- United States

- /

- Household Products

- /

- NYSE:SPB

Spectrum Brands Holdings, Inc.'s (NYSE:SPB) Subdued P/S Might Signal An Opportunity

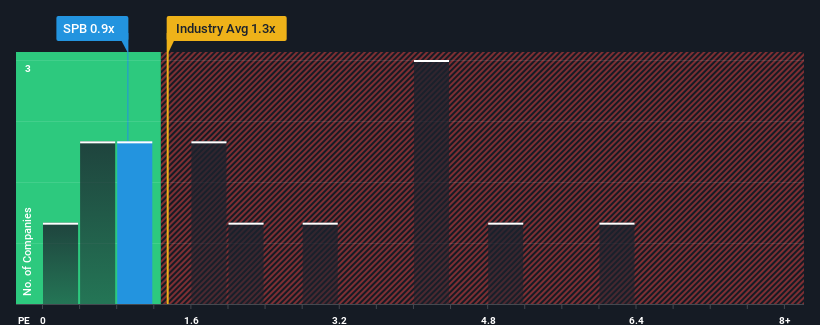

With a price-to-sales (or "P/S") ratio of 0.9x Spectrum Brands Holdings, Inc. (NYSE:SPB) may be sending bullish signals at the moment, given that almost half of all the Household Products companies in the United States have P/S ratios greater than 2.4x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Spectrum Brands Holdings

What Does Spectrum Brands Holdings' Recent Performance Look Like?

Recent times haven't been great for Spectrum Brands Holdings as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Spectrum Brands Holdings.Is There Any Revenue Growth Forecasted For Spectrum Brands Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Spectrum Brands Holdings' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 42% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 1.9% per year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 3.2% each year, which is not materially different.

With this information, we find it odd that Spectrum Brands Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Spectrum Brands Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Spectrum Brands Holdings remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Spectrum Brands Holdings (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SPB

Spectrum Brands Holdings

Operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, Latin America, and Asia-Pacific regions.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives