- United States

- /

- Personal Products

- /

- NYSE:ELF

e.l.f. Beauty (ELF): Exploring Valuation After Strong Earnings, Rhode Deal, and Global Expansion Moves

Reviewed by Simply Wall St

Most Popular Narrative: 3.2% Undervalued

According to the most widely followed outlook, e.l.f. Beauty is seen as modestly undervalued, with the current price slightly below the consensus fair value. Analyst forecasts converge on a narrow gap, indicating expectations are high and the company is considered almost fairly priced.

The expansion into new international markets and rapid growth in existing ones, such as 30% international net sales growth, top rankings in new geographies, and a global Sephora rollout, provide significant runway for future revenue growth and increased diversification. This potential is likely under-appreciated by the market.

Curious about the foundation for this ambitious price tag? This narrative is built on projections of rapid expansion, bigger profit margins, and a future profit multiple that might surprise you. Want the full breakdown of the aggressive targets and underlying growth bets that could propel e.l.f. Beauty’s value even higher? Explore the narrative’s hidden assumptions and see what could be fueling this just-out-of-reach fair value.

Result: Fair Value of $139.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still uncertainties around tariff exposure and sustained competitive pressure, which could challenge e.l.f. Beauty’s current growth trajectory.

Find out about the key risks to this e.l.f. Beauty narrative.Another View: Is the Price Too High?

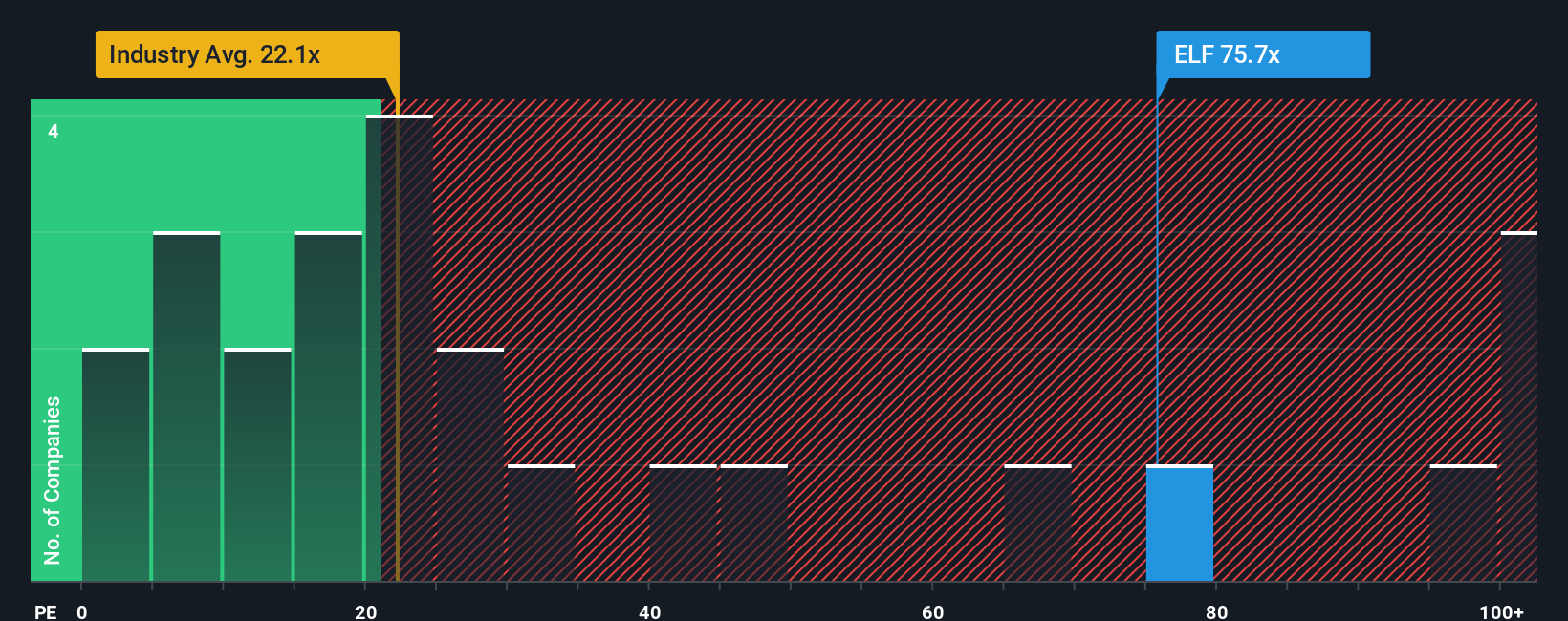

Taking a different approach, a simple comparison to the wider industry suggests e.l.f. Beauty is priced much higher than its peers. This raises the question: is the market overlooking something, or just getting too excited?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding e.l.f. Beauty to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own e.l.f. Beauty Narrative

If you are inclined to dig deeper or have a different perspective on e.l.f. Beauty, you can easily explore the data and build a unique view in just a few minutes. Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your strategy and stay ahead by tapping into sectors and stocks that others might miss entirely.

- Jump into fast-moving tech trends and spot tomorrow’s leaders by checking out AI penny stocks. This is where the latest artificial intelligence breakthroughs meet serious market potential.

- Boost your portfolio’s income stream and secure higher yields with dividend stocks with yields > 3%. This connects you to shares offering standout dividend returns above 3%.

- Shake up your investment approach and uncover rare gems trading below their true worth through undervalued stocks based on cash flows. This resource is tailored for value-seekers pursuing maximum upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives