- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

Recent 5.4% pullback isn't enough to hurt long-term BRP Group (NASDAQ:BRP) shareholders, they're still up 33% over 1 year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the BRP Group, Inc. (NASDAQ:BRP) share price is up 33% in the last year, that falls short of the market return. We'll need to follow BRP Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Since the long term performance has been good but there's been a recent pullback of 5.4%, let's check if the fundamentals match the share price.

See our latest analysis for BRP Group

BRP Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, BRP Group's revenue grew by 126%. That's stonking growth even when compared to other loss-making stocks. Let's face it the 33% share price gain in that time is underwhelming compared to the growth. When revenue spikes but the share price doesn't we can't help wondering if the market is missing something. It's possible that the market is worried about the losses, or simply that the growth was already priced in. Or, this could be worth adding to your watchlist.

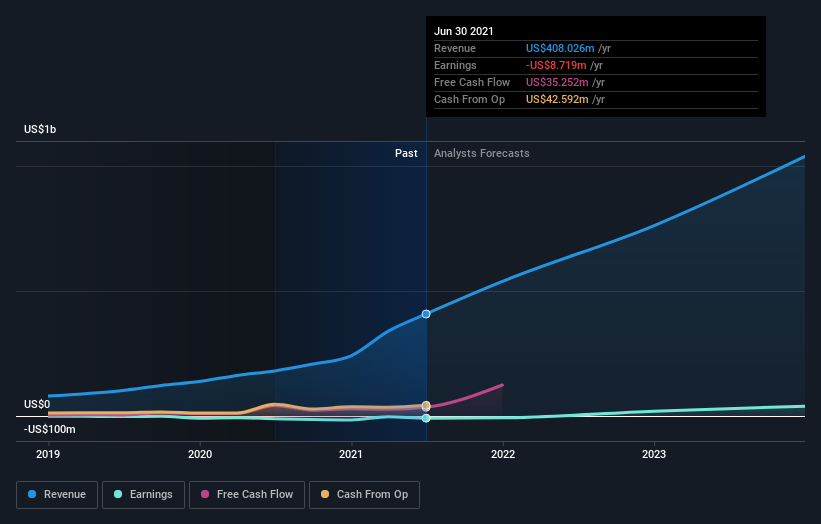

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're happy to report that BRP Group are up 33% over the year. Unfortunately this falls short of the market return of around 38%. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for BRP Group that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade BRP Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026