- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

The Goosehead Insurance (NASDAQ:GSHD) Share Price Has Gained 98% And Shareholders Are Hoping For More

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Goosehead Insurance, Inc (NASDAQ:GSHD) share price is 98% higher than it was a year ago, much better than the market return of around 9.4% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Goosehead Insurance

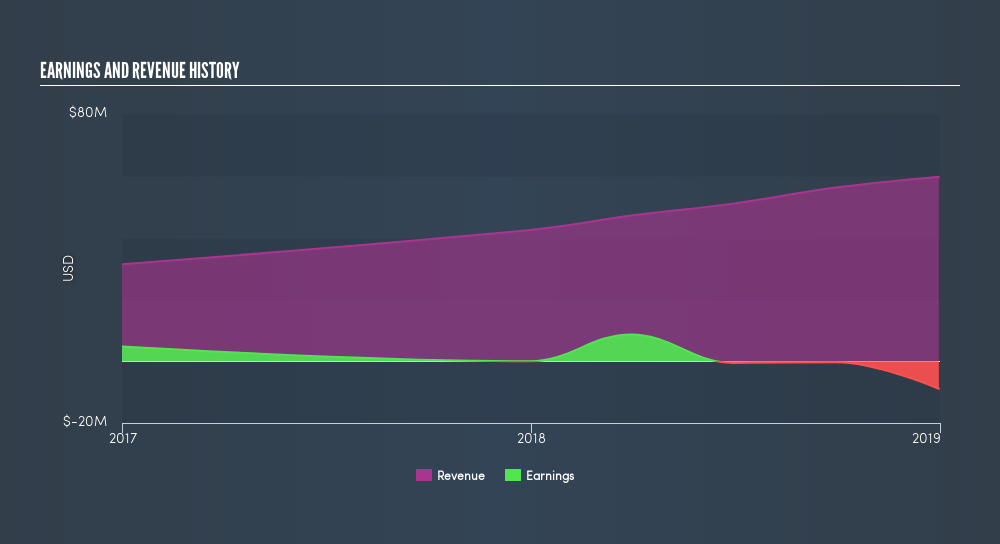

Because Goosehead Insurance is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Goosehead Insurance grew its revenue by 41% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 98% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But it's crucial to check profitability and cash flow before forming a view on the future.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered Goosehead Insurance's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Goosehead Insurance's TSR, at 101% is higher than its share price return of 98%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Goosehead Insurance shareholders have gained 101% over the last year. That's better than the more recent three month gain of 5.1%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). Before spending more time on Goosehead Insurance it might be wise to click here to see if insiders have been buying or selling shares.

But note: Goosehead Insurance may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives