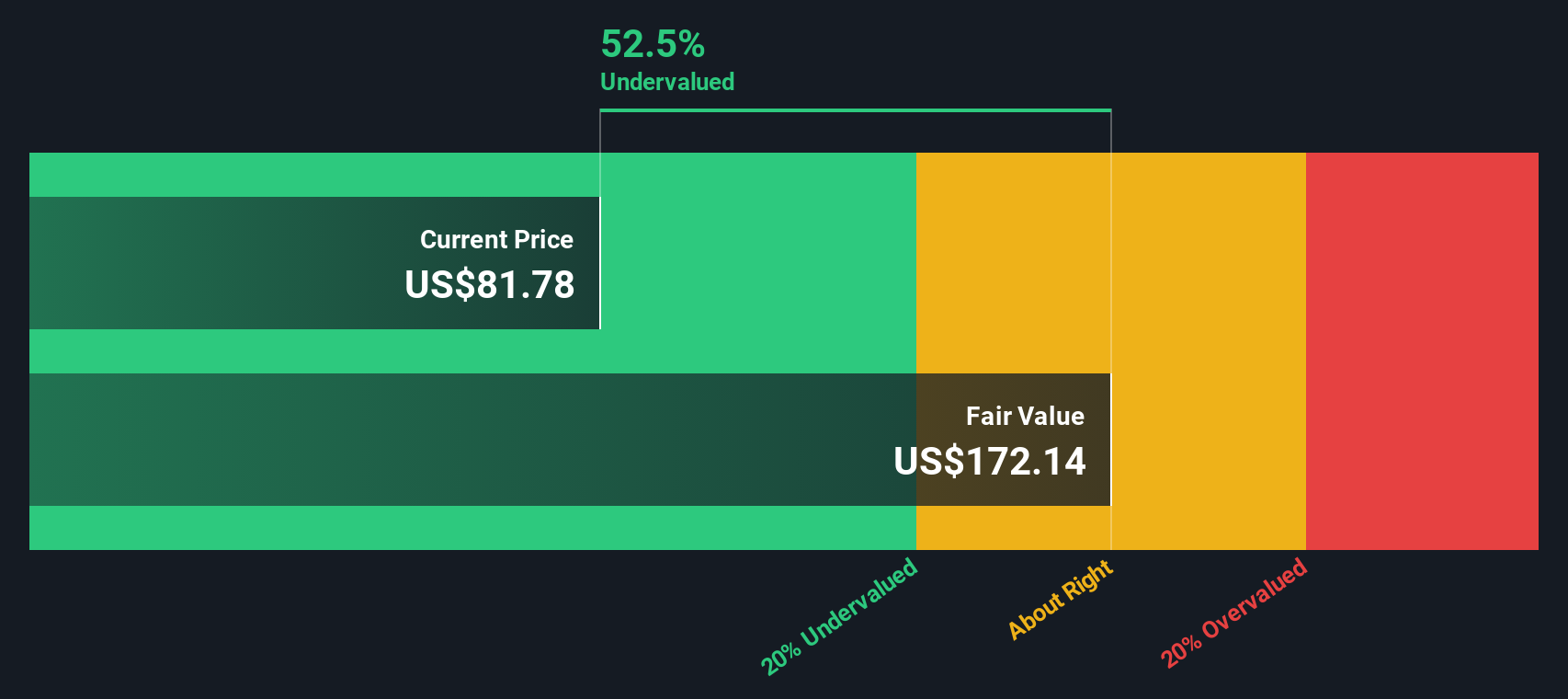

Looking at Selective Insurance Group through our DCF model provides a very different picture. The SWS DCF model estimates fair value at $178.60, which means SIGI might be trading more than 50% below what its future cash flows suggest. Could this indicate the market is missing a key upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Selective Insurance Group Narrative

If this story doesn’t quite fit your perspective or you want to put your research to the test, you can quickly craft your own analysis. It takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Selective Insurance Group.

Looking for More Smart Investment Moves?

Seize the opportunity to add new ideas to your watchlist and spot strategies others might overlook. Today’s best investors move quickly and confidently to capture what’s next.

- Uncover stocks with high growth potential by reviewing these 876 undervalued stocks based on cash flows, where strong fundamentals meet standout value opportunities.

- Boost your portfolio’s income with these 17 dividend stocks with yields > 3%, featuring companies offering attractive yields above 3% to help you achieve consistent returns.

- Catalyze your gains with innovative market leaders by targeting these 24 AI penny stocks, with artificial intelligence at the core of your future strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives