- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Should Root's (ROOT) Slowing Revenue Growth Outlook Prompt a Closer Look from Investors?

Reviewed by Sasha Jovanovic

- Root, Inc. announced that it will release its latest earnings results this Wednesday after market close, with analysts expecting revenue to increase 21.4% year on year, a slower pace compared to the very large growth reported last year.

- A unique aspect is that Root has consistently surpassed Wall Street’s revenue expectations in every quarter over the past two years, beating estimates by an average of 21.7%.

- We’ll explore how strong historical revenue outperformance ahead of the upcoming earnings announcement could influence Root’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Root Investment Narrative Recap

At its core, Root, Inc. appeals to investors who believe that technology-driven insurance models and advanced AI can deliver sustainable competitive advantage and customer acquisition at scale. The upcoming earnings announcement, with revenue growth expected to moderate sharply from last year, is unlikely to materially alter the stock’s biggest near-term catalyst: the ongoing expansion into new states and embedded digital channels. The primary risk remains heightened competition impacting Root’s customer acquisition and revenue trajectory, especially as direct-to-consumer channels evolve.

Among recent developments, Root’s September expansion into Washington, completing its West Coast coverage, directly supports its growth catalyst by adding millions of prospective customers to its addressable market. By leveraging behavioral data and technology for pricing, Root continues to broaden its geographic reach, addressing one of its most important short-term drivers ahead of the earnings release.

Yet, while Root’s AI-powered growth story has clear appeal, investors should not overlook the very real risk if customer acquisition costs rise sharply and revenue growth slows…

Read the full narrative on Root (it's free!)

Root's narrative projects $1.9 billion revenue and $72.3 million earnings by 2028. This requires 10.8% yearly revenue growth and a decrease of $9.3 million in earnings from $81.6 million today.

Uncover how Root's forecasts yield a $124.40 fair value, a 54% upside to its current price.

Exploring Other Perspectives

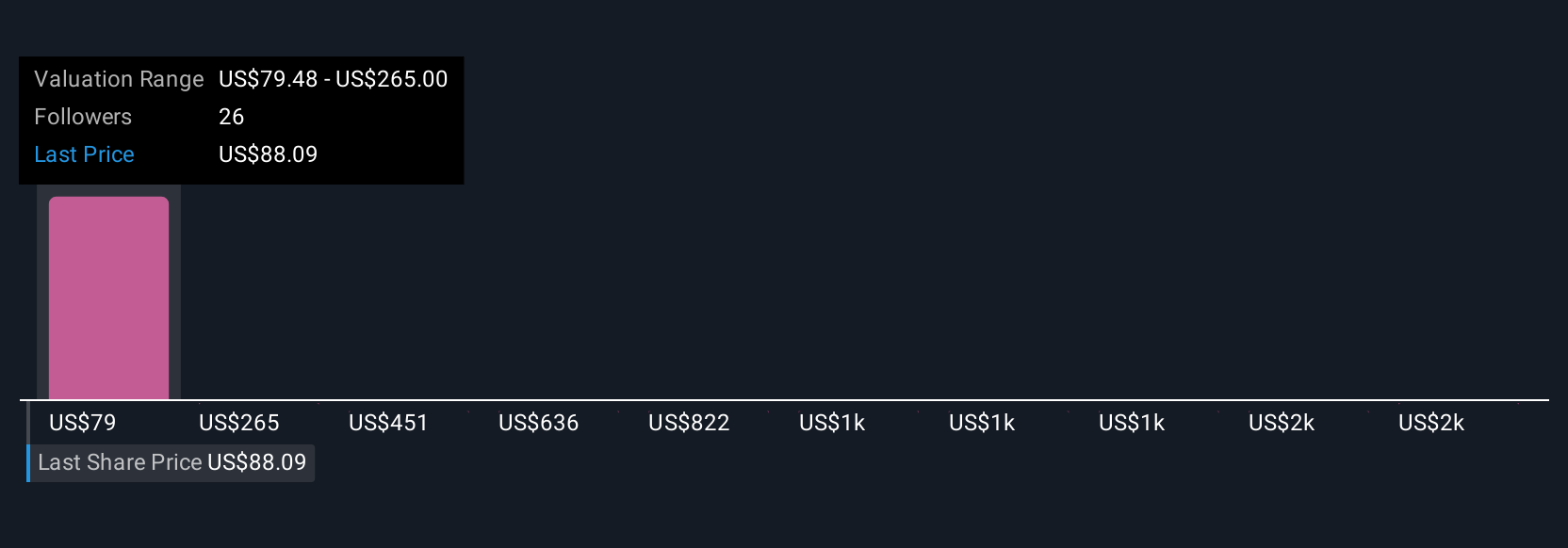

Fourteen fair value estimates from the Simply Wall St Community range between US$79 and US$1,935, highlighting exceptionally broad viewpoints. Customer acquisition cost pressures remain front of mind as performance and profitability expectations shift, reminding you to consider how varying opinions reflect Root’s competitive and financial outlook.

Explore 14 other fair value estimates on Root - why the stock might be worth just $79.48!

Build Your Own Root Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Root research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Root research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Root's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROOT

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives