- United States

- /

- Insurance

- /

- NasdaqGS:JRVR

The James River Group Holdings (NASDAQ:JRVR) Share Price Has Gained 87% And Shareholders Are Hoping For More

While James River Group Holdings, Ltd. (NASDAQ:JRVR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 21% in the last quarter. On the bright side the returns have been quite good over the last half decade. It has returned a market beating 87% in that time.

See our latest analysis for James River Group Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, James River Group Holdings actually saw its EPS drop 12% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

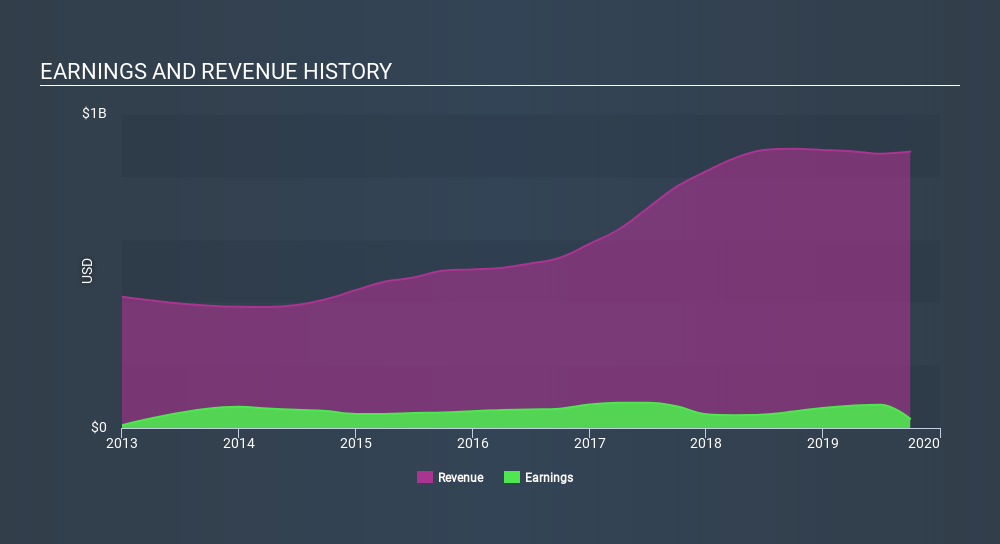

In contrast revenue growth of 17% per year is probably viewed as evidence that James River Group Holdings is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think James River Group Holdings will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for James River Group Holdings the TSR over the last 5 years was 131%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

James River Group Holdings provided a TSR of 7.8% over the last twelve months. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 18% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

James River Group Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:JRVR

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives