- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

Safety Insurance Group (SAFT): Is This Steady Insurer Fairly Priced After a Modest Recent Rebound?

Reviewed by Simply Wall St

Safety Insurance Group (SAFT) has slipped around 10% this year, even though the stock is roughly flat over the past month and mildly positive in the past 3 months. That disconnect deserves a closer look.

See our latest analysis for Safety Insurance Group.

With the share price now around $74.60, Safety Insurance Group’s modest recent gains sit against a weaker year to date share price return. Its five year total shareholder return still reflects steady, if unspectacular, compounding.

If this conservative insurer has you thinking about where else to deploy capital, it could be worth exploring fast growing stocks with high insider ownership as a hunting ground for more dynamic opportunities.

So is this steady niche insurer quietly trading below its intrinsic value, or has the recent share price simply caught up with the company’s growth prospects, leaving little upside for investors from here?

Price-to-Earnings of 12.8x: Is it justified?

Safety Insurance Group trades on a price to earnings ratio of 12.8 times, roughly in line with the US insurance sector and implying neither a glaring bargain nor a clear premium at the recent 74.60 dollars share price.

The price to earnings multiple compares what investors are willing to pay today for each dollar of current earnings. This is a key lens for a mature, dividend paying insurer like Safety. It matters because a lower multiple can signal skepticism about the durability of profits, while a higher one can reflect confidence in growth, capital allocation or balance sheet strength.

Here, the 12.8 times price to earnings sits below the broader US market average of 18.7 times. This suggests investors are not paying up for Safety’s earnings despite its high quality profit profile and recent improvement in margins. Given that earnings have declined on average over five years but grew in the most recent year and outpaced the industry, the current multiple looks broadly consistent with a cautious but not pessimistic view of the company’s prospects.

Compared with both the US insurance industry average of 12.8 times and a much richer 31.6 times peer group average, Safety’s valuation looks restrained rather than stretched. The market is effectively pricing the company in line with the sector, while many peers command a far higher earnings multiple. This underscores that investors are not extrapolating aggressive growth for Safety at today’s level.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.8x (ABOUT RIGHT)

However, investors should watch for prolonged auto claims inflation and any sharp competitive pressure in New England, as both could compress margins and dampen earnings.

Find out about the key risks to this Safety Insurance Group narrative.

Another View Using Our DCF Model

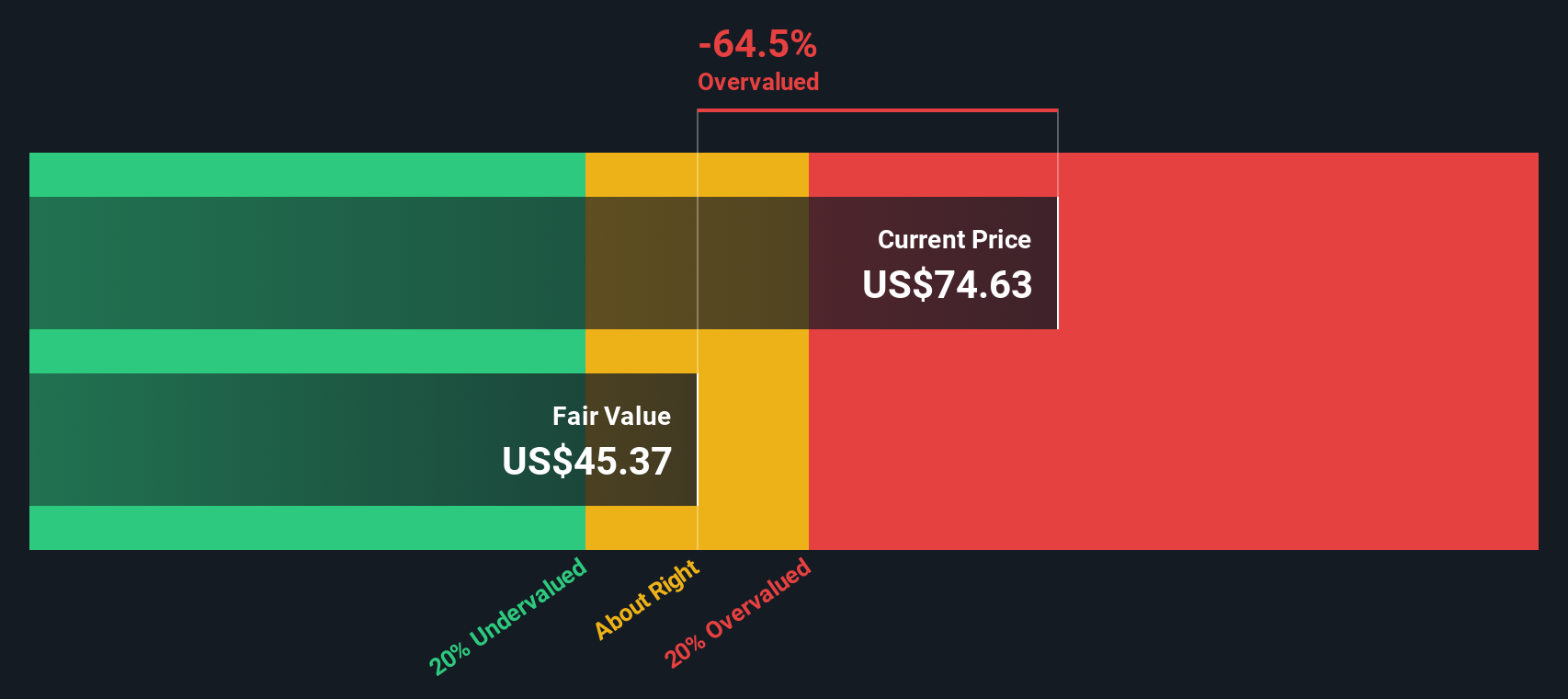

Our DCF model tells a different story. It puts Safety Insurance Group’s fair value at about 45.37 dollars per share, which suggests that the stock looks overvalued at the current 74.60 dollars level. Is the market overestimating future cash flows, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Safety Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Safety Insurance Group Narrative

If your interpretation of Safety Insurance Group differs, or you would rather lean on your own research and judgment, you can quickly craft a personalized view in just a few minutes, Do it your way.

A great starting point for your Safety Insurance Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not wait on a single insurer when you can quickly scan focused stock ideas on Simply Wall St that match your risk appetite and return goals.

- Capture potential bargains by targeting companies that look mispriced based on future cash flows, using these 905 undervalued stocks based on cash flows to uncover opportunities the market may be overlooking.

- Ride powerful innovation trends by filtering for early movers in artificial intelligence, with these 26 AI penny stocks helping you pinpoint names reshaping entire industries.

- Boost your income strategy by lining up businesses with robust payouts, as these 15 dividend stocks with yields > 3% highlights companies offering attractive yields backed by real fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026