- United States

- /

- Personal Products

- /

- NYSE:KVUE

Does the Recent Kenvue Stock Dip Signal Opportunity for 2025 Investors?

Reviewed by Simply Wall St

Approach 1: Kenvue Cash Flows

A Discounted Cash Flow (DCF) model projects a company’s future free cash flows and then discounts them back to today to estimate what the business is truly worth. For Kenvue, this method starts with its latest reported Free Cash Flow, which stands at $1.62 billion, and then considers analyst projections and longer-term estimates for where those cash flows might head.

Looking forward, analysts expect Kenvue’s annual cash flows to rise, with projections reaching $2.85 billion by 2029. Beyond that, Simply Wall St extends the forecast using a trend-based approach to estimate cash flows up to 2035. All future values are discounted back to present-day rates to reflect the time value of money and risk.

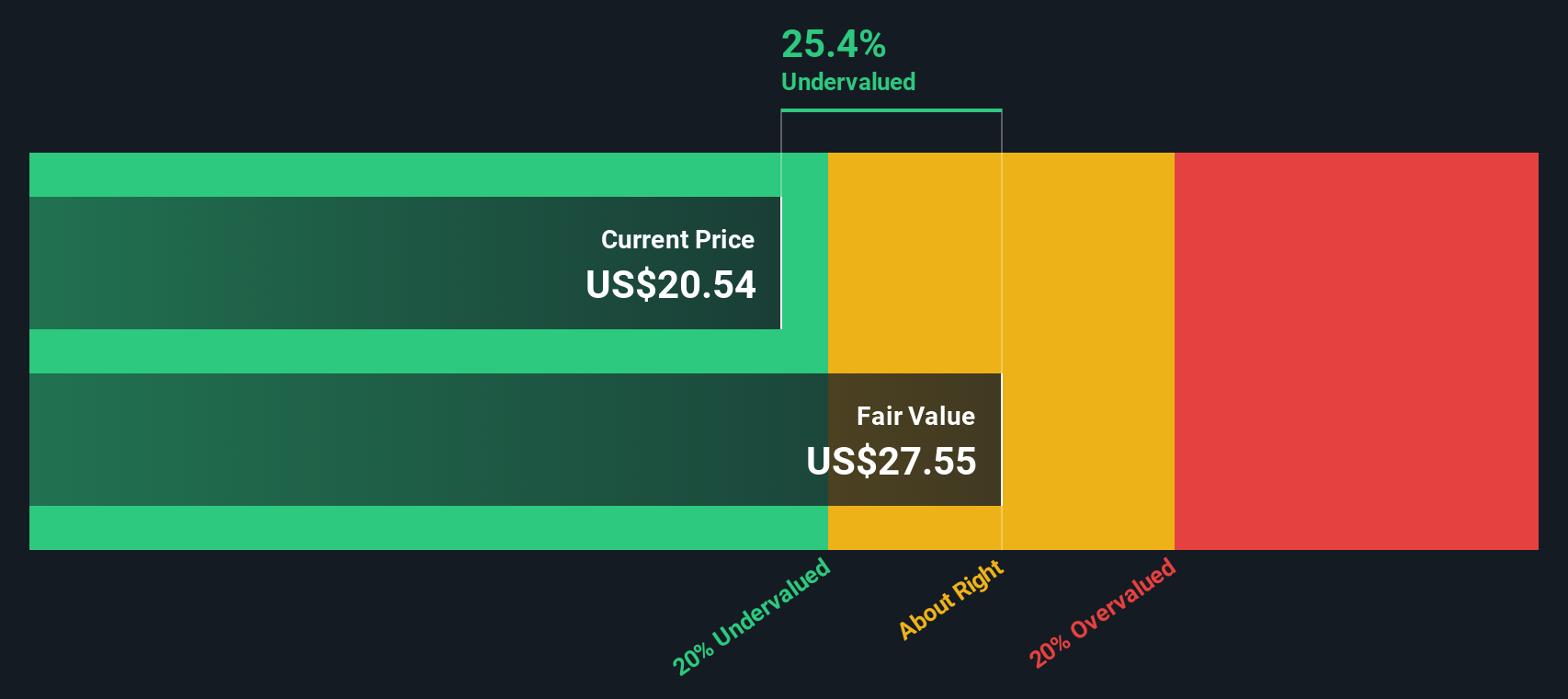

Adding these figures together, the DCF calculation estimates a fair value for Kenvue of $27.82 per share. With shares recently closing at $21.19, the company appears 23.8% undervalued according to this metric.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Kenvue.

Approach 2: Kenvue Price vs Earnings

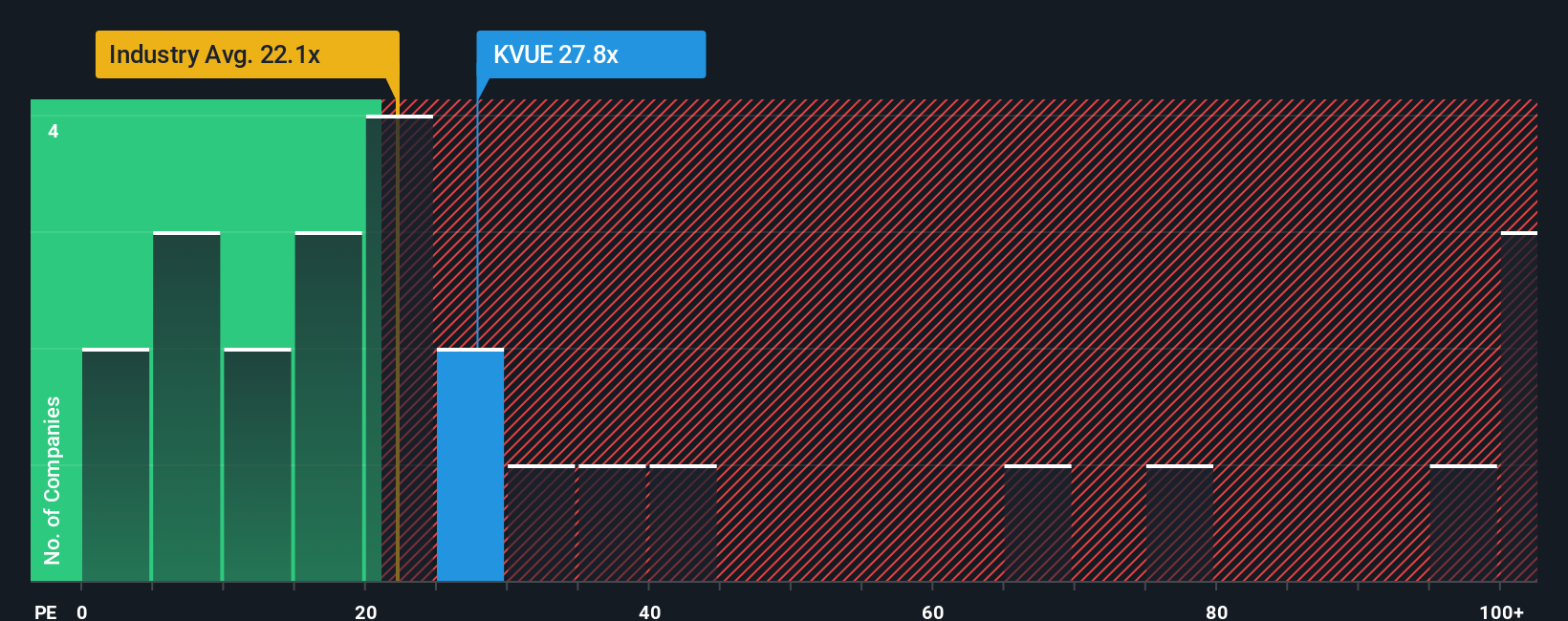

The Price-to-Earnings (PE) ratio remains one of the most widely used valuation tools for profitable companies like Kenvue. This metric helps investors compare how much they are paying for each dollar of current earnings. The "right" PE ratio for a stock often depends on its expected future growth and the level of risk investors are willing to accept. Higher growth or lower perceived risk typically justifies a higher PE ratio.

Kenvue currently trades at a PE ratio of 28.68x. For context, the average PE in the Personal Products industry is 23.47x, and the average among direct peers is even higher at 35.89x. While comparing these benchmarks provides some perspective, there is more nuance involved in determining a fair price.

Simply Wall St’s "Fair Ratio" offers a more tailored assessment. This proprietary measure looks beyond raw sector averages by considering Kenvue’s unique earnings growth, risk profile, industry position, profit margins, and size. For Kenvue, the Fair Ratio is calculated at 27.65x, offering a more comprehensive evaluation of what investors might consider paying.

With Kenvue’s actual PE ratio only slightly above its Fair Ratio, this suggests the market’s pricing is generally in line with the company’s underlying fundamentals and outlook.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Kenvue Narrative

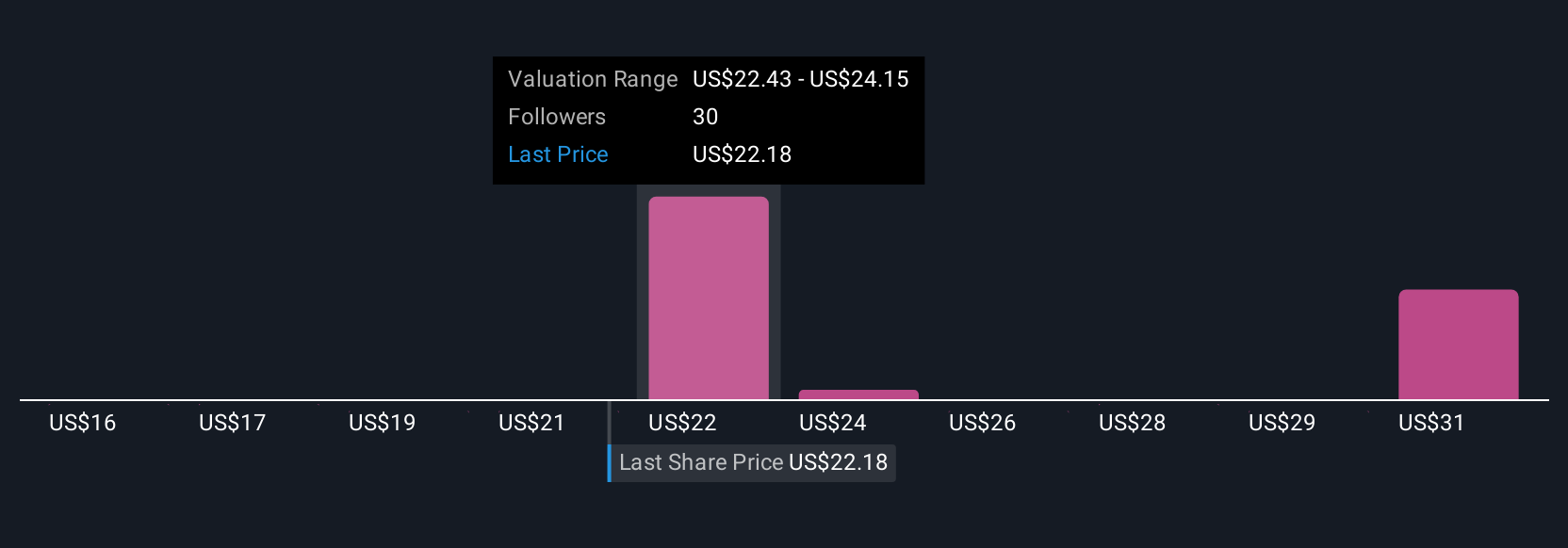

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful way to bring your own perspective to the numbers by connecting a company’s story to a financial forecast and ultimately to your estimate of fair value. Instead of relying solely on static ratios or analyst models, Narratives let you articulate your assumptions about Kenvue’s growth, margins, or future challenges directly on Simply Wall St’s Community page, where millions of investors share their views. This tool helps you see and compare how different storylines — for example, a turnaround into strong revenue growth, or a caution around competitive threats — lead to very different valuations. Narratives update dynamically when new news or earnings are released, keeping your outlook fresh. For instance, one Narrative estimates Kenvue’s fair value at $25.09 based on a bullish outlook on autonomy and innovation, while another sees a more cautious value of $22.80, highlighting operational risks and moderation in growth. By comparing your Narrative’s fair value to today’s share price, you can decide more confidently when to buy, hold, or sell and make your investment decision-making both smarter and more personal.

Do you think there's more to the story for Kenvue? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives