- United States

- /

- Insurance

- /

- NasdaqGS:CINF

I Ran A Stock Scan For Earnings Growth And Cincinnati Financial (NASDAQ:CINF) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Cincinnati Financial (NASDAQ:CINF). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Cincinnati Financial

Cincinnati Financial's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Cincinnati Financial has grown EPS by 23% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Cincinnati Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Cincinnati Financial is growing revenues, and EBIT margins improved by 20.9 percentage points to 35%, over the last year. That's great to see, on both counts.

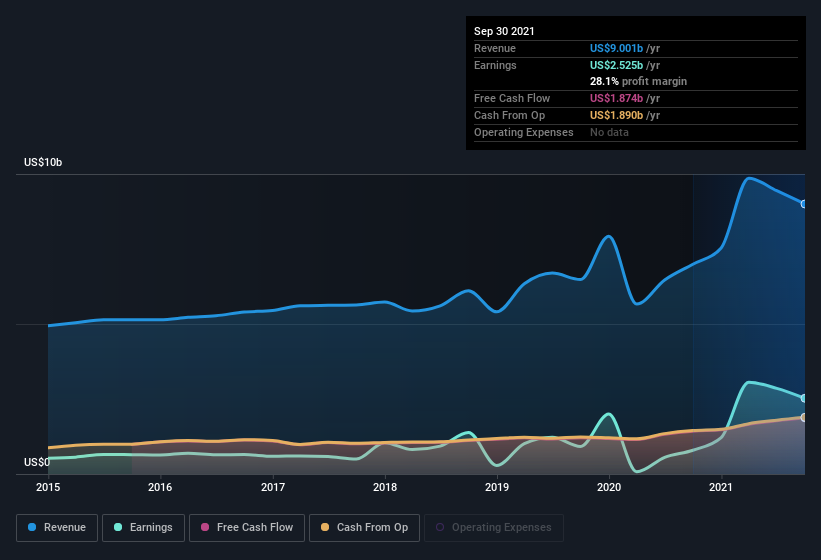

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Cincinnati Financial's forecast profits?

Are Cincinnati Financial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Cincinnati Financial top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the US$85k that Independent Director Dirk Debbink spent buying shares (at an average price of about US$106).

On top of the insider buying, it's good to see that Cincinnati Financial insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$634m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Steve Johnston, is paid less than the median for similar sized companies. For companies with market capitalizations over US$8.0b, like Cincinnati Financial, the median CEO pay is around US$11m.

The Cincinnati Financial CEO received total compensation of just US$3.8m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Cincinnati Financial Worth Keeping An Eye On?

For growth investors like me, Cincinnati Financial's raw rate of earnings growth is a beacon in the night. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Even so, be aware that Cincinnati Financial is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Cincinnati Financial is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Solid track record established dividend payer.