- United States

- /

- Insurance

- /

- NasdaqGS:PFG

Assessing Principal Financial Group’s (PFG) Valuation After Deanna Strable’s Appointment as Board Chair and CEO

Reviewed by Simply Wall St

If you are tracking Principal Financial Group (PFG), the news that Deanna Strable, current president and CEO, has also been elected chair of the board might have caught your eye. Leadership transitions at this level can nudge investors off the sidelines, especially given Strable’s decades-long history and proven management track record at the company. With Strable now holding both top executive roles, the move signals continuity and a unified strategic direction. This prompts the market to weigh the likely impact: will stability drive future value, or are there new risks on the horizon?

This leadership update comes after a year of steady gains for Principal Financial Group shares. The stock is up more than 5% over the past 12 months and has climbed nearly 17% in the last three years, tracking well ahead of broader insurance sector averages. With momentum holding firm recently, investors appear comfortable with the transition, perhaps viewing it as an endorsement of the company’s direction following a stretch of consistent revenue and net income growth.

But after this measured advance, is Principal Financial Group trading at a discount with room to run, or is the market already pricing in every bit of Strable’s leadership and future growth?

Most Popular Narrative: 6.1% Undervalued

According to community narrative, Principal Financial Group is considered to be trading below its estimated fair value, based largely on a future-oriented outlook for its earnings, margins, and balance sheet. Analysts currently see the shares at a discount to their consensus fair value, with underlying assumptions around business expansion and profitability driving this view.

Principal Financial Group is positioning itself to capitalize on growth opportunities in the retirement ecosystem, focusing on SMBs and Global Asset Management. This strategy could drive future revenue growth as these markets expand.

What goes into the calculation behind this bullish stance? The community narrative hints at forward revenue growth, margin expansion, and a lower profit multiple in the future. There is a specific mix of projections at the heart of this valuation. If you want to see exactly why analysts believe the stock is trading below what it could be worth, you will want to take a closer look at the underlying numbers in this narrative.

Result: Fair Value of $86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, factors like volatile markets or persistent client withdrawals could challenge Principal Financial Group’s growth path. This may put short-term pressure on margins and revenue.

Find out about the key risks to this Principal Financial Group narrative.Another View: What Does the DCF Model Say?

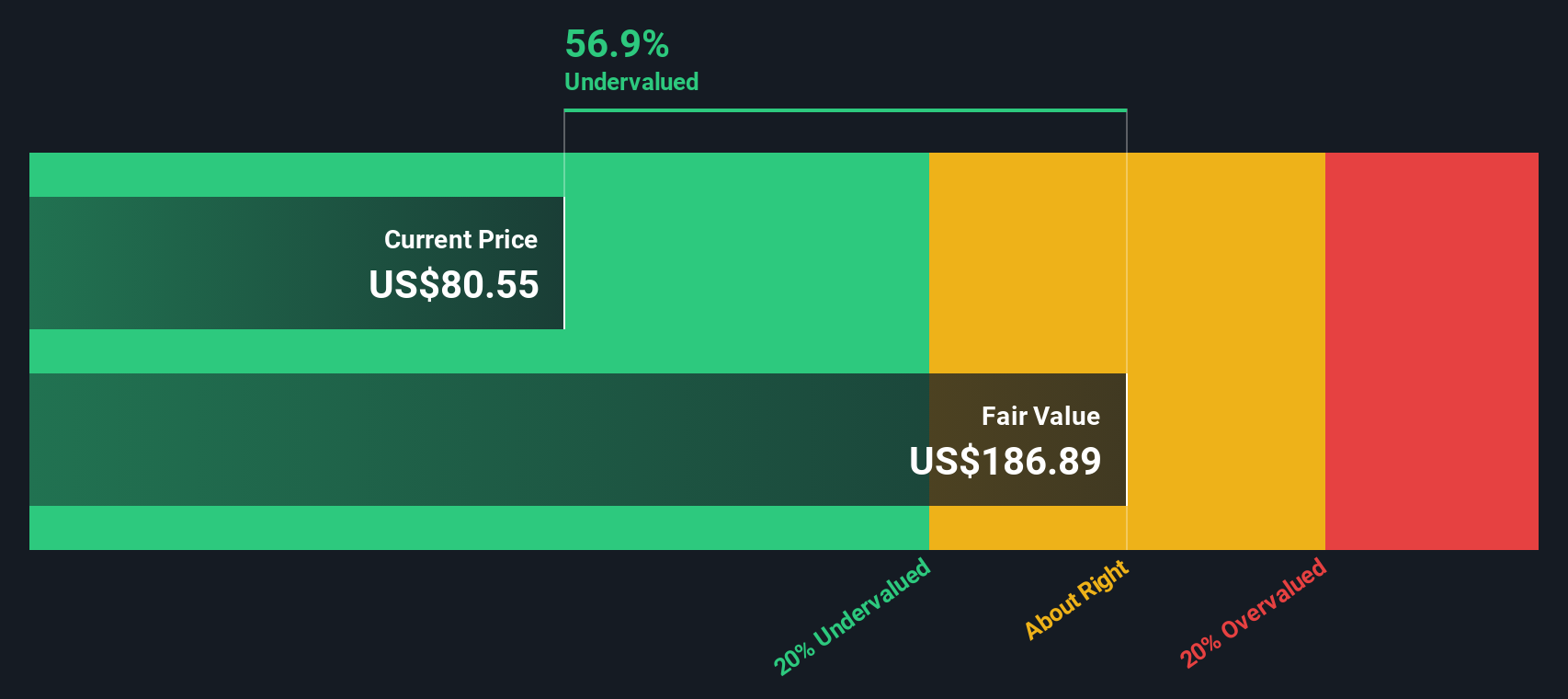

While market multiples suggest Principal Financial Group is undervalued, our DCF model paints a different picture. This approach, which relies on projected cash flows, points to even deeper value than what analyst targets reveal. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Principal Financial Group Narrative

If you see things differently or want to dig into the data on your own terms, you can craft a custom narrative in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Principal Financial Group.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by while you wait on the sidelines. Still hungry for new ways to grow your portfolio? Simply Wall Street’s powerful screener provides fresh ideas tailored for today’s markets and tomorrow’s breakthroughs.

- Tap into the earning potential of companies in the AI healthcare revolution by finding leading innovators with healthcare AI stocks.

- Spot stocks delivering reliable income with strong yields higher than 3 percent by using dividend stocks with yields > 3%.

- Take advantage of undervalued opportunities based on future cash flows through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFG

Principal Financial Group

Provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives