- United States

- /

- Insurance

- /

- NasdaqGS:GLRE

Exploring 3 Undervalued Small Caps With Insider Action Across Global Markets

Reviewed by Simply Wall St

As U.S. markets experience volatility with major indices like the Dow Jones and S&P 500 posting declines, small-cap stocks are drawing attention amid fluctuating economic indicators and market sentiment. In this environment, identifying promising small-cap companies involves looking at those with solid fundamentals and potential for growth, especially when insider actions suggest confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infinity Natural Resources | NA | 0.7x | 46.70% | ★★★★★★ |

| Hanmi Financial | 10.7x | 3.1x | 34.15% | ★★★★★☆ |

| PCB Bancorp | 8.7x | 2.8x | 31.47% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 47.54% | ★★★★★☆ |

| MVB Financial | 10.0x | 1.9x | -7.84% | ★★★★☆☆ |

| Fidelity D & D Bancorp | 9.5x | 2.8x | 47.59% | ★★★★☆☆ |

| S&T Bancorp | 10.6x | 3.6x | 41.89% | ★★★★☆☆ |

| Farmland Partners | 6.2x | 7.7x | -35.75% | ★★★★☆☆ |

| Citizens & Northern | 12.6x | 3.1x | 46.88% | ★★★☆☆☆ |

| Shore Bancshares | 9.1x | 2.4x | -45.24% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

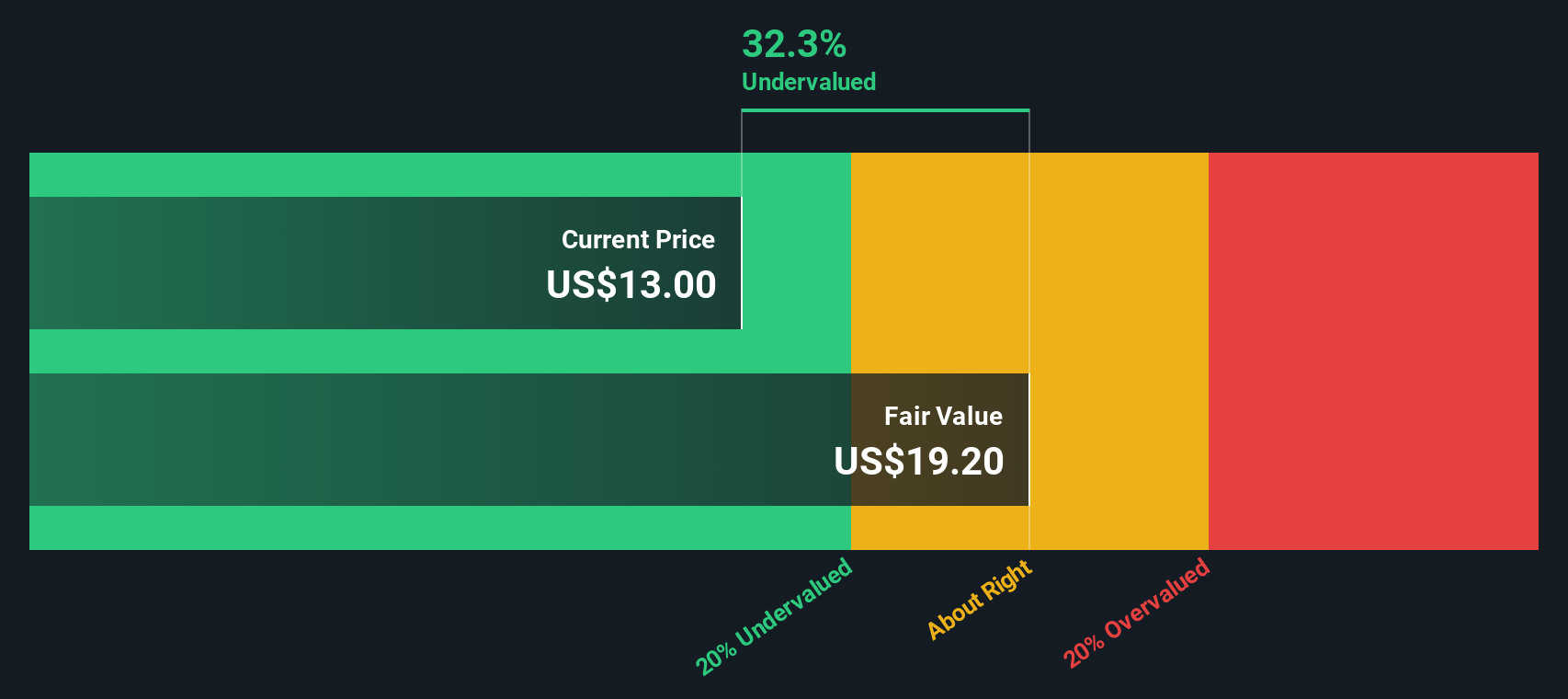

Greenlight Capital Re (GLRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greenlight Capital Re is a reinsurance company that provides risk management solutions and has a market capitalization of approximately $0.27 billion.

Operations: The company's revenue is primarily derived from the Open Market segment, contributing $590.39 million, followed by Innovations at $70.28 million. The Gross Profit Margin has shown variability over time, with recent figures such as 20.64% in Q3 2023 and 18.71% in Q1 2024, reflecting fluctuations in cost management and pricing strategies against revenue generation efforts across its segments.

PE: -235.4x

Greenlight Capital Re, a smaller company in the U.S. market, recently reported a third-quarter revenue drop to US$146 million from US$188 million the previous year, alongside a net loss of US$4.41 million. Despite these challenges, insider confidence is evident as Greg Richardson acquired 50,000 shares for approximately US$637,300. The company repurchased 155,249 shares between July and November 2025 for US$2 million and completed a buyback of 512,527 shares totaling US$7 million since May. Their financial strategy includes amending credit agreements to secure a $50 million revolving facility maturing in 2030 and an uncommitted £50 million letter of credit with Citibank Europe to bolster their Lloyd's business operations.

- Dive into the specifics of Greenlight Capital Re here with our thorough valuation report.

Evaluate Greenlight Capital Re's historical performance by accessing our past performance report.

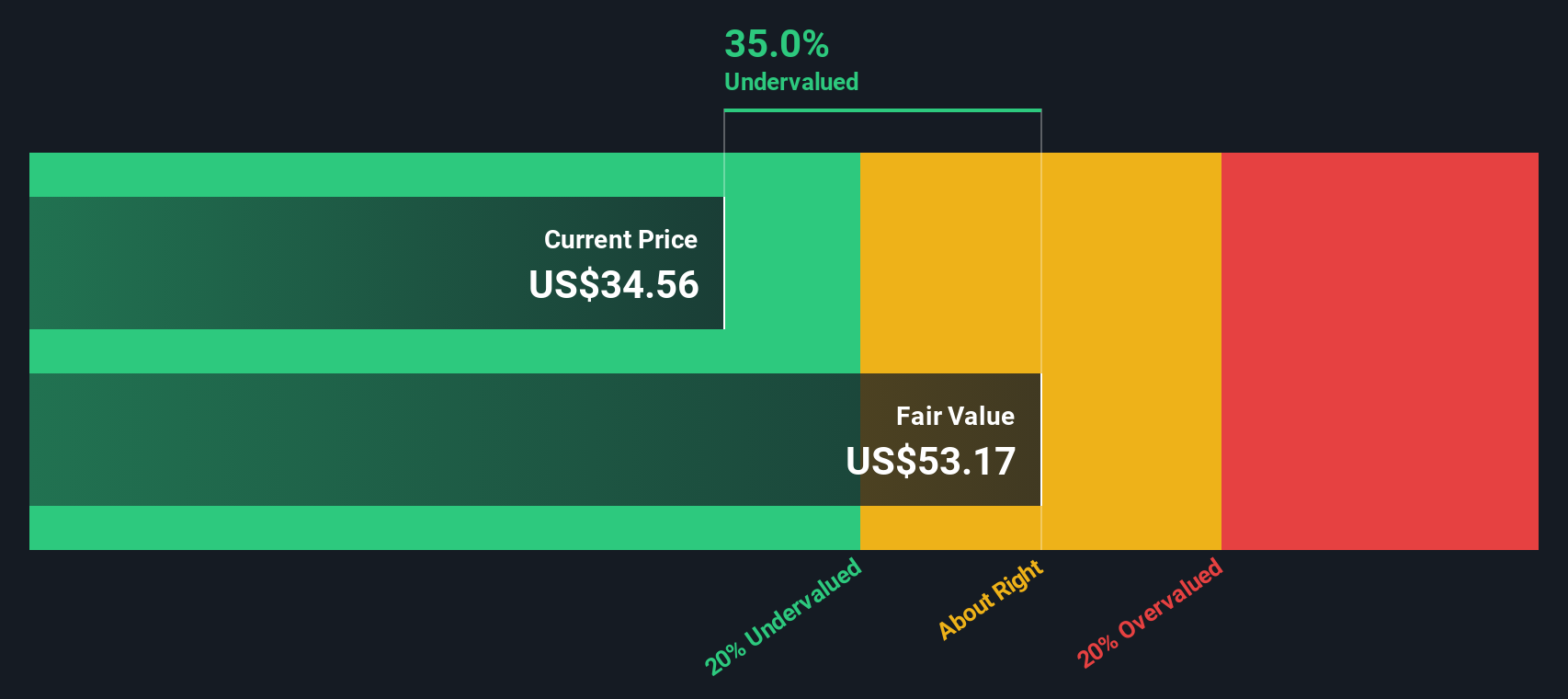

Saul Centers (BFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Saul Centers operates a portfolio of shopping centers and mixed-use properties, with a market capitalization of approximately $1.22 billion.

Operations: The company's revenue streams primarily comprise shopping centers and mixed-use properties, contributing $185.61 million and $97.14 million respectively. The gross profit margin has shown variability, with the most recent figure at 71.61%. Operating expenses include general and administrative costs, which recently amounted to $26.59 million, alongside depreciation and amortization expenses of $57.13 million in the latest period analyzed.

PE: 26.1x

Saul Centers, a smaller player in the market, recently reported third-quarter sales of US$70.68 million, up from US$65.55 million last year, while net income dropped to US$10.49 million from US$14.48 million. Despite steady revenue growth and consistent dividends on its common stock at $0.59 per share, profit margins have shrunk to 9.9% from 16.7%. Insider confidence is evident with recent share purchases in September 2025, suggesting belief in future growth despite current challenges with high-risk funding sources and interest coverage issues.

- Click here and access our complete valuation analysis report to understand the dynamics of Saul Centers.

Understand Saul Centers' track record by examining our Past report.

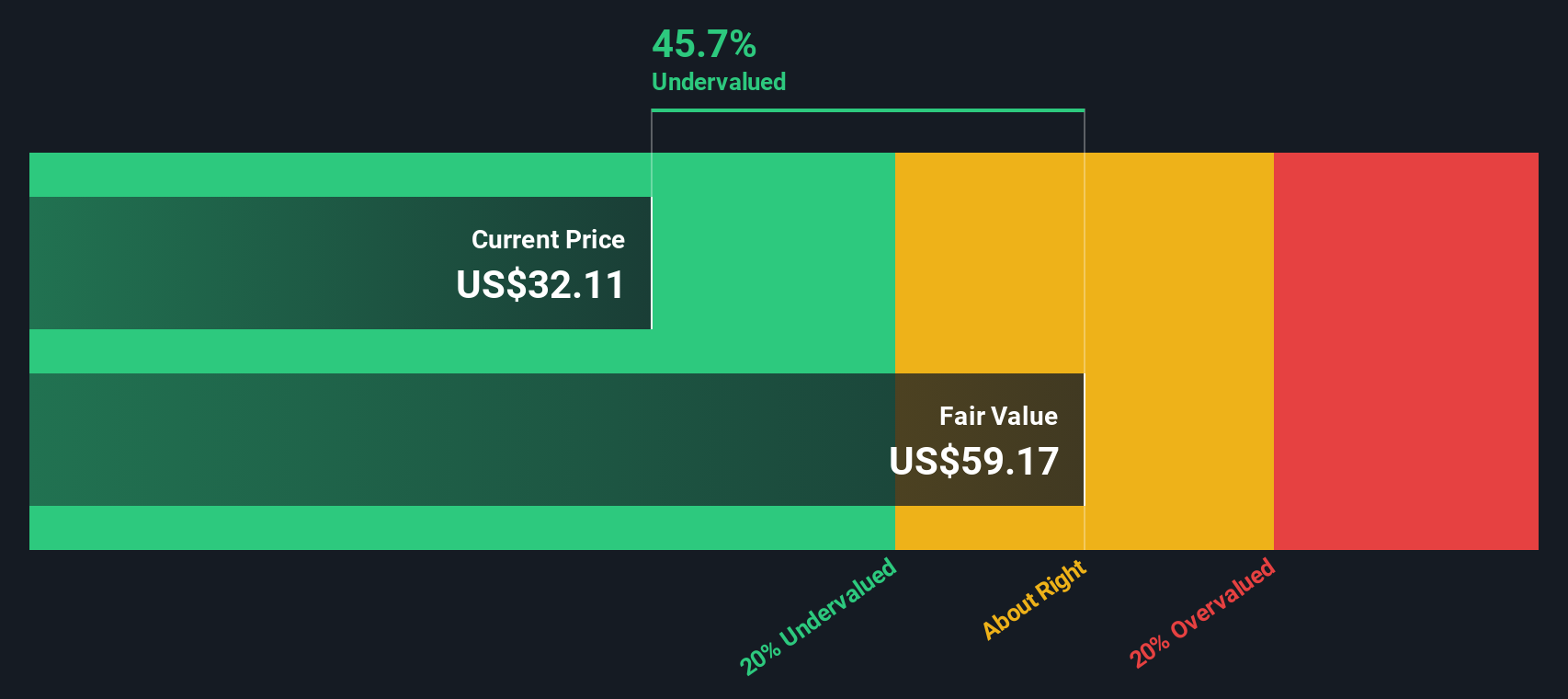

Global Medical REIT (GMRE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Medical REIT is a real estate investment trust focused on acquiring and managing healthcare facilities, with a market cap of approximately $0.51 billion.

Operations: The company generates revenue primarily through investing in medical properties, with recent figures indicating $144.83 million. Operating expenses, including general and administrative costs, significantly impact profitability. The gross profit margin has been consistently high, reaching 99.89% recently.

PE: -130.2x

Global Medical REIT, a smaller company in the healthcare real estate sector, has recently completed a US$50 million fixed-income offering with an 8% preferred stock. Despite reporting a net loss of US$4.55 million for Q3 2025, compared to last year's profit, their sales rose to US$37.04 million from US$34.18 million. The company underwent significant financial restructuring, including extending credit facilities and hedging interest rates on term loans through 2031. These moves suggest strategic positioning for future growth amidst current challenges in covering interest payments with earnings alone.

Turning Ideas Into Actions

- Click this link to deep-dive into the 60 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLRE

Greenlight Capital Re

Through its subsidiaries, operates as a property and casualty reinsurance company worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives