- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Arch Capital Group (ACGL): Net Profit Margin Decline Challenges Bullish Valuation Narrative

Reviewed by Simply Wall St

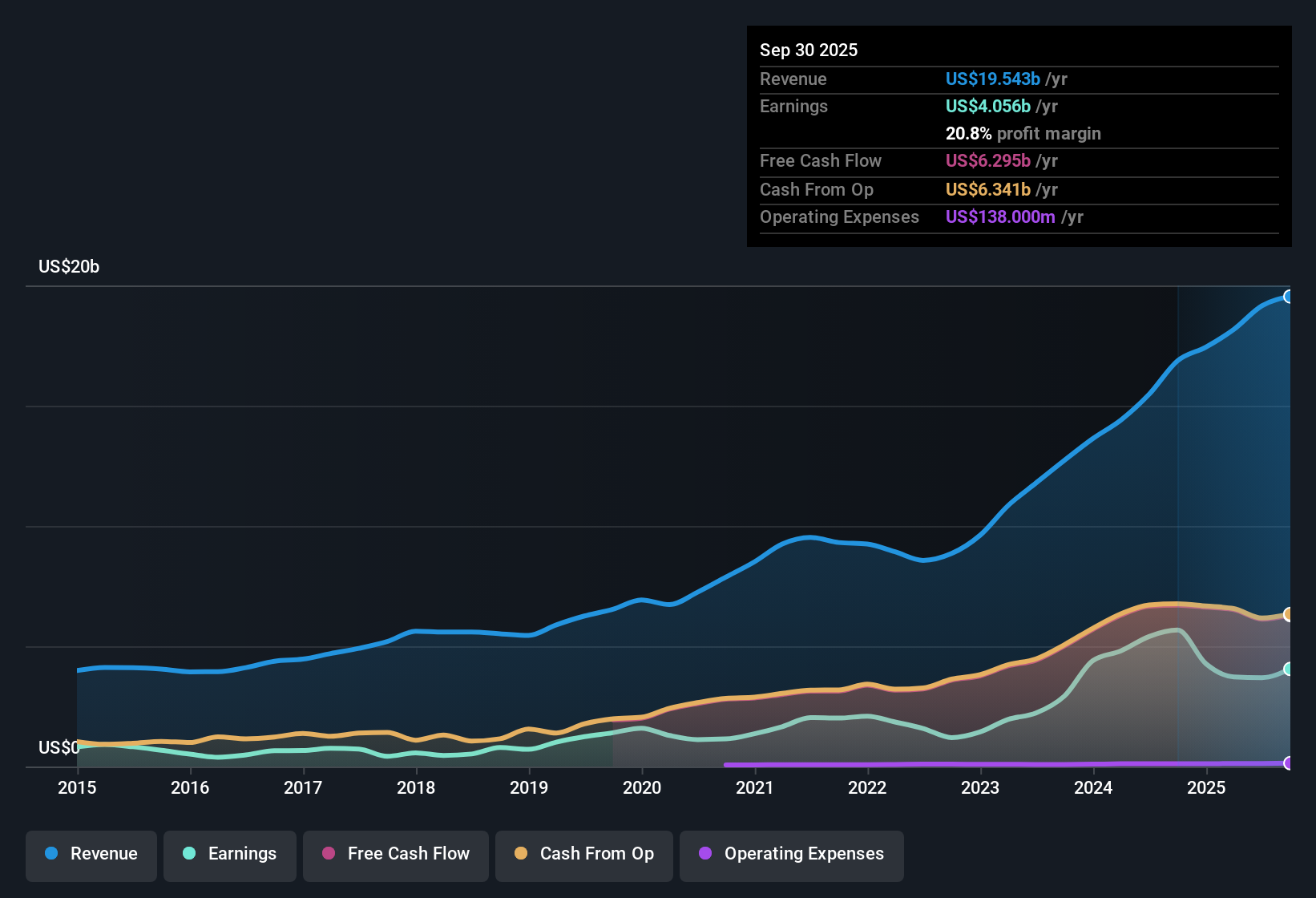

Arch Capital Group (ACGL) has posted a five-year earnings growth rate of 26.6% per year, with recent net profit margins at 20.8%, down from last year's 33.6%. Looking ahead, the company faces a projected -1.4% annual decline in earnings and just 0.08% revenue growth per year, well below the broader US market's 10.1% expectation. Despite softer growth, the stock's 7.6x Price-To-Earnings Ratio and recent price of $84.72 stand out against both peer and industry averages, offering investors an apparent value play even as profitability moderates.

See our full analysis for Arch Capital Group.Up next, we will see how these numbers compare with the narratives shaping sentiment in the market and break down where the stories match up or diverge.

See what the community is saying about Arch Capital Group

Margins Recover Despite Catastrophe Losses

- Profit margins are expected to rise from 19.3% today to 20.6% in three years, even after the Property and Casualty segment absorbed $547 million in California wildfire claims.

- Analysts' consensus view sees cycle management and investment in data analytics driving higher future margins, which

- is supported by expectations that improved risk selection could deliver more stable underwriting profits,

- and that sharper focus on lines with better risk-adjusted returns will further strengthen Arch's earnings resilience, despite the recent dip in net profit margin.

- Consensus narrative argues Arch is well-positioned to weather volatility and margin shocks, thanks to its strategy and data-driven insights.

📊 Read the full Arch Capital Group Consensus Narrative.

Premium Growth Slowdown and Market Headwinds

- Revenue is projected to contract by 0.2% annually for the next three years, pointing to a stall in premium growth despite robust demand elsewhere in the industry.

- Analysts' consensus view highlights that

- specialty premium declines, especially in non-renewing large structured and cyber lines, could restrict top-line expansion and earnings stability,

- while rising competition and higher risk retention among peers may further dampen Arch's ability to grow premiums, emphasizing the need for ongoing diversification.

Valuation: Price Under DCF and Analyst Targets

- Arch Capital trades at $84.72, which is a hefty discount to both the analyst target of $108.41 and its $234.16 DCF fair value.

- Analysts' consensus view links Arch's undervalued stock price to

- its low Price-To-Earnings Ratio of 7.6x versus an industry average of 13.5x, implying the market is skeptical about future growth,

- yet analysts believe management’s strategic capital deployment and expected margin recovery could help the stock close the valuation gap over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arch Capital Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your outlook and build your own narrative in just a few minutes. Do it your way

A great starting point for your Arch Capital Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Arch Capital’s margin resilience, premium growth is stalling and top-line revenue is projected to shrink over the coming years.

If predictable results matter most to you, focus on stable growth stocks screener (2116 results) to find companies that consistently grow earnings and revenue without the same volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives