- United States

- /

- Insurance

- /

- NasdaqGS:ESGR

Did Enstar Group's (NASDAQ:ESGR) Share Price Deserve to Gain 27%?

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Enstar Group Limited (NASDAQ:ESGR) share price is up 27% in the last five years, that's less than the market return. Zooming in, the stock is actually down 3.9% in the last year.

Check out our latest analysis for Enstar Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

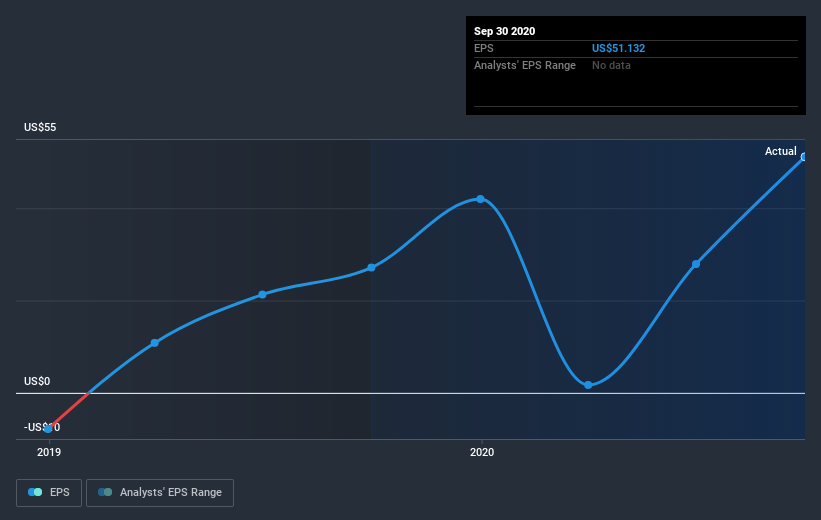

Over half a decade, Enstar Group managed to grow its earnings per share at 36% a year. The EPS growth is more impressive than the yearly share price gain of 5% over the same period. So it seems the market isn't so enthusiastic about the stock these days. The reasonably low P/E ratio of 3.83 also suggests market apprehension.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Enstar Group's earnings, revenue and cash flow.

A Different Perspective

Investors in Enstar Group had a tough year, with a total loss of 3.9%, against a market gain of about 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Enstar Group is showing 1 warning sign in our investment analysis , you should know about...

Enstar Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Enstar Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enstar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ESGR

Enstar Group

Acquires and manages insurance and reinsurance companies and portfolios in run-off in Bermuda and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives