The board of Energizer Holdings, Inc. (NYSE:ENR) has announced that it will pay a dividend of $0.30 per share on the 16th of March. This means the annual payment is 3.2% of the current stock price, which is above the average for the industry.

See our latest analysis for Energizer Holdings

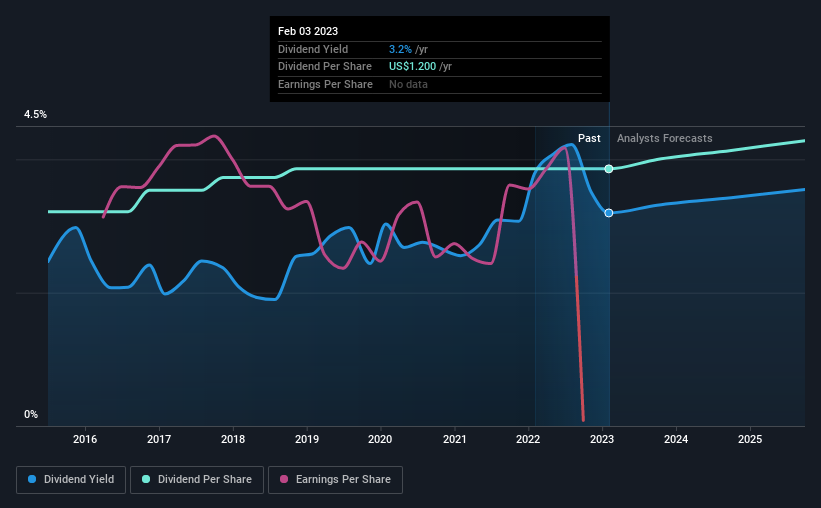

Energizer Holdings Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even in the absence of profits, Energizer Holdings is paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Over the next year, EPS might fall by 20.5% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Energizer Holdings Doesn't Have A Long Payment History

Energizer Holdings' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2015, the dividend has gone from $1.00 total annually to $1.20. This works out to be a compound annual growth rate (CAGR) of approximately 2.3% a year over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Energizer Holdings' EPS has fallen by approximately 21% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

We're Not Big Fans Of Energizer Holdings' Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. The dividend doesn't inspire confidence that it will provide solid income in the future.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 4 warning signs for Energizer Holdings you should be aware of, and 3 of them make us uncomfortable. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives