- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Getting In Cheap On Cincinnati Financial Corporation (NASDAQ:CINF) Is Unlikely

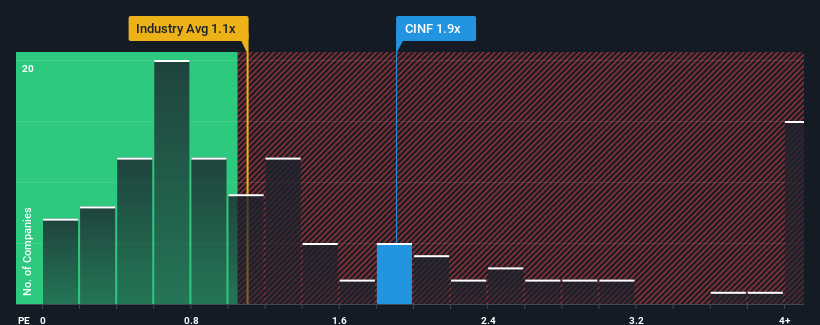

When you see that almost half of the companies in the Insurance industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, Cincinnati Financial Corporation (NASDAQ:CINF) looks to be giving off some sell signals with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Cincinnati Financial

What Does Cincinnati Financial's Recent Performance Look Like?

Cincinnati Financial certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Cincinnati Financial's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cincinnati Financial's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Cincinnati Financial's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. The strong recent performance means it was also able to grow revenue by 33% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue growth is heading into negative territory, declining 2.2% over the next year. That's not great when the rest of the industry is expected to grow by 6.9%.

With this information, we find it concerning that Cincinnati Financial is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Cincinnati Financial's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about this 1 warning sign we've spotted with Cincinnati Financial.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives