- United States

- /

- Household Products

- /

- NYSE:ENR

Energizer Holdings (ENR): Assessing Value After a 16% Decline and Prolonged Downtrend

Reviewed by Kshitija Bhandaru

See our latest analysis for Energizer Holdings.

Zooming out from this month’s dip, Energizer Holdings’ momentum has been gradually fading over the past year, with a 1-year total shareholder return of -20.5% reminding investors that steady fundamentals have not translated into lasting gains. While recent events have not sparked a turnaround, the bigger picture highlights continued pressure on the share price despite stable financial results.

If recent volatility has you rethinking your watchlist, this could be the perfect moment to spot new opportunities and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and fundamentals holding steady, is Energizer Holdings an overlooked value pick, or is the market wisely factoring in limited future growth potential?

Price-to-Earnings of 6.6x: Is it justified?

Energizer Holdings trades at a price-to-earnings (P/E) ratio of 6.6x compared to the last close price of $24.15. This multiple signals the stock is valued significantly below both its industry and peer averages, suggesting the market could be undervaluing projected earnings.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For consumer staples like Energizer Holdings, it reflects both near-term profit expectations and long-term business stability. A low P/E may imply the market is discounting future growth or accounting for particular risks unique to the company or its sector.

Energizer Holdings' 6.6x P/E stands out sharply against the Global Household Products industry average of 18.8x and the peer average of 21.2x. The company also compares favorably to its estimated fair P/E of 18x, reinforcing the sense that shares could be trading at a steep discount. If the market reverts towards the fair ratio, there could be substantial upside for investors paying close attention.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 6.6x (UNDERVALUED)

However, sluggish long-term returns and tepid revenue growth may signal ongoing concerns that could affect Energizer Holdings’ recovery prospects.

Find out about the key risks to this Energizer Holdings narrative.

Another View: Our DCF Model Paints a Different Picture

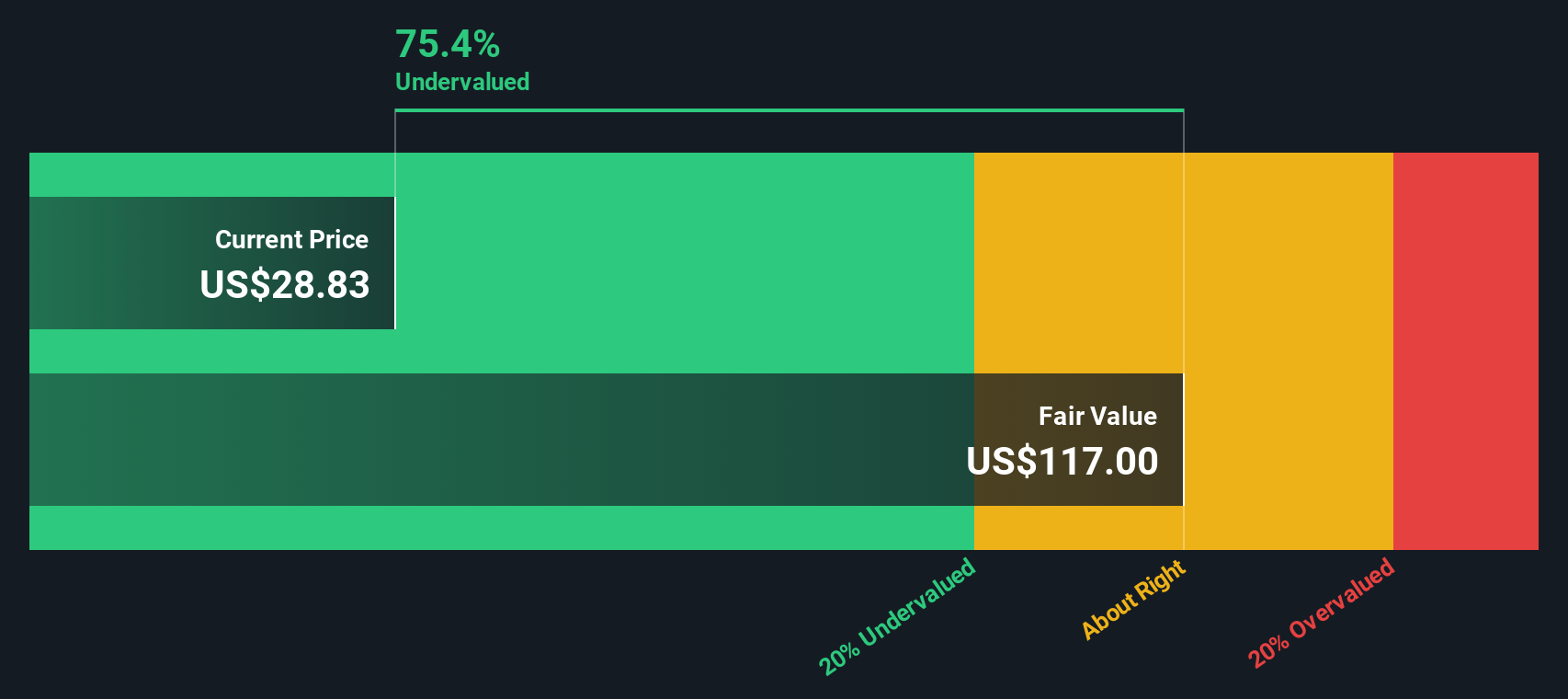

Beyond industry comparisons, our DCF model offers a long-term perspective by estimating fair value based on projected cash flows. According to this approach, Energizer Holdings is currently trading at a deep discount of 78.3% below the estimated fair value. This suggests the stock may be significantly undervalued. Could the market be overlooking the company's true worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you see things differently or want to dive deeper, you can quickly build your own narrative with just a few minutes of hands-on analysis. Do it your way

A great starting point for your Energizer Holdings research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait while others act. Take charge of your portfolio by seizing smart opportunities you can filter in seconds with the Simply Wall Street Screener.

- Capture the upside from breakthrough technology. Start your search with these 25 AI penny stocks primed for high impact growth.

- Maximize potential income by targeting these 19 dividend stocks with yields > 3% offering attractive yields above 3% for steady returns.

- Ride the future of money by evaluating these 78 cryptocurrency and blockchain stocks uniquely positioned for blockchain and digital transformation trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives