- United States

- /

- Personal Products

- /

- NYSE:HLF

Positive Sentiment Still Eludes Herbalife Ltd. (NYSE:HLF) Following 32% Share Price Slump

Herbalife Ltd. (NYSE:HLF) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

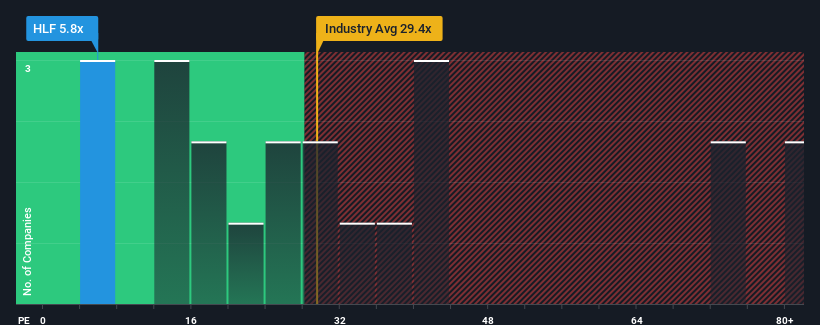

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Herbalife as a highly attractive investment with its 5.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Herbalife has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Herbalife

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Herbalife would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 56%. The last three years don't look nice either as the company has shrunk EPS by 49% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 42% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader market.

In light of this, it's peculiar that Herbalife's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Herbalife's P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Herbalife currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Herbalife (2 shouldn't be ignored) you should be aware of.

You might be able to find a better investment than Herbalife. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Herbalife might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLF

Herbalife

Provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and the Asia Pacific.

Good value slight.

Similar Companies

Market Insights

Community Narratives