- United States

- /

- Personal Products

- /

- NYSE:USNA

USANA Health Sciences (USNA) Profit Margin Falls to 1.9%, Tests Bullish Recovery Narratives

Reviewed by Simply Wall St

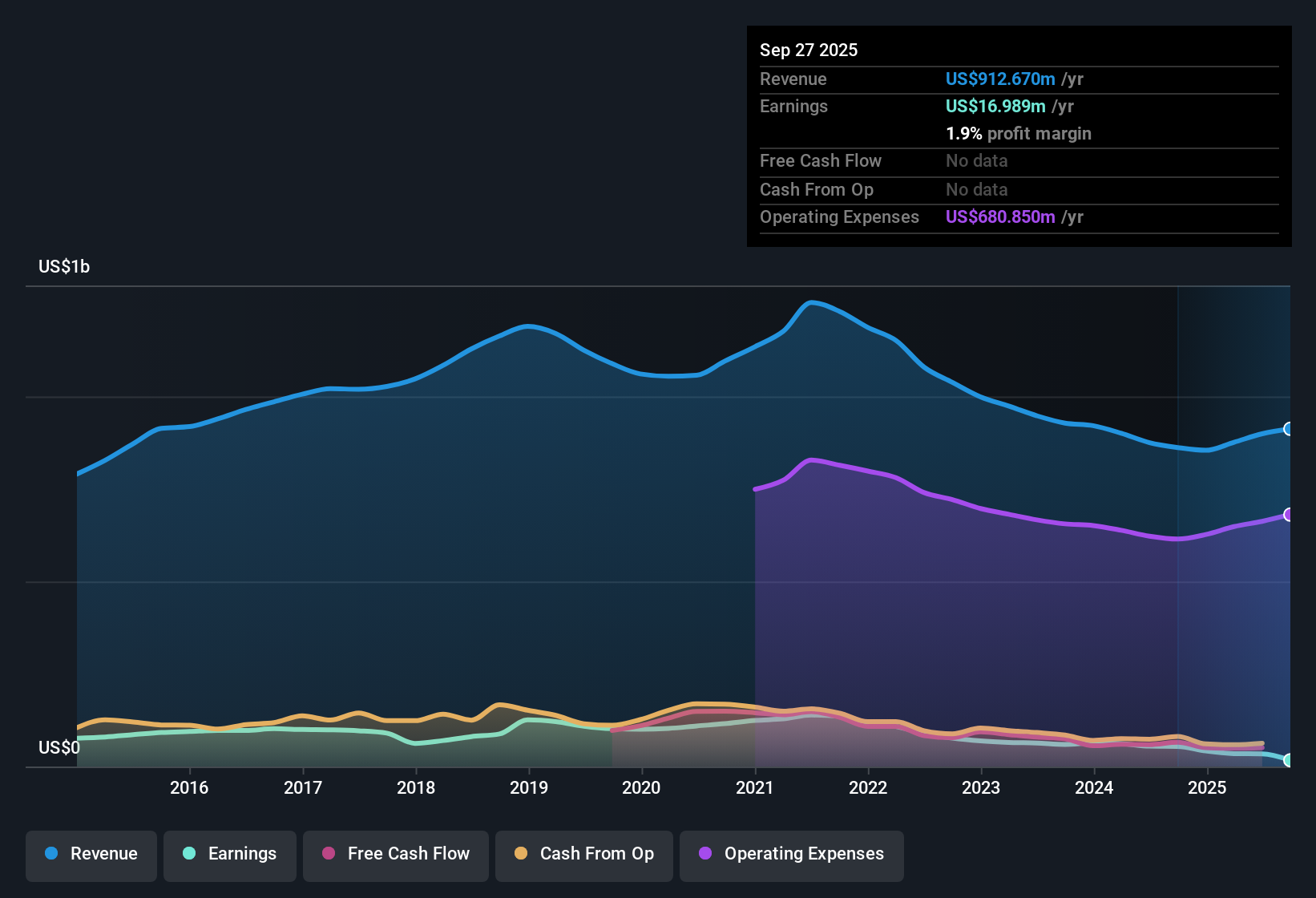

USANA Health Sciences (USNA) is expected to deliver standout annual earnings growth of 80.5% per year, a rapid rebound compared to the US market average of 15.5% per year. Despite this bullish outlook, revenue is projected to expand just 1.6% per year, trailing the broader market’s 10% trend, and the company currently operates at a net profit margin of 1.9%, down significantly from 6.3% a year ago, after five years of annual earnings declines averaging 28.6%. These headline figures highlight both the magnitude of the company’s current profit challenge and the strength of its near-term recovery expectations.

See our full analysis for USANA Health Sciences.The next section breaks down USANA's latest results versus the dominant narratives, spotlighting where the numbers align with consensus and where they might surprise the market.

See what the community is saying about USANA Health Sciences

Profit Margin Nosedives, Recovery Predicted

- Net profit margin sits at a slim 1.9%, slumping sharply from the prior year’s 6.3%. Analysts now forecast profit margins rebounding to 6.6% within three years.

- According to the analysts' consensus view, management’s drive to modernize the direct sales model and boost distributor engagement is expected to shore up productivity and restore profitability.

- Analysts project profit margins to nearly triple, even as recent years have seen average annual earnings drops of 28.6% and shrinking active customers highlight ongoing distributor challenges.

- The consensus perspective treats successful digital innovation and incentive changes as essential pivots. These are considered necessary for the company to stabilize margins and return to steady growth.

Asia-Pacific Reliance Heightens Risk

- USANA’s heavy dependence on Asia-Pacific for sales means that regulatory or geopolitical changes in one region could have an outsized impact on overall performance.

- The consensus narrative notes that while expansion into new markets offers some diversification, the company’s vulnerability is intensified by increased regulatory scrutiny and negative shifts in distributor or customer trends.

- Bears argue ongoing attrition in the distributor base and stiffer competition from digital-first brands create pressures that are not fully offset by USANA’s current strategies.

- The risk of declining sales and more volatile earnings is amplified by continued challenges attracting the next wave of brand partners.

DCF Fair Value Signals Upside

- At $20.63 per share, USANA trades at a sharp discount to its DCF fair value of $53.82 and an analyst price target of $39.00. This suggests that the market is underpricing its future recovery potential if consensus estimates are achieved.

- The analysts’ consensus view argues that, to justify these price targets, the company must reach $1.1 billion in sales and $76 million in earnings by 2028. This will require stronger execution on margin expansion and innovation investment.

- Consensus sees potential for rerating if margin improvements materialize and digital tools drive distributor growth. However, success hinges on overcoming persistent Asia-Pacific risks and revitalizing active customer counts.

- The share price gap reflects skepticism around the durability of the turnaround, with investors weighing whether recent profitability pressures are structural or cyclical.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for USANA Health Sciences on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your unique view by building a narrative in just a few minutes: Do it your way.

A great starting point for your USANA Health Sciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

USANA’s inconsistent profits, declining revenue growth, and dependence on one region highlight vulnerabilities that could undermine a stable earnings recovery.

If you’re seeking stocks with more predictable track records and steady improvement, check out stable growth stocks screener (2089 results) to discover companies that consistently deliver reliable results across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USNA

USANA Health Sciences

Develops, manufactures, and sells science-based nutritional, personal care, and skincare products in the Asia Pacific, the Americas, and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives