- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

How Revenue Growth and a Dividend Hike Could Influence Safety Insurance Group (SAFT) Investors

Reviewed by Simply Wall St

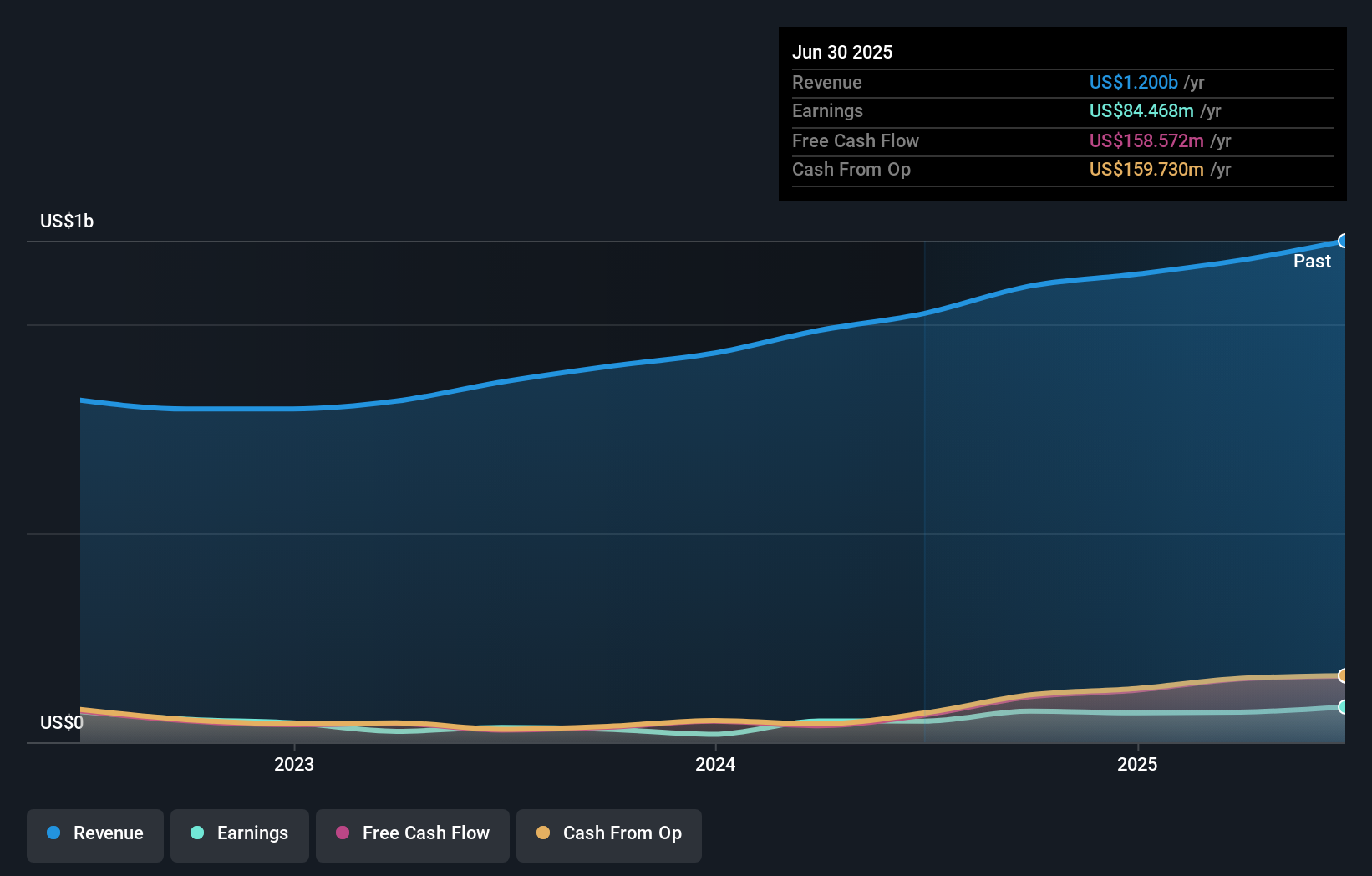

- Safety Insurance Group, Inc. announced improved second quarter 2025 results, reporting revenue of US$316.34 million and net income of US$28.94 million, along with an increase in its quarterly dividend to US$0.92 per share.

- The company’s solid earnings and higher dividend reflect year-over-year financial growth, highlighting management’s ongoing focus on shareholder returns.

- We’ll take a closer look at how the combination of revenue growth and a dividend boost shapes Safety Insurance Group’s investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Safety Insurance Group's Investment Narrative?

To see Safety Insurance Group as an attractive holding, it helps to believe in the reliability of its earnings and management’s consistent approach to shareholder returns. The recent strong Q2 numbers and dividend hike clearly align with those themes, providing shareholders with tangible upside in both income and profit metrics. These results likely reinforce confidence in the company’s ability to produce steady cash flow, offsetting some previously highlighted risks around lackluster long-term returns and sector underperformance. That said, while improved quarterly figures and a slightly higher dividend are supportive, they may not fundamentally shift major short-term catalysts like pricing power or claims volatility. The main risks, such as ongoing share price weakness or broader insurance market challenges, are still very much present, even as this quarter gives investors something positive to point to.

But with share price returns continuing to trail the market, potential risks shouldn’t be ignored.

Exploring Other Perspectives

Explore another fair value estimate on Safety Insurance Group - why the stock might be worth as much as $48.03!

Build Your Own Safety Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Safety Insurance Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Safety Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Safety Insurance Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives