- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Will New Fintech Investments at ITC Vegas Reshape Erie Indemnity's (ERIE) Innovation Narrative?

Reviewed by Sasha Jovanovic

- Erie Indemnity Company participated in ITC Vegas 2025 on October 14 at the Rí Rá Irish Pub in Las Vegas, with Senior Vice President Keith Edward Kennedy representing the company and Erie Strategic Ventures announcing new fintech investments during the event.

- This move signals the company’s ongoing focus on innovation through venture activity, targeting operational improvement and partnerships in financial technology.

- We’ll explore how growing analyst optimism around Erie Indemnity’s earnings outlook now shapes the investment narrative for the company.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Erie Indemnity's Investment Narrative?

The big picture for an Erie Indemnity shareholder is shaped by steady revenue and earnings growth, backed by a high return on equity and a reliable dividend. The company's participation at ITC Vegas 2025 and the new fintech investments highlight a commitment to innovation, potentially supporting operational efficiency and future growth, though the immediate financial impact seems limited given recent share price underperformance and gradual business momentum. Near-term catalysts remain focused on the upcoming third-quarter earnings release, with analysts projecting notable profit improvement. On the risk side, the ongoing state court litigation around Erie Indemnity's management fee could be a source of uncertainty, potentially impacting costs or reputation if the outcome proves unfavorable. While recent corporate actions signal a proactive approach, these risks deserve close attention as they may influence the company’s short-term performance.

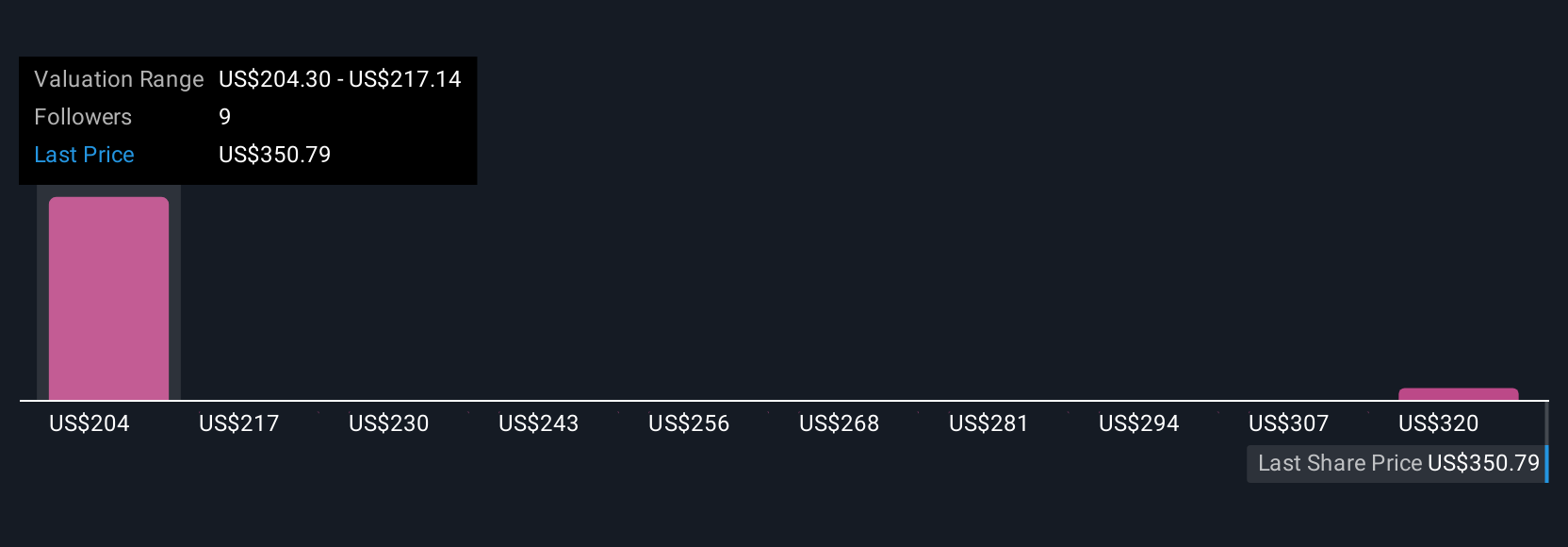

But despite these stable results, unresolved legal challenges could still pose surprises for investors. Erie Indemnity's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth as much as 7% more than the current price!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives