- United States

- /

- Personal Products

- /

- NYSE:ELF

Evaluating e.l.f. Beauty's Value After a 4% Weekly Drop and Recent Growth Surge

Reviewed by Bailey Pemberton

Let’s be honest: figuring out what to do with e.l.f. Beauty stock can feel like standing at a crossroads, especially with the price activity we’ve seen lately. If you’re watching the ticker with last Friday’s close at $127.13 and a recent dip of 4.0% this past week, you might be wondering whether now’s the moment to buy in, hold steady, or even trim your position. Here is the kicker: despite some recent short-term volatility, e.l.f. Beauty has handed investors a staggering 193.2% return over three years and more than 506% over five. That’s not just growth; it’s market-crushing momentum.

Part of the story behind these moves is the company’s relentless brand expansion and growing market share in affordable, high-quality beauty. Recent product launches and collaborations have kept e.l.f. Beauty firmly in the headlines and on shoppers’ minds, fueling long-term optimism even while the stock has cooled by 9.2% over the past month. With a year-to-date gain of 3.4% and a strong 19.2% surge over the past twelve months, it’s clear that sentiment around the stock is anything but static.

If you’re trying to figure out whether e.l.f. Beauty is fairly valued at these levels, you might have come across various metrics and ratings. One popular valuation scoring system gives the company a score of 2 out of 6 for being undervalued. Does that mean the stock is getting expensive, or is there hidden value? Next, I’ll break down what these valuation methods actually mean for e.l.f. Beauty, plus a smarter way to assess what the market might still be missing.

e.l.f. Beauty scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: e.l.f. Beauty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and then discounting them back to their value today. This approach helps investors determine how much a company is really worth, beyond just its current market price.

For e.l.f. Beauty, the latest reported Free Cash Flow stands at $144.5 million. Analysts forecast substantial growth in future cash flows, with projections reaching $425 million by 2028. Although analysts only provide up to five years of estimates, further growth forecasts for the next decade are derived from Simply Wall St's extrapolations. These estimates show Free Cash Flow rising steadily, topping out at roughly $1 billion by 2035.

These robust projections, when run through the DCF model, generate an estimated intrinsic value of $249.88 per share. With the current share price at $127.13, e.l.f. Beauty stock appears to be trading at a 49.1% discount to its intrinsic value. Based on this analysis, the company looks significantly undervalued according to its future cash flow prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests e.l.f. Beauty is undervalued by 49.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: e.l.f. Beauty Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it connects the current share price to the company’s underlying earnings. Since e.l.f. Beauty is consistently profitable, its PE ratio helps investors judge how much they are paying for each dollar of earnings the business generates.

It is important to remember that a “normal” or “fair” PE ratio is not the same for every company. Higher growth prospects, lower risks, and bigger profit margins can justify a richer PE ratio, while lower growth or higher risks can make the PE lower.

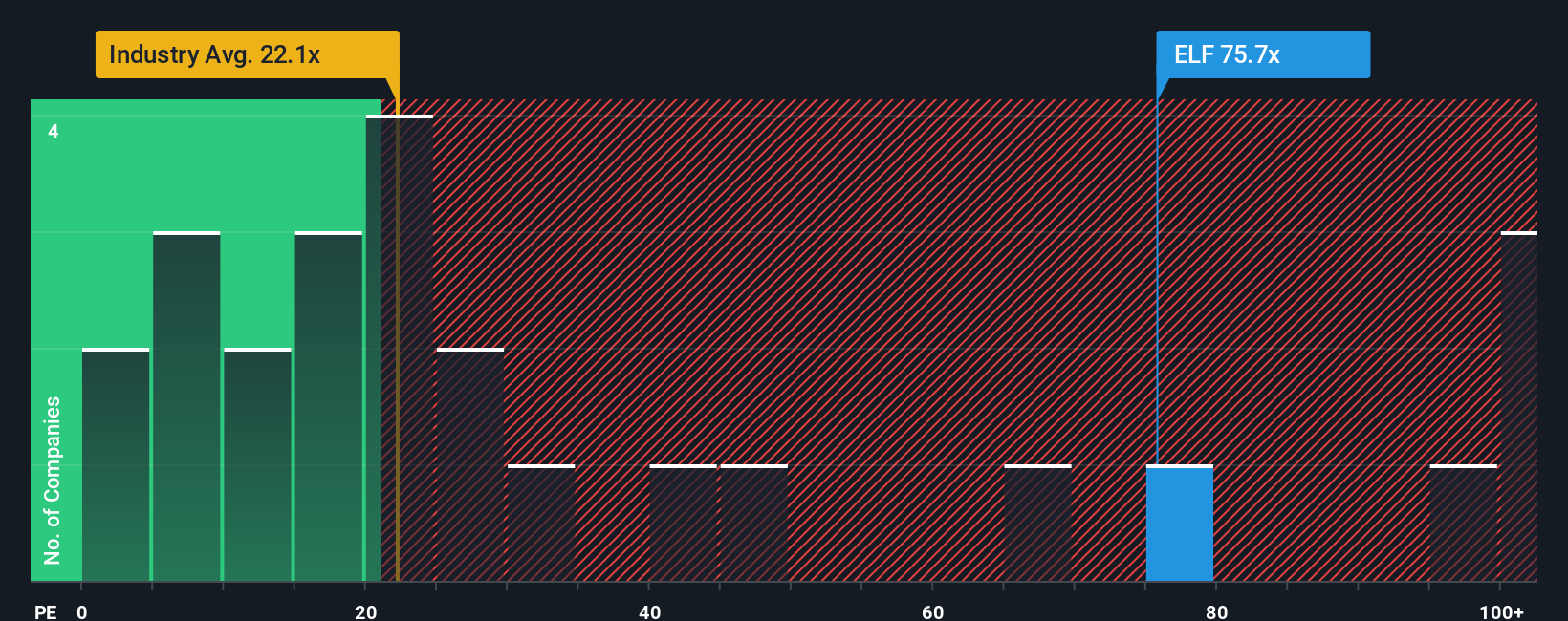

At the moment, e.l.f. Beauty trades at a PE ratio of 77.1x. That is much steeper than both the Personal Products industry average of 21.8x and its peer group average of 21.2x. On the surface, that might make the stock look very expensive compared to its immediate peers.

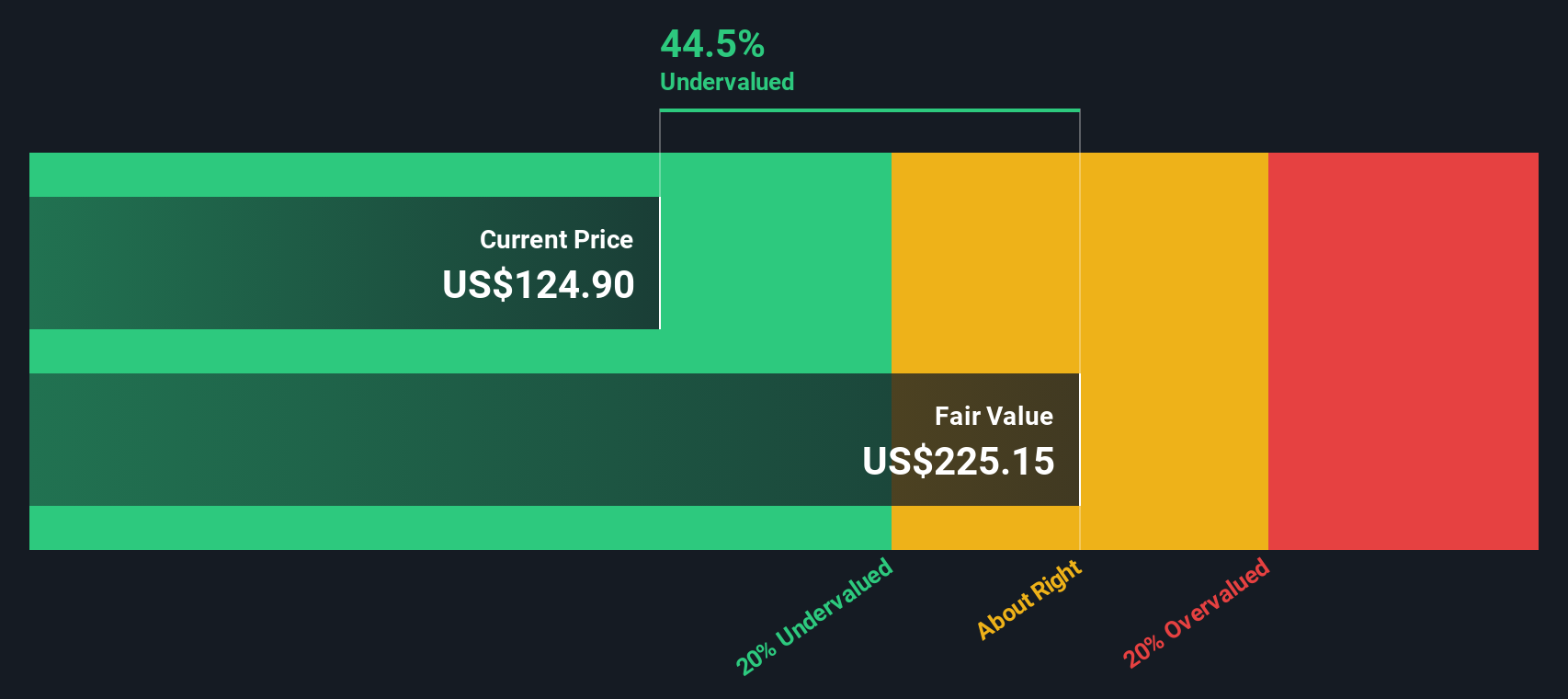

However, Simply Wall St’s proprietary “Fair Ratio” considers the company’s specific growth rate, profit quality, industry, size, and individual risks and puts the fair PE for e.l.f. Beauty at 30.9x. Unlike a simple peer comparison, the Fair Ratio adapts to what makes the business unique and gives a more complete sense of whether the market price is justified.

Comparing the actual PE of 77.1x against the Fair Ratio of 30.9x, the current price suggests e.l.f. Beauty’s shares are trading well above what fundamentals alone would support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your e.l.f. Beauty Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story. It is how you link your view of a company’s growth drivers, risks, and opportunities to a financial forecast and ultimately to your fair value estimate. Rather than getting lost in endless ratios, Narratives help you lay out your perspective, making your reasoning clear and actionable.

On Simply Wall St’s Community page, creating a Narrative is as easy as outlining the numbers you believe in, such as revenue growth, profit margins, and long-term risks, with millions of investors posting and updating their stories every day. Narratives are especially useful because they connect your view directly to a live fair value, letting you quickly compare it to the current share price and decide whether to buy, hold, or sell.

Your Narrative is not static. If new earnings come in or news breaks, your assumptions and fair value update automatically, keeping your outlook fresh and relevant. For example, one investor might see e.l.f. Beauty’s global expansion and influencer-driven growth fueling a fair value above $165. Another, weighing tariff risks and tighter margins, could justify a lower target closer to $112. Narratives let you make dynamic, evidence-based decisions that reflect your personal view of the company.

Do you think there's more to the story for e.l.f. Beauty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives