- United States

- /

- Personal Products

- /

- NYSE:KVUE

Is There an Opportunity in Kenvue After Recent 24% Share Price Drop?

Reviewed by Bailey Pemberton

If you are holding shares of Kenvue or thinking about jumping in, you are probably wondering what is really going on with the stock. It has been a rocky period to say the least, with the price closing recently at $15.73 and slipping another 2.7% in the past week alone. The last 30 days have been even more dramatic, with shares tumbling 24.3%, and since the start of the year, Kenvue is down 26.1%. That is certainly enough to unsettle even the most patient investor.

Why the slide? Broader market uncertainty and shifting consumer sentiment have played a role, putting established names like Kenvue under the microscope. Still, despite the tough performance, there is an interesting story shaping up beneath the surface. It is a story about value. With a valuation score of 5 out of 6, Kenvue checks five important boxes for being undervalued. This suggests there could be a disconnect between where the price sits today and where its fundamentals point in the long run.

This is where things get interesting. In the next section, we will break down how Kenvue measures up according to the most common valuation methods and which signals are worth trusting. If you are looking for an even sharper edge, make sure to stick around for the approach that could change how you assess value entirely.

Why Kenvue is lagging behind its peers

Approach 1: Kenvue Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's dollars. This method helps investors look beyond the current market mood, focusing instead on how much cash the business can generate in the years ahead.

For Kenvue, the latest twelve-month Free Cash Flow sits at $1.62 billion. Analysts anticipate steady growth, with projections reaching $2.83 billion by 2029. While analysts offer forecasts for the next five years, further growth estimates beyond that are extended using established modeling approaches.

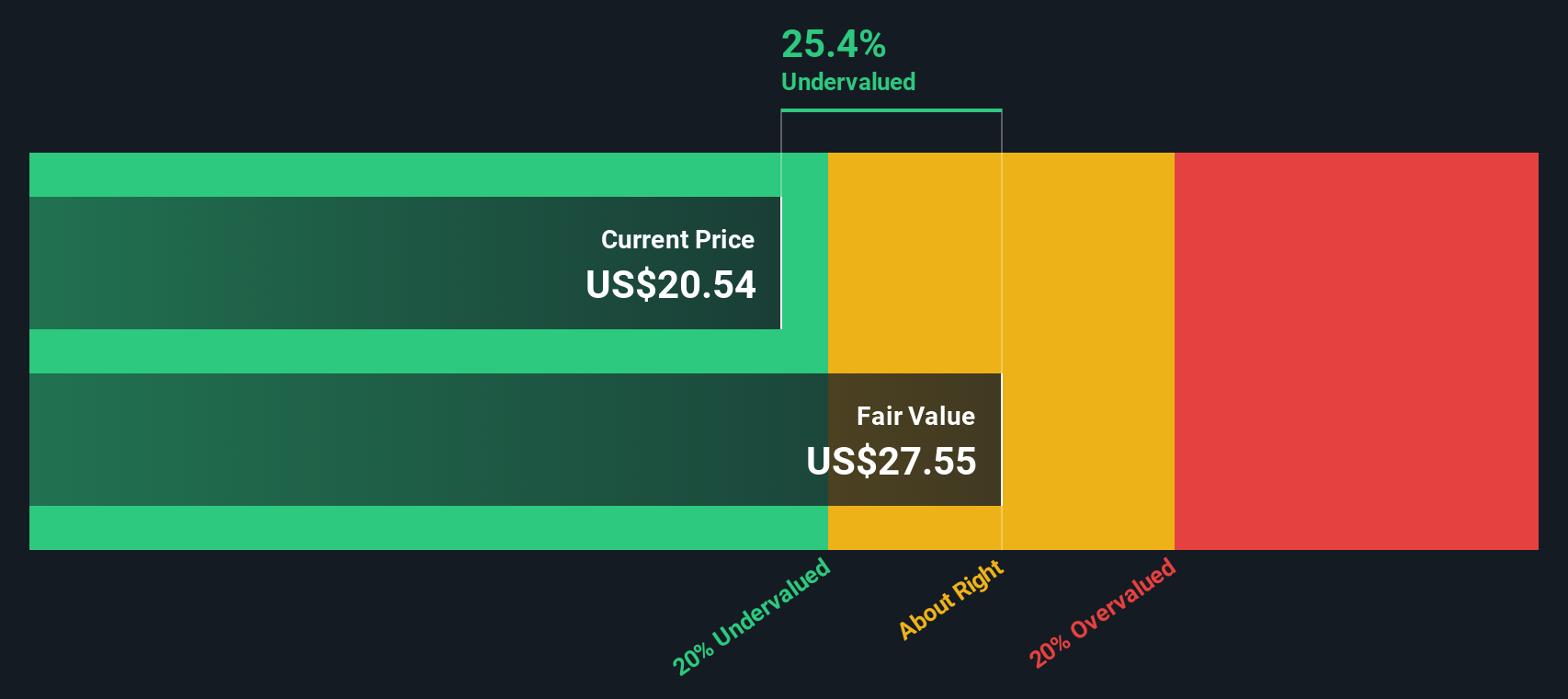

Based on these projections, the DCF analysis calculates an intrinsic value of $26.92 per share. With the stock's recent close at $15.73, this suggests Kenvue shares are trading at a 41.6% discount to their estimated fair value. This could indicate that the market is overlooking the company's long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kenvue is undervalued by 41.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kenvue Price vs Earnings

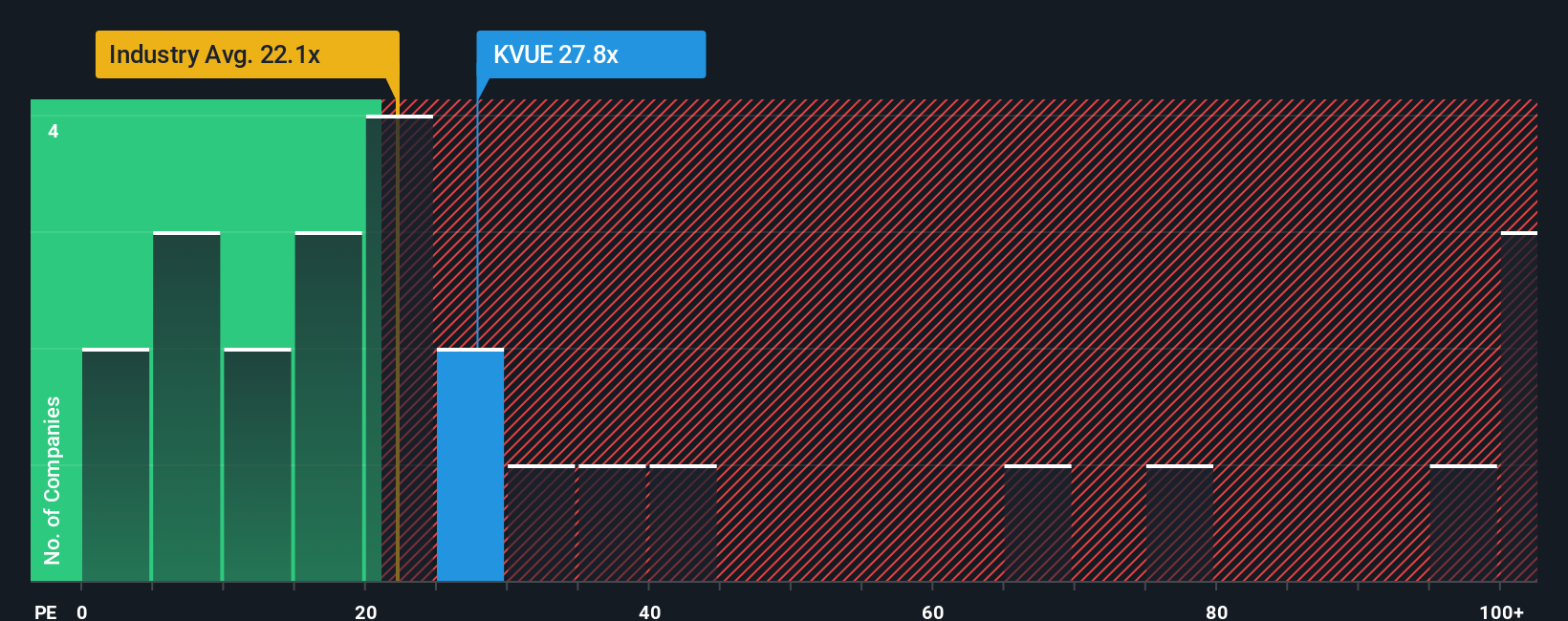

The Price-to-Earnings (PE) ratio is widely used when analyzing profitable companies like Kenvue, as it directly compares a company's share price with its earnings. This gives investors a quick sense of whether the stock is reasonably valued based on its profitability.

Growth expectations and risk play a big role in setting what is considered a “normal” or “fair” PE ratio. Faster-growing businesses typically command higher PE ratios, while companies facing elevated risks or uncertain earnings outlooks will often trade at lower multiples.

Kenvue’s current PE ratio stands at 21.3x. This is just a bit below the average for its Personal Products industry peers, which is 22.6x, and it is far lower than the broader peer group average of 37.9x. On the surface, this might suggest Kenvue is slightly undervalued relative to others in its space.

Simply Wall St introduces a “Fair Ratio”, calculated to reflect the multiple Kenvue deserves based on its earnings growth prospects, profit margins, risk profile, industry, and market cap rather than just headline comparisons. This approach aims to offer a more accurate benchmark than simply stacking the stock against the industry or a group of competitors.

For Kenvue, the Fair Ratio is 24.0x, which is above its current PE of 21.3x. This signals that, accounting for Kenvue’s fundamental characteristics, the market is undervaluing the company on a PE basis compared to what it could reasonably justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kenvue Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, flexible way to combine your perspective on a company’s story with your own expectations for its future results. This approach lets you connect your view about Kenvue’s business, product momentum, or industry forces directly to forecasts for revenue, profit margins, and other financials. You can then see how that translates into a “Fair Value.”

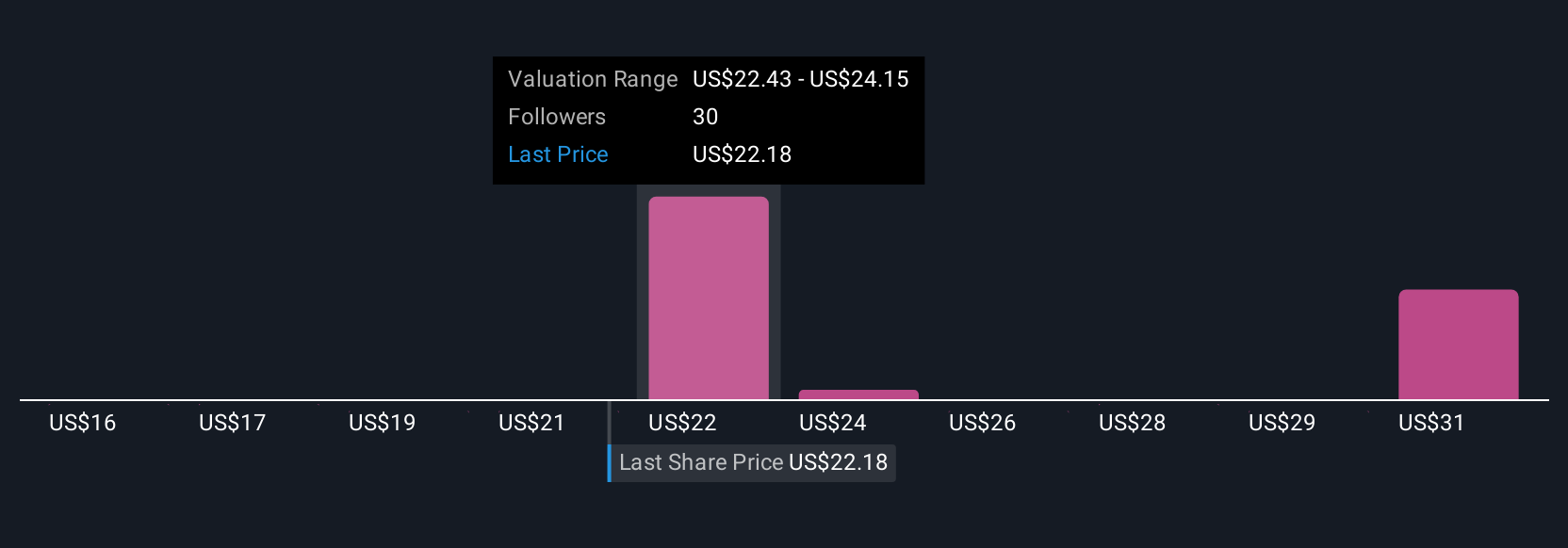

On Simply Wall St’s Community page, millions of investors use Narratives to tell their story for each company and instantly see what their fair value implies versus the current share price. Since Narratives update automatically as news or earnings are released, you can always sense-check your assumptions against the latest information and community views.

For example, some investors believe Kenvue’s innovation and global expansion could justify a fair value as high as $25.09, while others, wary of litigation risks and competitive pressures, see more downside with price targets as low as $19.00. Narratives help you quickly decide whether the current share price means it is time to buy, hold, or sell by using logic, not just headlines.

Do you think there's more to the story for Kenvue? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives