- United States

- /

- Insurance

- /

- NasdaqGS:GLRE

Greenlight Capital Re's (NASDAQ:GLRE) Stock Price Has Reduced 63% In The Past Five Years

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Greenlight Capital Re, Ltd. (NASDAQ:GLRE) share price dropped 63% over five years. We certainly feel for shareholders who bought near the top. The good news is that the stock is up 5.1% in the last week.

Check out our latest analysis for Greenlight Capital Re

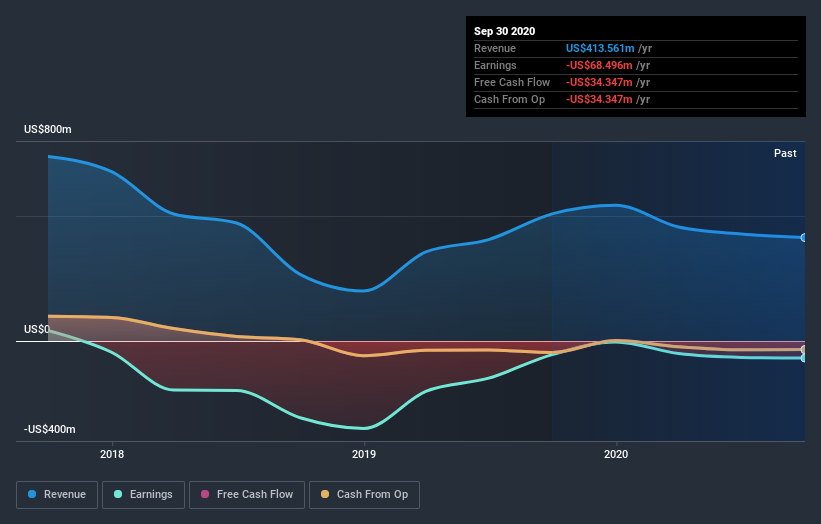

Greenlight Capital Re wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Greenlight Capital Re grew its revenue at 4.3% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 10% for the last five years. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Greenlight Capital Re stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 39% in the last year, Greenlight Capital Re shareholders lost 8.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Greenlight Capital Re is showing 1 warning sign in our investment analysis , you should know about...

Of course Greenlight Capital Re may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Greenlight Capital Re, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Greenlight Capital Re, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:GLRE

Greenlight Capital Re

Through its subsidiaries, operates as a property and casualty reinsurance company internationally.

Flawless balance sheet and good value.