- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

How Goosehead Insurance’s Earnings Miss and Estimate Cuts Could Impact GSHD Investors

Reviewed by Sasha Jovanovic

- Goosehead Insurance recently confirmed the release of its Q3 2025 earnings report on October 22, 2025, following a quarter in which the company exceeded revenue projections but missed earnings expectations.

- This mixed quarterly performance, combined with downward revisions to 2025 and 2026 financial estimates, has heightened investor focus ahead of the latest results.

- With analysts having reduced forward-looking estimates, we'll explore how this shift could influence Goosehead Insurance's broader investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Goosehead Insurance Investment Narrative Recap

To own Goosehead Insurance stock, investors need to believe in the scalability and resilience of its franchise agent network and technology-enabled service platform, even as near-term results show volatility. The recent announcement of downward earnings revisions for 2025 and 2026 could impact sentiment, but the most important short-term catalyst remains execution on agent productivity initiatives, while the biggest risk continues to be exposure to tighter carrier underwriting in weather-affected regions. For now, the headlines do not appear to meaningfully alter these core drivers.

The company’s expanded franchise partnership with Nan & Company Properties, announced in September, is directly relevant in the context of broadening distribution and enhancing client reach. This collaboration integrates Goosehead’s insurance offerings into real estate transactions, providing a tangible example of the sort of pipeline growth that can support long-term revenue catalysts despite any temporary financial estimate downgrades.

However, investors should be aware that, in contrast to these expansion efforts, one of the key risks remains the company’s reliance on a limited set of carrier relationships in shifting insurance markets...

Read the full narrative on Goosehead Insurance (it's free!)

Goosehead Insurance's narrative projects $588.5 million revenue and $71.4 million earnings by 2028. This requires 20.0% yearly revenue growth and a $41.5 million earnings increase from $29.9 million today.

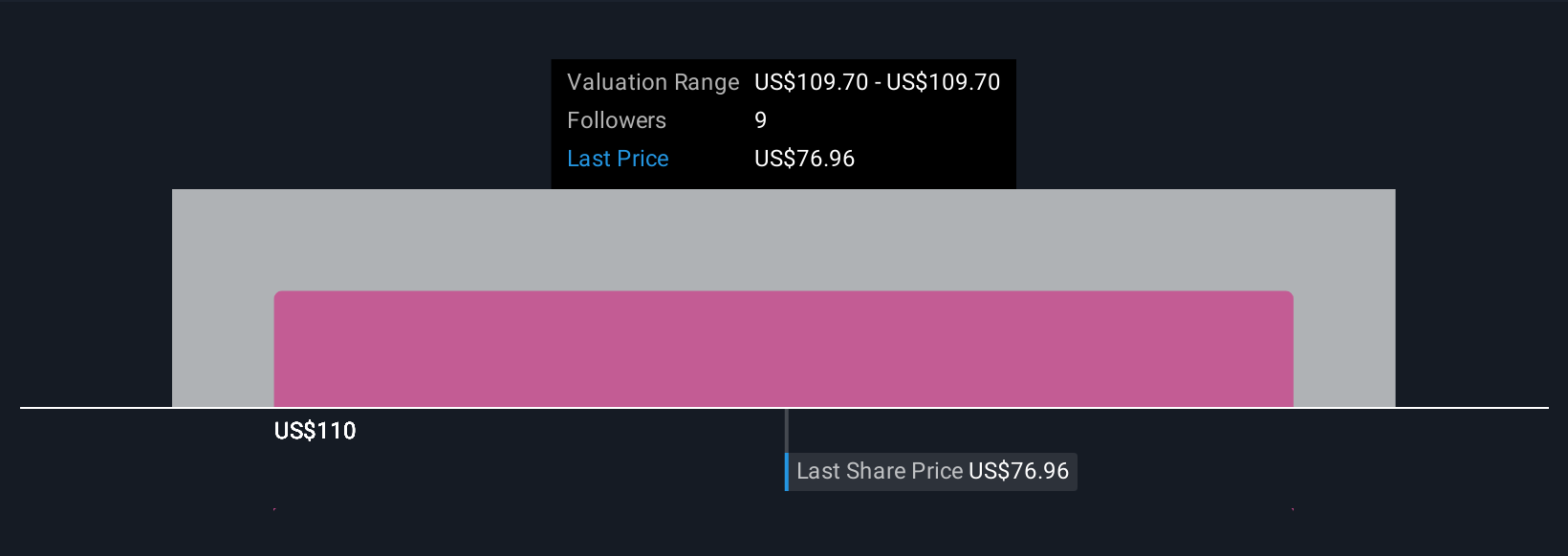

Uncover how Goosehead Insurance's forecasts yield a $101.30 fair value, a 48% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value insights for Goosehead Insurance all cluster at US$101.30, reflecting a single perspective before recent estimate cuts. Against this, analysts have flagged the emerging risk from tighter carrier partnerships and potential margin pressure, an area worth further investigation for anyone considering multiple outlooks.

Explore another fair value estimate on Goosehead Insurance - why the stock might be worth as much as 48% more than the current price!

Build Your Own Goosehead Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goosehead Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goosehead Insurance's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives